NYSE exhibiting signs of panic-like buying despite stock market weakness

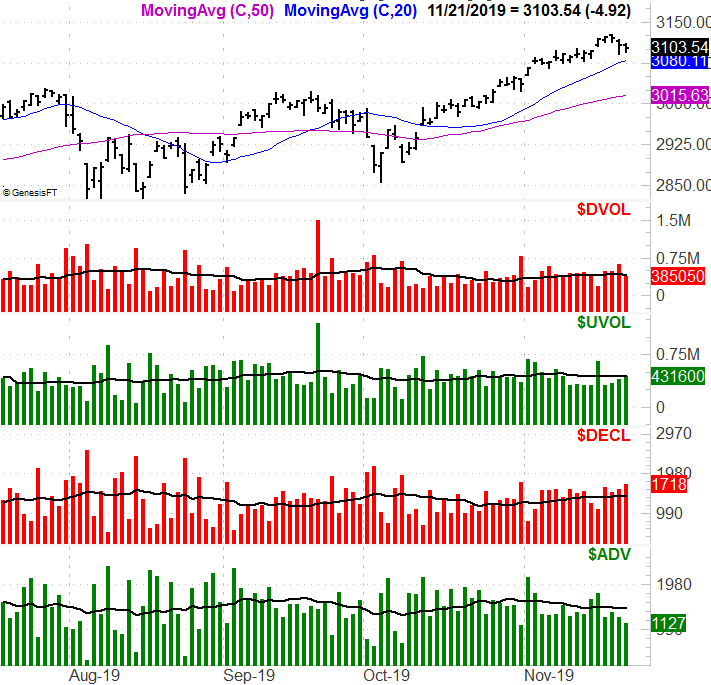

Despite declines in the Big 3 stock market indexes, and most stocks trading lower, the NYSE market breadth data is flashing signs that are usually associated with panic buying. The number of stocks declining is outnumbering advancers 1,624 to 1,168 on the NYSE, but the volume of stocks that are advancing represents 59.2% of total exchange volume. That has knocked the NYSE Arms Index, a volume weighted breadth measure, down to 0.482. Meanwhile, the Dow Jones Industrial Average fell 24 points, or 0.1%, the S&P 500 slipped 0.1% and the Nasdaq Composite eased 0.2%. The Nasdaq Arms is also down, but much less so at 0.940.

The Arms is the ratio of advancers-over-decliners over advancing volume-over-declining volume. The Arms usually rises above 1.000 when the stock market is falling, and falls below 1.000 when the market is rising, as investors typically trade advancing stock more aggressively than they trade decliners. An Arms reading below 0.50 is believed by many market watchers to suggest panic-like buying, while readings above 2.00 are seen as suggesting panic-like selling.

From MarketWatch