By Bret Kenwell, TheStreet.com

Netflix (NFLX) - Get Report continues its blistering run, with shares rallying 5.3% at one point Thursday and hitting a new all-time high of $449.52.

It’s not the only FAANG stock with momentum, with Amazon.com (AMZN) - Get Report also hitting a record high on Thursday, although Netflix remains the best-performing stock of the group this year.

Driving shares higher is a combination of investors realizing just how strong streaming video is right now - which also includes Disney+ (DIS) - Get Report and Roku (ROKU) - Get Report - and momentum traders bidding the stock higher.

As inspiring as this rally has been, investors are likely better off trimming some profit to lock in gains rather than initiate a new position. Let’s take a look at the charts to get a better idea of what the technicals say of Netflix.

Amazon and Disney are holdings in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells AMZN or DIS? Learn more now.

Trading Netflix Stock

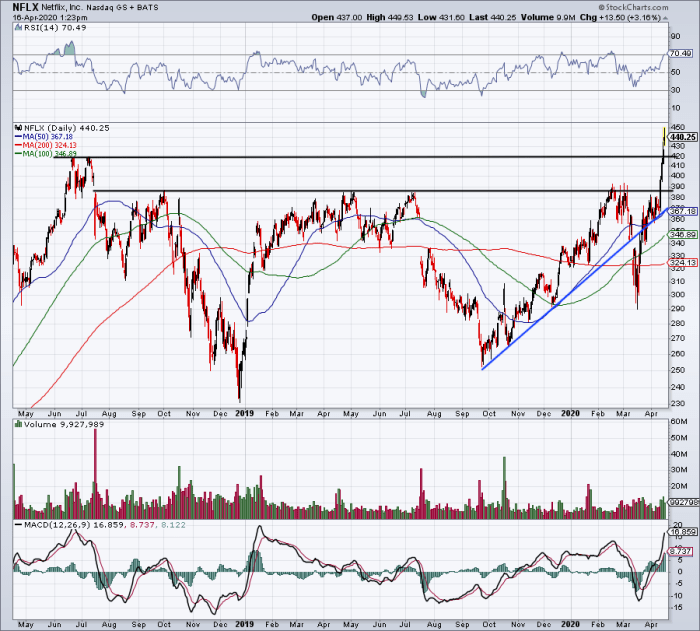

Daily chart of Netflix stock.

Chart courtesy of Stockcharts.com

In a perfect world, trading Netflix stock would be a piece of cake. Unfortunately, rarely is it that easy. A few days ago on Monday, Netflix stock burst through multi-year resistance at $380. This is something investors should have had on their radar. On Wednesday, the stock pushed higher to new all-time highs and then did so again on Thursday. Not many were looking for this big of a move so quickly.

Netflix is scheduled to report earnings on April 21st. Most investors think of earnings as the big catalyst - and it is, for both directions - but the stock can act funky ahead of the print too.

In other words, we could get a pullback in Netflix as investors take profits ahead of what could be a volatile event or they may continue to bid Netflix higher into the report in anticipation of strong results.

Whether the stock pulls back after earnings or before (or at all), I want to look at some of the potential downside levels. Specifically, I want to see how Netflix stock trades on a pullback to the former highs near $420. If this level gives the stock a bounce, $450 is back in play.

If a pullback to $420 materializes and support doesn’t hold, it puts prior range resistance on the table near $380. Given how powerful the breakout was over this mark and how long it was resistance, I would expect it to act as support upon its first test. Just below that is the 50-day moving average and uptrend support (blue line).

Is this a guarantee that Netflix will pull back? Of course not. But I would expect the stock to cool off a bit, either ahead of or after earnings.

From TheStreet.com