More Option Spreads Explained: Bull Call Spreads

We’ve spent some time this month looking at various kinds of option spreads, with the bigger goal of learning the ins and outs of the strategy. It just so happens there are several different approaches to spread trading, each with their own pros and cons. Our first example was a bear put spread, though our more recent run-through was a bull put spread… a credit trade. Let’s continue fleshing out all the intricacies of options spreads with an example of a bull call spread.

In simplest terms, a bull call spread involves the purchase of call options with a lower strike price, and shorting a call option with a higher strike price; both calls have the same expiration date. Bull call spreads are debit spreads, meaning we pay a net price to enter them because the long call we’re buying is worth more than the short call we’re… well, shorting. For such a trade to become profitable we want the underlying stock’s price to rise, although like all spread trades, our potential profit on a bull call spread is limited. Ditto for our potential loss.

As has been the case thus far, learning about bull call option spreads is easiest with an example. So…

Let’s say we’re bullish on Micron (MU), expecting it to rally from its current price of $67.70 to its recent ceiling near $74.00. Let’s also assume this stock will remain volatile and choppy, and will require more than the average amount of time to reach this target.

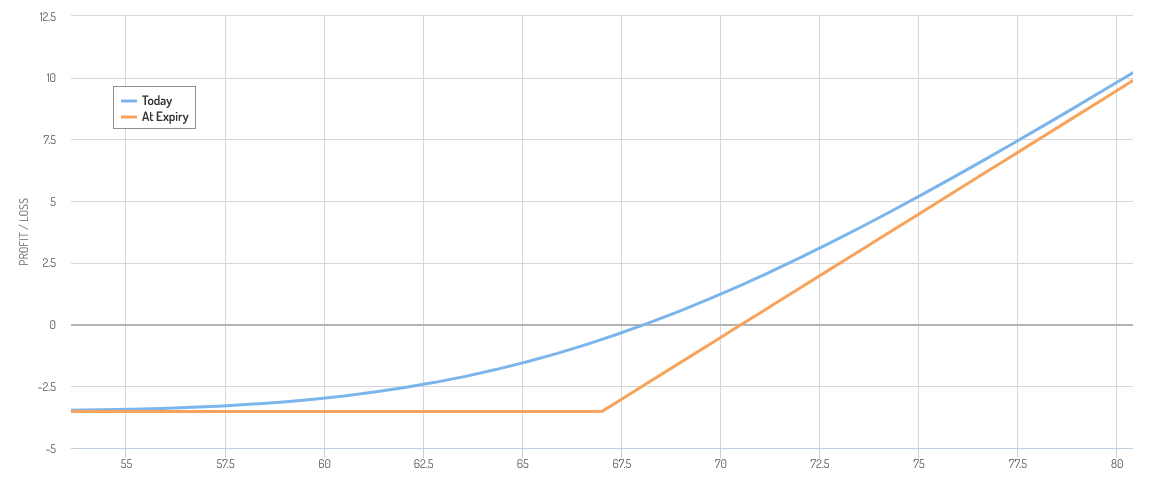

The proverbial anchor and breadwinner for this trade will be a simple purchase of a call option. We’ll choose the Dec. 1st $67 calls. These give us enough time to let Micron shares get to where we want them to go, and while the 67 calls are in-the-money, they’re not so in-the-money that they cost a fortune.

Here’s the profit-and-loss profile for this particular call option. The upside potential is theoretically infinite, but this piece of the trade will cost us $3.50, or $350 per contract. If Micron shares are still under $67 by expiration date, that entire call option will expire worthless. We’ll have wasted that $350, but at least our prospective loss will be limited. We need Micron to be at $71.50 by expiration just to break even; we’ll be able to sell those $67 calls at a price of $3.50 (or $350 per contract) then.

