Option Spreads Made Easy: When and Where to Use Bull Put Spreads

Last week we started what’s going to be a lengthy-but-learnable lesson about option spreads. We didn’t mention this at the time, but the bearish trade we placed on General Electric (GE) was a bear put spread, or more accurately, as bear put debit spread. We were bearish on GE so we bought puts on the stock. We wanted to hedge our bet, however, so we also sold a similar (although not identical) put to offset some of our cost. This limited our potential profit, but it made the position pretty cheap to enter. We call this a debit spread because we still paid (net) to get into the two-part option trade.

A bear put spread and/or a debit spread is just one of several kinds of option spreads you can use to tap into a trend and make some money though. As another example, let’s look at things from a bullish perspective. And, just for additional learning, let’s net pay a net price to enter the trade. Let’s sell an option for more than we’re paying to buy a similar option, in anticipation that both will expire worthless.

This trade is called a bull put spread; the credit part of the trade is implied.

In simplest terms, a bull put spread involves shorting put with a higher strike price and buying another put option with a lower strike price. Both of put options are of course options on the same stock and both have the same expiration date; the only difference is their strike prices. These trades produce a net credit at their onset, and achieve their maximum profit potential -- the full amount of the credit -- when the stock rises from the point when the trade is initiated. Conversely, the maximum loss is realized if and when the underlying stock moves below the strike price of the purchased put.

Don’t freak out if that just confused you. It’s a lot of words in a fairly short paragraph that don’t mean as much without the right context. To add that needed context, let’s work through an example.

Let’s say we expect bullishness in the near future from Starbucks (SBUX) stock. Specifically, we believe Starbucks shares are ready to rally from their current price near $94 to somewhere near $100… a tradeworthy move, but nothing exactly heroic. (This is why we’re using a credit-driving bull put spread rather than a debit-based bull call spread… more on this in a moment.)

We’ll start with figuring out which put option we want to short. In this case we’ll go with the 97 puts expiring just a couple of weeks from now; this isn’t a long-term kind of trade. This put is about three strikes in the money, and priced at $4.50 ($450 per contract).

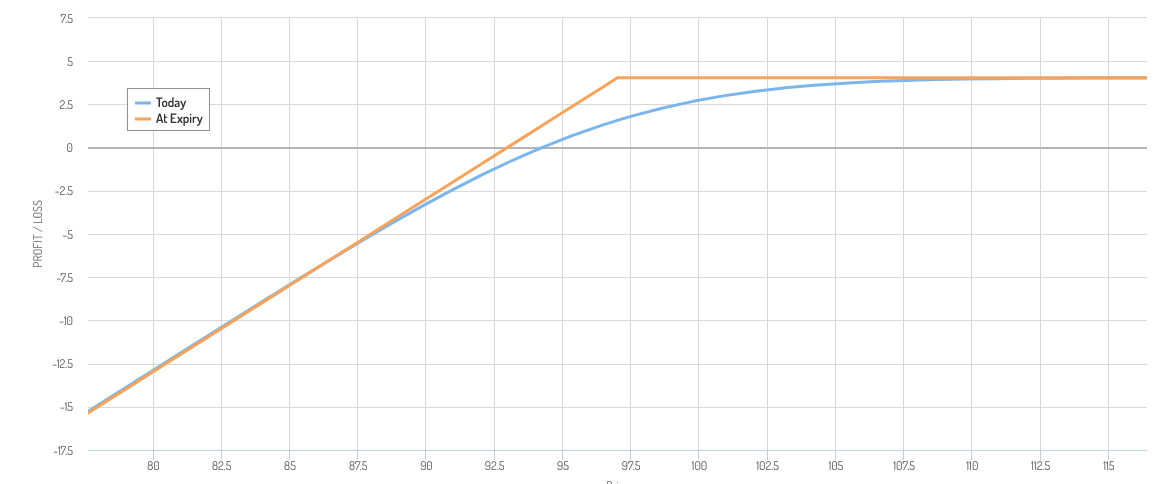

We could simply sell/short this put option on faith that Starbucks shares on faith that it will indeed rise. And, once the stock get to $97 per share (or above), we get to keep all upfront credit of $450… although not one cent more. Conversely, if Starbucks starts to lose value, we could be in a heap of trouble real fast. Remember, we have to close this short trade out sometime. It’s just a matter of price. The risk here is that we’d have to buy it back at a price much greater than our upfront credit. That’s what the profit-and-loss scenario chart below shows us.

So how do we defend ourselves from this possibility? We buy a put option.

We don’t have to buy an expensive one. In fact, to make this a credit-producing bull put spread, we can’t spend from than $4.50 (or $450 per contract). That’s ok though. The way these particular spread trades work, the long put -- the put we’re buying -- is cheaper than the put we’re shorting because its less in-the-money, or maybe even a little but out-of-the-money. In this particular scenario the 93 puts expiring a couple weeks from now will do nicely. They’re only priced at $2.30 right now, or $230 per contract.

