- Cisco Systems is bubbling just below its prior 2020 high. A good earnings report could propel the stock over it or it could hammer it lower. -

By Bret Kenwell, TheStreet.com

Cisco Systems (CSCO) has put together a solid run from the March lows, up 50%. However, that hardly makes it unique.

Most of the market has made a healthy rebound from the lows, with the Nasdaq rallying more than 60% to new all-time highs.

Based on that performance, Cisco actually looks like a laggard. That's particularly true when comparing it to some of its larger tech peers like Apple (AAPL) and Microsoft (MSFT).

The question now is whether the stock can play catch-up. Cisco has earnings scheduled for Wednesday after the close of trading and investors will be looking for the report to act as a positive catalyst for the stock.

If it does, it's possible Cisco stock could rotate up to new 2020 highs, a mark it hit right before it reported earnings in February. Let's look at the charts.

Trading Cisco Stock

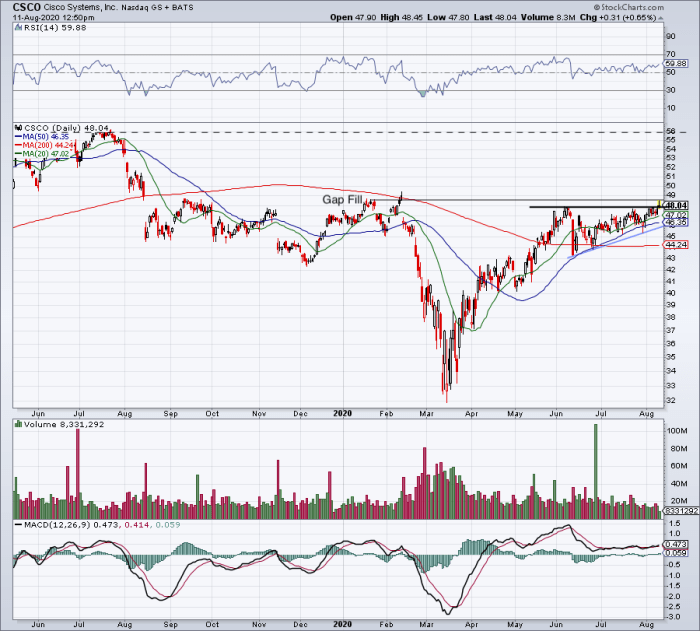

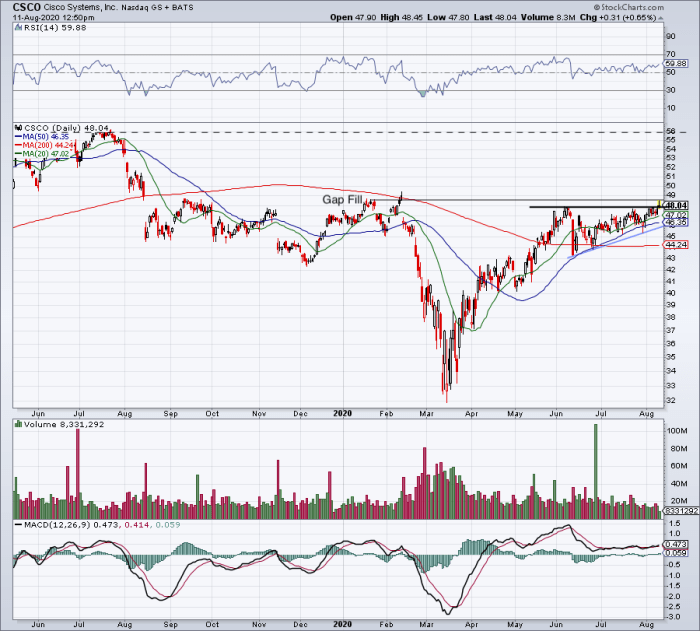

Daily chart of Cisco stock. Chart courtesy of Stockcharts.com

Above is a daily chart for Cisco stock over the last five quarters. With Tuesday's rally, we're seeing two things happen. First, shares are poking out over $47.50 resistance, which is a bullish technical development. However, we're also seeing Cisco fill the February gap.

The gap fill could act as a "job well done," opening the door to potential downside; the breakout could fuel shares higher. It's a mixed bag, but it doesn't matter now. Earnings will drive the narrative with this one.

If the reaction is bullish, look for Cisco stock to clear the current 2020 high from February, up at $49.42. That is up just 3.5% from current levels, but a close above this mark - particularly if the move is powerful - could unlock more upside levels.

In particular, it could trigger a move north of $50, potentially up toward $53.50. There Cisco finds the 123.6% extension for the 2020 range, as well as fills the last remaining gap-down from its 2019 highs.

The downside is also interesting. The 50-day moving average has been guiding this name higher. A dip to this area that holds as support would be encouraging for longs, potentially green-lighting a buy-the-dip situation.

However, all hope is not lost below the 50-day moving average. Near $44, Cisco stock will find its 200-moving average, along with the 20-week and 50-week moving averages. However, a break below this mark will not bode well for bulls.

In a nutshell, watch $49.42 on the upside. Above puts $50 and $53.50 in play. On the downside, watch $46, then $44.

From TheStreet.com