September's 47-Year-Low Unemployment Rate Wasn't Just Fortuitous Math

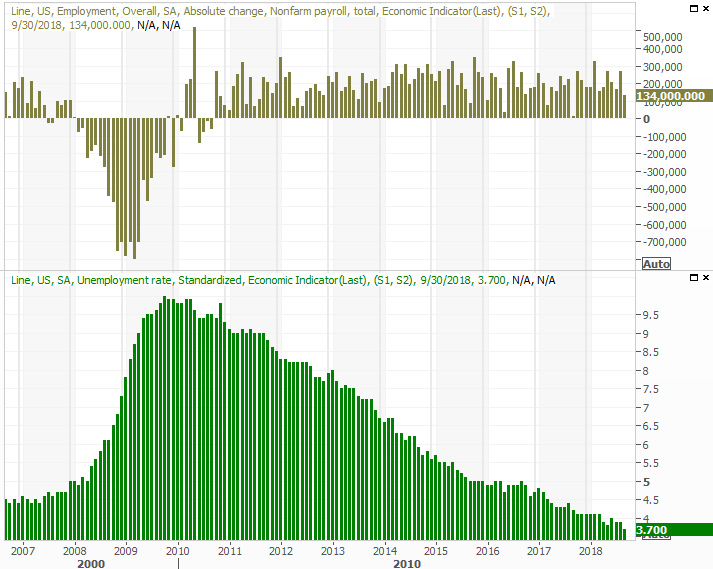

If there was only one word that could be used to describe the September jobs report, it would easily be "wow." The unemployment rate fell to a multi-decade low of 3.7%, and given the backdrop and trajectory, it may well move even lower before all is said and done.

But the 134,000 new payrolls created last month was alarmingly well short of the expected 184,000 jobs? It was, but be careful about jumping to a conclusion about that figure. It's not a lack of job openings holding the economy back. It's a lack of workers willing to leave their current position... a good problem to have.

And yet, there are some red flags. There aren't many of them, but there are some noteworthy ones.

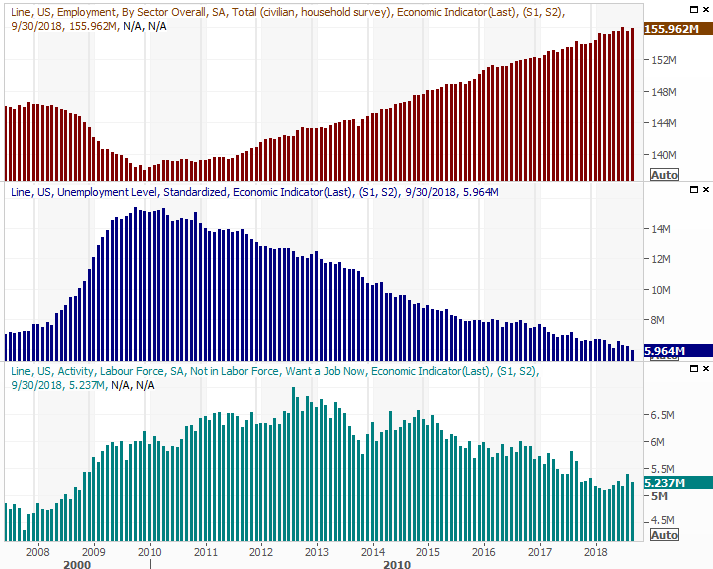

First and foremost, although the total number of people with jobs moved a little higher to a near-record 155.96 million and the number of individuals officially unemployed fell to a multi-decade low of 5.96 million, there's a subset of people that is arguably bigger than it should be. Those are the people who way they want jobs, but are currently NOT officially unemployed (and therefore not receiving any sort of government benefit). That figure fell from August's levels, but they continue to edge higher after bottoming earlier in the year.