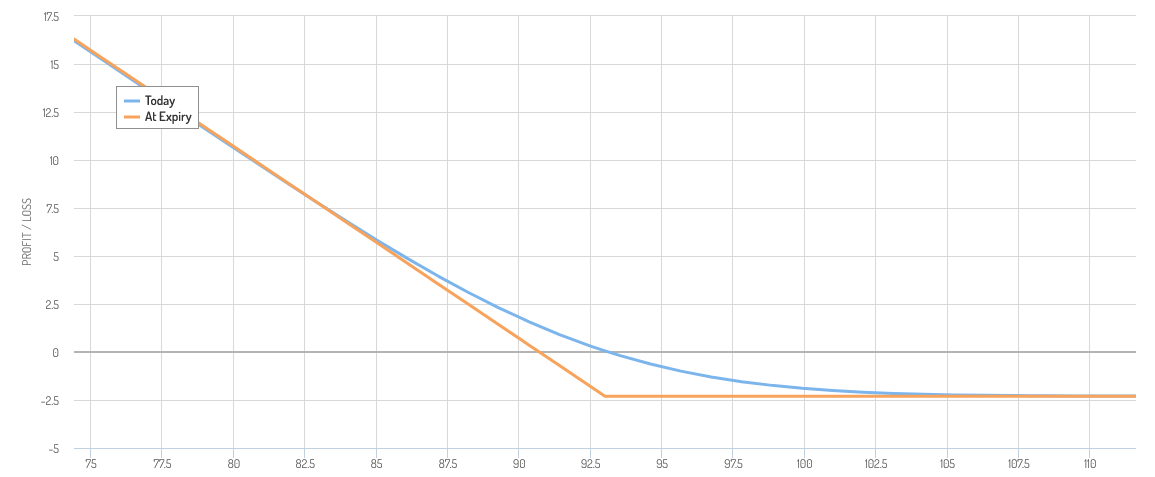

Here’s the profit-and-loss profile just for this long contract. Since we own it and already paid for it, the maximum loss we can suffer on this piece of the trade (were it a standalone trade) is the $230 debit. The low Starbucks shares fall, however, the more value this put option has.

The thing is, we actually think Starbuck shares are poised to move upward. If we’re right, the 93 puts we’re buying ONLY have value to us as a hedge. That’s essentially the purpose of option spreads in the first place.

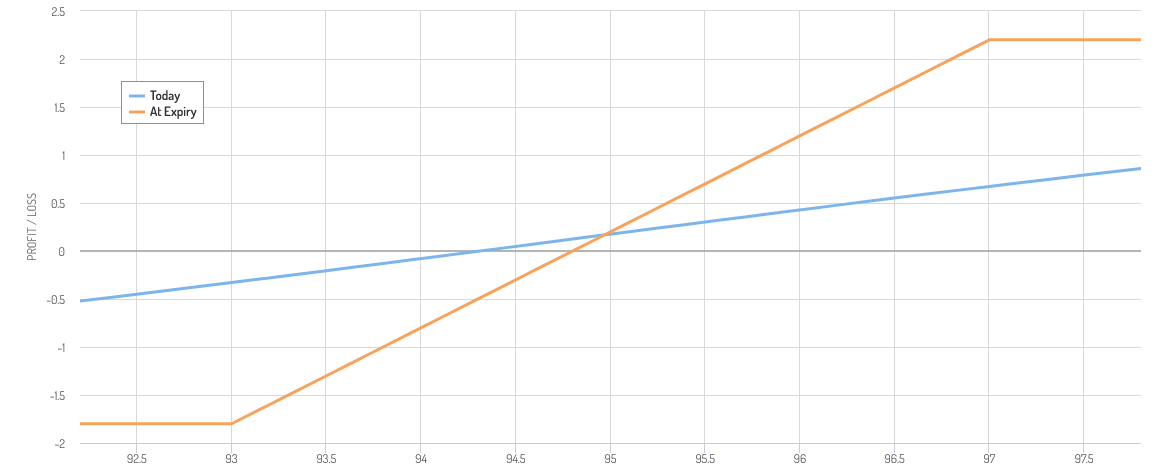

Whatever the case, now with two components to this trade -- one long, and one short -- our profit-and-loss scenario is a combination of the two profit-and-loss scenarios above. Here’s what that looks like when combined. Our maximum profit is the $2.20 (or $220 per contract) difference between the $450 worth of proceeds we got for shorting the puts with the 97 strike price and the $230 we paid per contract for the puts with the strike at 93.

Our maximum-possible loss here is $1.80, or $180 per contract. That’s the $4.00 difference between the two strike prices in question minus the $2.20 upfront credit we got for entering this trade. And, that loss is based on the (reasonable) assumption that if Starbucks shares fall below 93, someone will exercise the option against us. We’ll have to cover the short and exit the long – probably at the same time – at a difference of about $4.00, or $400 for the pair of put options.

More risk than reward? You’re seeing that right. With credit spreads of all sorts, there’s more mathematical downside than upside. Don’t freak out though. As long as you’re just generally right (or even just not completely wrong) about Starbucks stock’s near-term future you should be ok.

See, both of these options will lose value – due to time decay -- over time regardless of what SBUX shares do… and that’s what we want to have happen. Ideally, we’ll simply let both of these puts expire worthless. Any price above $97 at the time of expiration will do the trick. Even though we’re not actually looking for a profitable exit point, the trade will gain net value just due to the passage of time en route to expiration.

For this reason, bull put spreads are well-suited for stocks like Starbucks that are volatile day to day, but are unlikely to actually make a lot of net movement for a given period of time.

Not every stock out there is like that, making this particular option spread strategy less than ideal for other scenarios.

As always, try some of these on paper first before risking in actual capital.