Options Trading

More Option Spreads Explained: Bull Call Spreads

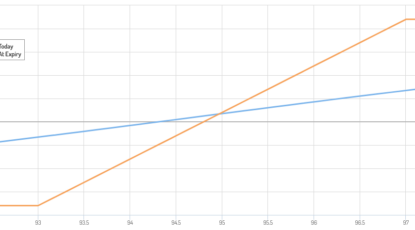

We’ve spent some time this month looking at various kinds of option spreads, with the bigger goal of learning the ins and outs of the strategy. It just so happens there are several different approaches to spread trading, each with their own pros and cons. Our first example was a bear put spread, though our more recent run-through was a bull put spread… a credit trade. Let’s continue fleshing out all the intricacies of options spreads with an example of a bull call spread. In simplest terms, a bull call spread involves the purchase of call options with a lower strike price, and shorting a call option with a higher strike price; both calls have the same expiration date. Bull call spreads are debit spreads, meaning we pay a net price to enter them because the long call we’re buying is worth more than the short call we’re… well, shorting.… more

Option Spreads Made Easy: When and Where to Use Bull Put Spreads

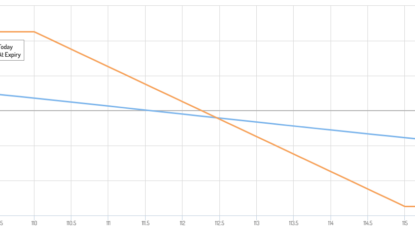

Last week we started what’s going to be a lengthy-but-learnable lesson about option spreads. We didn’t mention this at the time, but the bearish trade we placed on General Electric (GE) was a bear put spread, or more accurately, as bear put debit spread. We were bearish on GE so we bought puts on the stock. We wanted to hedge... more

What the Heck Is an Option Spread Anyway?

You’ve heard the term, but do you really know what an option spread is? Even if you’re versed and experienced in buying and then selling options for a profit, it’s entirely possible you don’t. (And if so, you’re not alone.) Maybe you’re looking for a new strategy to limit the volatility of — and the potential for loss in —... more

Credit Spreads or Debit Spreads? Actually, You Should Be Using Both. Here's Why. (Part 3)

In part 1 one of this lesson we looked at debit spreads, how they work, and why you'd want to use them. In simplest terms, a debit spread is still a net-long purchase of a put or call that bets on a stock's (or index's) direction. In that it's a debit, you're paying money to own the position with plans... more

Credit Spreads or Debit Spreads? Actually, You Should Be Using Both. Here's Why. (Part 2)

In part 1 of this lesson we took a look at what debit spreads were, and how they work. The explanation, however, is only the first piece of the groundwork we're laying to illustrate how and why you'd want to use them but also use their opposing trade… the credit spread. As a refresher, a debit spread means you're a... more

Credit Spreads or Debit Spreads? Actually, You Should Be Using Both. Here's Why. (Part 1)

If you're ready to move beyond the mere purchase of put or call options, great! You'll be opening up a whole new world of ways to take advantage of how option prices change. As you may likely already know, it's not so simple. There are a lot of factors that influence — often unexpectedly — option pricing. And, perhaps one... more

Here's Why Boring Stocks Make Exciting Option Trades

Veteran option traders understand the concept well enough. While plenty of investors aim to avoid sea-sickening volatility from their long-term holdings, volatility is precisely what many option traders seek out. Volatility makes option prices move further and faster, in fact. Indeed, the whole point of the option Greek "Vega" is to let a would-be trader know how much an option's... more

BIG TRENDS

INSIDER NOW!

Trend Watch, TRENDSCORE, webinars, technical analysis e-book, and more!