There are two interpretations of that data, and they're diametrical opposites. On the one hand it's concerning that for some reason there are people that want jobs but don't have one. On the other hand, it may be an indication that for the first time in years a wide swath of unemployed people may feel like they've got a decent shot at landing a job. Given the environment, it's most likely the latter that's the case, which casts a bullish light on the picture.

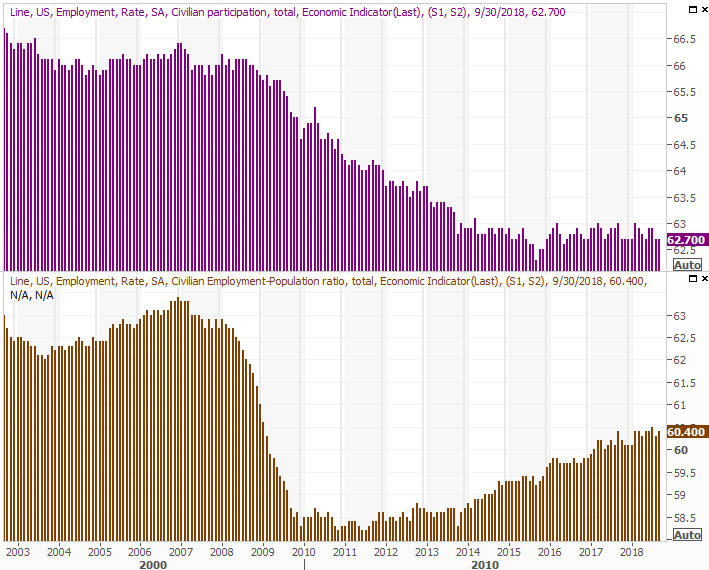

Underscoring this premise is the fact that the portion of the country's population that's working is still in an uptrend. It's not a red-hot uptrend, slowed down by August's lull. The current reading of 60.4% could be better. It's also not gone unnoticed that the labor force participation rate hasn't budged much from the current reading of 62.7% in several years. This may be partially (though not totally) explained by the ongoing mass retirement by baby-boomers, and could further be skewed by military employment. Regardless, it would be nice to see both moving upward, as it would indicate that the country's capitalistic economy is providing jobs that few people can turn down.

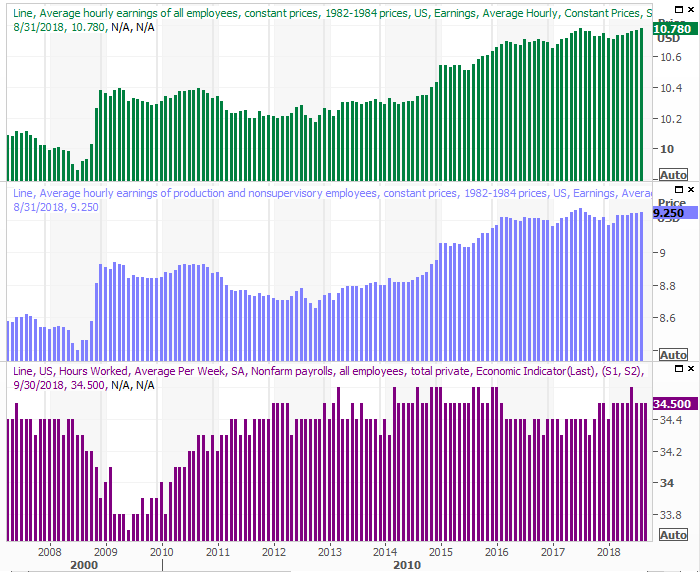

Finally, though the month's forward progress in wage levels was only 0.3% higher, that was a 0.3% improvement on August's wages. Paychecks have improved for six straight months, and are now at multi-year highs because employers are so desperate for workers. (The graphic below is only updated through August, not September.)

Putting all the pieces of the puzzle together, and it's difficult to come to any other conclusion than the economy is firing on all cylinders even though the real estate/construction market isn't what it should be. That weak spot is being offset by every other facet of the economy.

As long as we're seeing this undertow, we have to assume that our consumer-driven economy is growing enough to keep the bull market going.