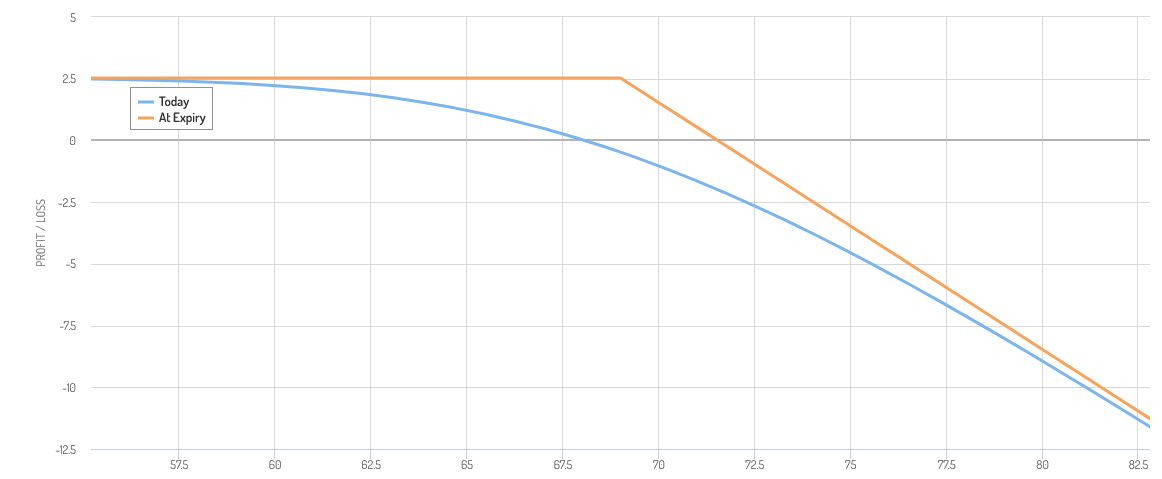

We can defray some of the cost of this purchase by shorting a similar -- but cheaper -- call option with the same expiration date. To make it cheaper, of course, this other call option with a Dec. 1st expiration date has to be less in-the-money, or maybe even out-of-the-money. We’ll go with the $69 strikes, which are worth $2.50, or $250 per contract. This will put $250 in our pocket, driving our net cost for the bull call spread down to $100… the difference between the long and short options.

Here's the profit-and-loss breakdown for the $69 calls we’re shorting. While the most we can possibly make from this position is the $100 credit we get from selling it, in that we’re shorting it, our prospective loss is theoretically infinite. The further above $71.50 Micron shares get, the bigger our loss could be.

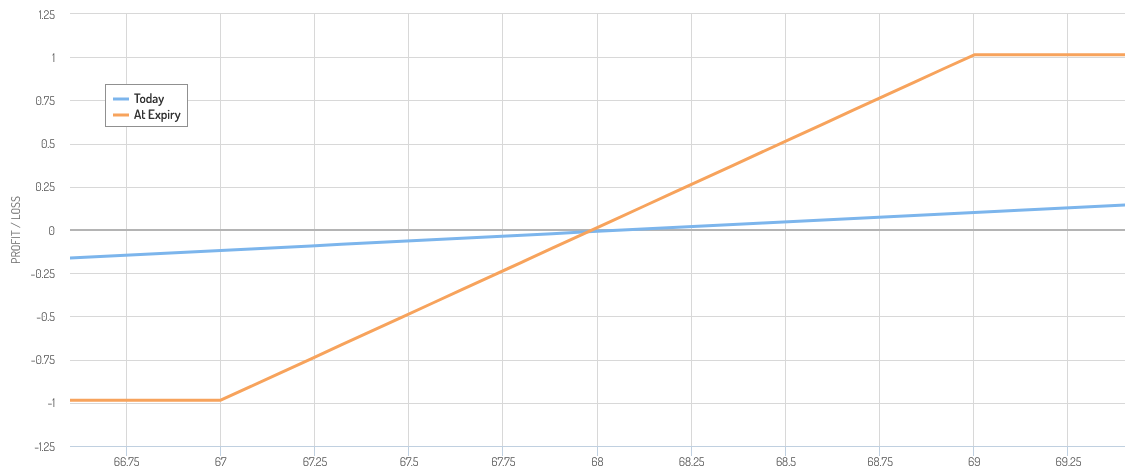

Here’s the thing… like all option spread trades, bull call spreads have capped gains and capped losses. When we combine the profit-and-loss scenarios for both options in question, our profit-and-loss situations change. Our net potential loss is capped, yet so is our net potential gain.

In this case the maximum loss is the net $1.00 (or $100 per contract) we have to spend to enter the trade. Our net prospective gain, though, is also $1.00, or $100 per contract. That’s the $2.00 (or $200 per contract) difference in value between the two calls MINUS the $1.00 (or $100 per contract) we have to spend to purchase the bull call spread. This full potential gain is realized if and only if Micron shares are at or above $69 by expiration.

Just bear in mind that since this is a debit spread, you’ll want/need to actively close out this trade by selling the long call and buying back the call you shorted. This will incur a commission cost, although these tend to be negligible. Just don’t forget to do it, particularly if the short call is in the money at expiration. It will be exercised against you. You can also exercise your long call and still get to your maximum net profit. It’s just a hassle to do so. It’s much easier just to reverse both legs of the trade rather than having them exercised.

Based just on the math, this particular spread doesn’t necessarily seem like it’s worth the risk. The numbers alone don’t tell the whole story though. The rest of the story is the odds of suffering that full loss, and the odds of achieving at least some degree of net gain. Micron shares only have to climb $1.00 from their present value to book that full gain. You’ll break even if MU shares barely move from their present price.

No, like all other option spreads, bull call spreads will never produce a massive profit on a per-trade basis. The idea is to enter these trades over and over again over time, collecting nickels and dimes. They add up to dollars soon enough, when handled properly.

As always, the best way to really learn about any spread trade strategy is by doing them with hypothetical money.

Stay tuned for more option spread lessons.