July's Retail Spending Speaks Volumes About Consumers' Confidence

Say what you want about a weakening economy and slowing corporate earnings, but don't deny that the American consumer is (still) feeling pretty good about the future... good enough to continue spending their hard-earned cash at the nation's stores and restaurants. In that personal consumption drives 2/3 of the U.S. economy, last month's retail spending figures bode well for stocks.

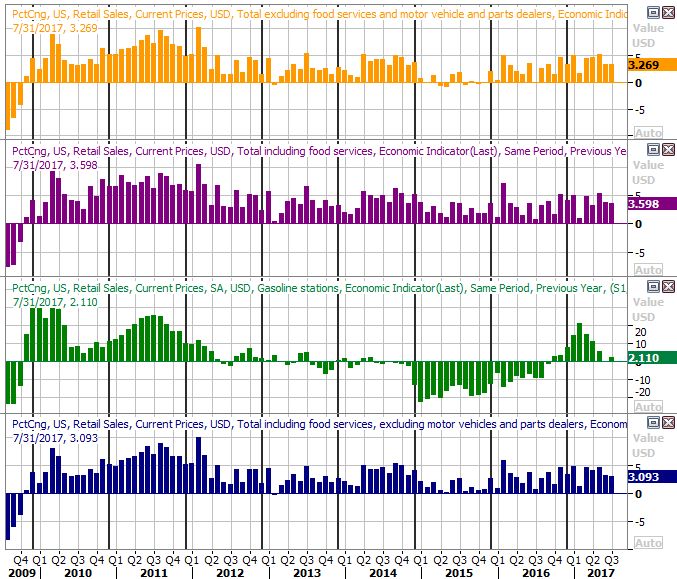

For July, overall retail spending was up 0.6% (month-to-month) overall, and higher by 0.5% when taking auto sales out of the equation. Analysts were only calling for 0.3% month-to-month growth, with or without car sales factored in. On an annualized basis, overall spending at stores and restaurants -- but not on cars -- grew 3.1%, was up 3.3% on non-food retail, and was up 3.6% counting store spending, automobiles and restaurant spending.

And bear in mind that all stratifications of that data were up against some very tough comparisons; retail consumption had already gotten pretty hot by the middle of last year.

Also bear in mind that this spending played out against a backdrop of incredible indecision in (and frustration with) Washington DC's political landscape, as well as in the shadow of a political standoff between North Korea and the United States -- both were serious concerns well before July came to a close. People mostly don't care, confident enough in what they see for the future to save at least a little less and spend at least a little more. The perceived upside outweighs the risks.

Part of that mindset has to be attributed to the strong jobs picture -- and strong wages -- we've seen take shape over the course of the past few months.

Another part of the strong spending mindset stems from the fact that Q2's earnings season has been mostly encouraging. The S&P 500's bottom line for the second quarter was up almost 20% year-over-year, which wasn't as strong as expected, but plenty strong all the same. The energy sector's turnaround drove the bulk of the earnings growth for the S&P 500, but growth is growth regardless of where it comes from.

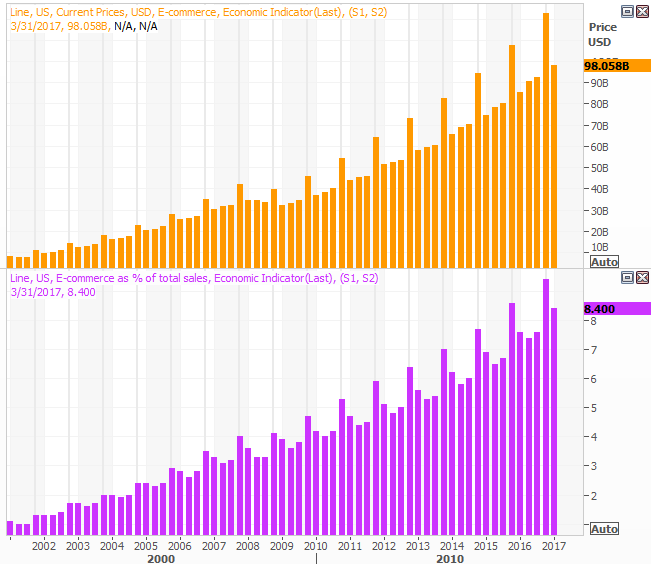

It does all beg one question though... if retail consumption is so strong, why are so many retailers struggling? The obvious answer is also the correct one -- the internet.

Take all the numbers with a grain of salt, as some retailers' revenue is counted as in-store spending when it's actually e-commerce revenue. Broadly speaking though, there's enough data and more than enough measurable change to say online alternatives like Amazon.com are driving retail spending outside of a brick-and-mortar environment. As of the end of the first quarter, 8.4% of the nation's retail consumption was done online. That's a new Q1 record, though the trend suggests we'll continue to see new records for many, many quarters.

Don't connect too many dots, and don't connect dots that shouldn't be connected. Just because retail spending is still strong doesn't inherently mean stocks can and will rocket higher. The market has a valuation problem, as stock prices have rocketed ahead a lot faster than earnings have. On the other hand, growing consumer spending does indicate economic strength, which will keep the larger bull market moving forward for the indefinite future.

In other words, any healthy pullback should be viewed as a buying opportunity.