The market is reaching a ‘point of reckoning,’ and it could be a make-or-break moment for the rally, says trader

The S&P 500 is creeping closer to a key critical level that could mark a make-or-break moment for the rally, says TradingAnalysis.com founder Todd Gordon.

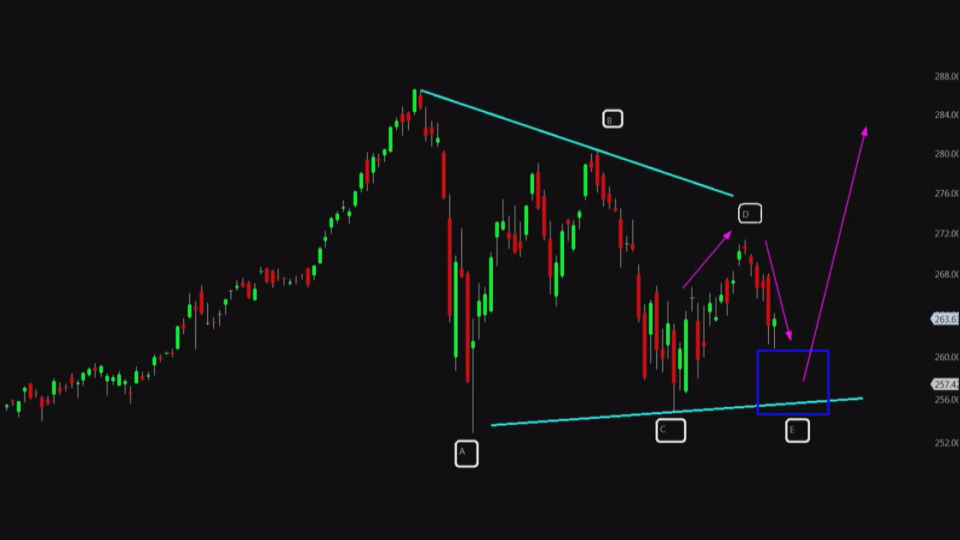

Last week, Gordon predicted that based on the classic Elliott Wave theory, which posits that market trends move in a succession of waves that can be used to foresee the next leg up or down, a short-term drop was about to occur in stocks. The drop did occur, which has Gordon looking at the chart to examine the next key technical level.

"We were looking for resistance in the S&P 500 to sell off," he said Thursday on CNBC's "Trading Nation." "That's exactly what happened, and now I would like to update the trade."

More specifically, Gordon is looking to the next leg of the Elliott Wave Triangle, and he believes one final drop is ahead for the market. However, this next leg down is especially important to watch, according to Gordon, as the market is headed toward a key support level that marks the bottom of the Elliott waves. Gordon finds this support line on a chart of the S&P-tracking ETF SPY and says that should SPY break below that line, the market's bull run may soon be over.

"Going forward, this Elliott Wave Triangle is coming to a point of reckoning. This is where we need to decide if this bull trend over the last couple of years continues," explained Gordon. "If we don't hold this, from my point of view and from the Elliott Wave Theory, we're in trouble."

But if SPY were to hold that bottom support line, then Gordon predicts that the market will be headed for another big rally up.

"We really need to hold this in the Elliott Wave to complete this triangle that's been in play for all of 2018," he said. "If we can successfully hold that level, then we should be able to move on up."

To play for this potential move up, Gordon wants to sell the June monthly 260-strike puts and buy the June monthly 255-strike puts, collecting about $1.30, or $130 per options spread. This is a bet that the SPY could hold above $255 through June. However, given the unpredictability of the market, Gordon noted that a tight stop must be put in place around the February low, or $253.

All three major indexes saw their biggest intraday gains since April 17 on Thursday and are now all positive for April.

From CNBC