Here's Why Boring Stocks Make Exciting Option Trades

Veteran option traders understand the concept well enough. While plenty of investors aim to avoid sea-sickening volatility from their long-term holdings, volatility is precisely what many option traders seek out. Volatility makes option prices move further and faster, in fact. Indeed, the whole point of the option Greek "Vega" is to let a would-be trader know how much an option's price is likely to change when a stock's volatility profile changes.

In trading, though, everything is a trade-off. Chasing volatility has its downsides. Sometimes it makes more sense to steer clear of it and instead look for less volatile stocks to trade options on. Of course, this also means you'll want to change your trading strategies to ones that favor less erratic tickers.

To put the idea in the proper perspective we only need to compare the Greeks of two seemingly-similar options on two similarly-priced stocks.

Right now, shares of chipmaker Advanced Micro Devices (AMD) and drugmaker Merck (MRK) are both trading right around $110 apiece. The former's priced at $111.52, to be specific, while the latter's trading at $112.39. But, there's a stark difference between the nature of the two names. That is, AMD's volatility is well above average, while Merck's volatility is well below the current market average. To make the comparison as meaningful as possible, we'll look at the call options that are two strikes in-the-money for each stock, and expiring at the same time at the end of next month.

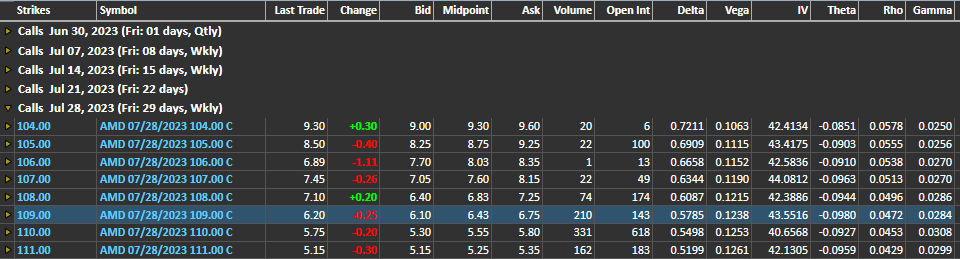

Here are AMD's Greeks, or measures that help us figure out what the is currently worth and what it might be worth under certain future scenarios.

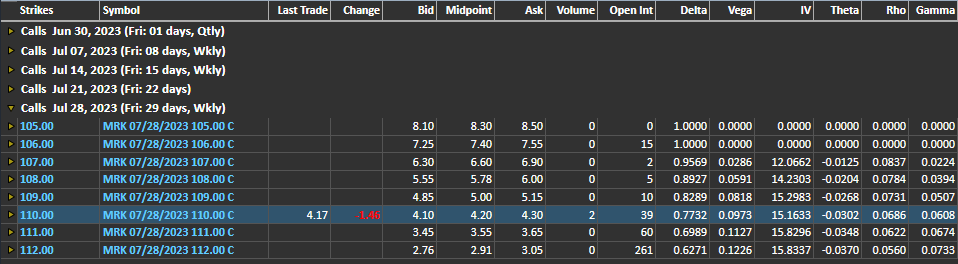

And, here's Merck's option Greek profile showing us the same basic data.

The differences are stark.

For starters, AMD's 109 calls only boast an intrinsic value of $1.17, but the call's price of $6.43 per contract translates into a premium of $5.03. Merck's 110 calls expiring on the same day are priced at $4.10 versus an intrinsic value of $2.44, or trading at a premium of only $1.66. Nearly 80% of AMD's 109 call price is premium, while only 40% of the Merck 110 calls' price is premium.

That's a huge difference. What gives? AMD shares are way more volatile... nearly three times as volatile, as measured by implied volatility (or "IV" on the images above). That cranks up premium value, or excess value above and beyond its mathematical value, in a big way.

That's only half of the story that would-be traders need to consider before placing an option trade on one or the other of these stocks though. The relatively more expensive AMD calls may well be worth it.

The key lies in the Greeks for both options. Namely, we're looking at delta and theta.

The AMD 109 call's delta is a modest 0.578, meaning it only increases in value by $0.58 for every dollar AMD shares gain in price. That's not much, particularly in light of the fact that Merck's 110 call's delta is a much higher 0.773, or $0.77 for every dollar Merck shares gain. And again, Merck's calls are just much, much cheaper to begin with.

Then there's theta, or time decay. The AMD 109 call's theta is 0.098, which means the call loses a dime's worth of value every single day just due to the passage of time. Conversely, the Merck call's theta of 0.03 means it only loses $0.03 worth of value every day just due to the passage of time.

Again, AMD's higher price, greater time decay, and more lethargic response to changes in AMD's price might be worth it. AMD shares move so much faster and farther than Merck stock does on any given day. The key is using the right trade-triggers or algorithms to prompt trades. If you're going to buy AMD calls, you need a signal that's not just bullish, but a trigger that suggests AMD shares are going to move far. You can afford to accept less net movement from Merck since its calls move better in tandem with Merck shares, and it's losing less to time decay. In this case, while you don't need a ton of movement, you'd want to use a higher odds algorithm with high odds that there will be some bullish movement.

BigTrends does this very thing, by the way. While most of our options advisory services tend to trade around the market's more volatile stocks, our Blue Chip Options Advisory combines proprietary settings on exponential moving averages (EMAs) and the directional movement index (DMI) indicators on daily charts... the only service to utilize this combination of tools for a very specific kind of slower-moving stock. These options, of course, tend to be cheaper than options on other kinds of stocks.

The irony? While blue chip stocks tend to be less volatile, this particular options service has the potential to dish out superior returns due to its consistency and reliability.

If you'd like to learn more about Blue Chip Options Advisory service, go here, or call us at 1-800-BIGTRENDS to discuss this exciting addition to the BigTrends suite of options-trading services.