You’ve heard the term, but do you really know what an option spread is? Even if you’re versed and experienced in buying and then selling options for a profit, it’s entirely possible you don’t. (And if so, you’re not alone.) Maybe you’re looking for a new strategy to limit the volatility of -- and the potential for loss in -- your portfolio.

Whatever your goal is, if you’re curious as to how option spreads work and how they could work for you, keep reading. The only pre-requisite> You need to know what an option is, and how single option trades are made, and why you’d want to make them. If you’ve got that part of the puzzle down, you’re good to go.

In simplest terms, an option spread is a combination trade of two related options for a very narrowly-defined expectation. All option spreads involve buying one of these options, and selling the other. As to which is which, that depends on your strategy and expectation.

Clear as mud? As always, an example will help make sense of things.

Let’s say you’re bearish on General Electric (GE), expecting it to slide all the way back to the $100 level -- where the 200-day moving average line (green) will soon lie -- over the course of the next couple of months.

The trade here is pretty straightforward. You buy a put option. In this case the smart pick would be a slightly in-the-money put. Let’s say 115 put expiring on November 17th is the one; it’s currently priced at $5.35, or $535 per contract.

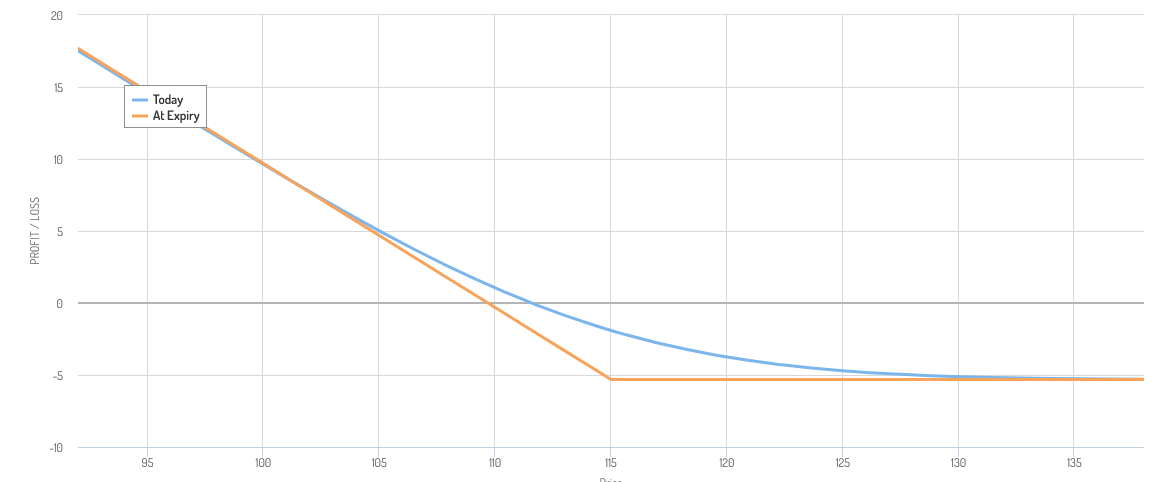

The graphic below puts the trade’s prospects in perspective. We want GE shares to fall as much as they possibly can. The lower it goes, the more profit we reap. On the chance things don’t go our way, the maximum loss is the net cost of buying the option itself. As the chart shows us, the maximum loss per contract flattens out at $5.35, or the $535 we shelled out to buy the puts.

While the reward is theoretically infinite and the risk is capped, the risk/reward balance isn’t entirely lopsided in our favor. There’s a time limit on this trade, and every day that passed dials back the overall value of the put option itself. The odds of a meaningful “win” here aren’t exactly leaps and bounds better than 50/50.

So what can we do to offset some of this risk (including the time-based risk) of this position? We can sell, or short, another put option to act as a hedge.

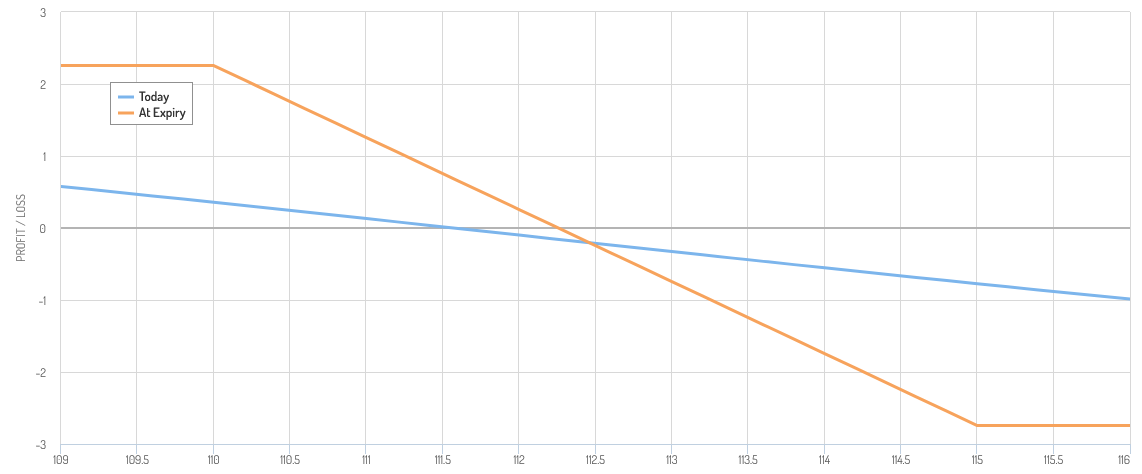

In this case we’ll select the 110 puts also expiring on November 17th. These are a little out-of-the-money, but they still have some speculative value. By selling this option, we’ll pocket right around $260 per contract; it’s currently priced at $2.60. This will bring our net cost for the two-component trade down to $275 ($535 - $260). That’s a key part of the goal.

There is a downside. That is, while the maximum loss is dialed back, the maximum possible gain is also limited no matter how far General Electric shares fall. Once GE shares fall below $110, the long call we own (the $115) and call we shorted ($110) will both gain in value at the same basic rate. That’s good and bad. It’s just as good and just as bad, however, whether GE shares fall to $105 or $75. Our maximum gain is the $5 difference (or $500 per contract) between the two contracts prices MINUS the initial net cost of $275. That’s $2.25, or $225 per contract-pair traded. The profit & loss profile is clear on the chart below.

Also note that the maximum loss and maximum gain will only be achieved right at expiration, and only if GE is above $115 or below $110 at the time. In the interim, the spread trade will only move toward that maximum gain or loss.

This example makes spread trades look like less-than-thrilling prospects. And in some ways, they are. The idea of an unlimited gain paired with a limited loss is exciting. Spreads generative relatively small per-trade returns.

Spread trades still have their benefit though. That is, the bar for turning some degree of net profit is lower, and it’s slightly more likely you’ll turn some sort of profit at all.

Also consider the reality that while a straight purchase of a put or a call has unlimited upside, you rarely see that full potential.

Spreads also offset the some of the impact of time decay; the short position you want to lose value does so almost as quickly as the long position you own does, pushing you closer to a profit at a slightly faster pace.

In other words, the trade-off may well be worth it.

The trick to making good money with option spreads, therefore, isn’t the occasional big win. It’s reaping many small wins back to back to back, over and over again. You’ll never get rich fast with them. But, they can generate consistent gains in any and all market environments. That’s a smart strategy too.

As always, the best way to get a handle on spread trading is by placing a few hypothetical paper trades.

We’ll work through some more of these spreads in the near future, working with credits as well as debits with puts as well as calls. Stay tuned.