Option Greek Lesson: Not All Thetas are Built the Same

One of the first lessons any new options trader learns -- even if sometimes the hard way -- is the importance of getting a grip on theta, or time decay. Simply put, theta measures how fast an option price deteriorates simply due to the passage of time. It's entirely possible to make the right directional call about an equity, but if that underlying stock doesn't move fast enough in the right direction, it can still turn into a losing trade because the time value evaporates at an even faster clip.

There's a nuance to managing theta that veteran traders should understand, if they don't already. That is, theta changes over time. And generally speaking, the less "out of the money" an option is, the faster it works against you.

The easiest way to illustrate this point is with some visualizations using Adobe (ADBE) as our guinea pig. We'll walk through a bullish/call scenario as well as a bearish put scenario, just to make sure we're able to fully explain the lesson. Beginning with the call...

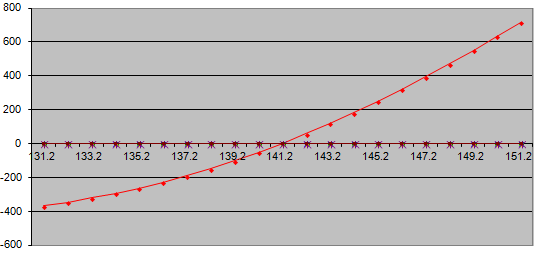

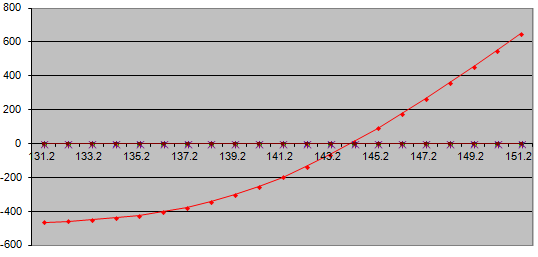

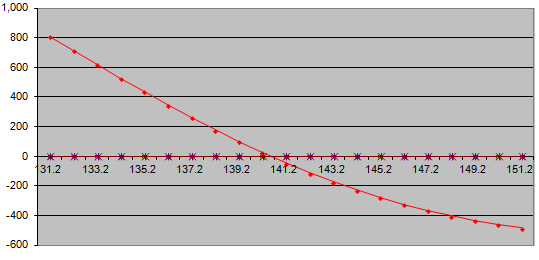

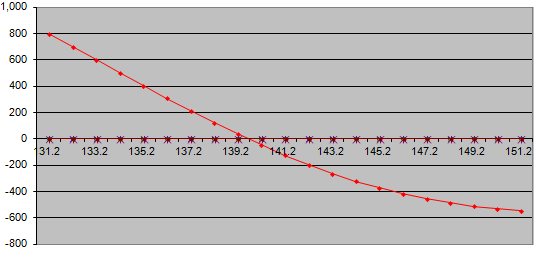

Let's assume we're bullish on Adobe shares, and want to buy a 140 call expiring next month, or about six weeks from now. With ADBE shares presently trading at $141.21, next month's 140 calls will cost us $4.73, or $473 per contract. As of right this very second, our breakeven point is more or less our entry point (ignoring the spread) is $141.21. But, were Adobe shares to suddenly fall $10 to a price of $131.21, our option trade would fall to a value of $105, translating into a loss of $368. Conversely, were Adobe shares to fly to $151.21, our profit on the trade would jump to $717. That's a 151% gain on our initial investment of $473.

That profit and loss potential changes tremendously two weeks from now, however. Two weeks from now, our net loss at a price of $131.21 would be $385, while our net profit at $151.21 would be $676. That's, respectively, a loss of 81% or a gain of $143%.

Fast forward another two weeks later. By that point the breakeven point has moved to $144.21. But, worse, at $131.21 the loss would be $451... a 95% loss on our initial capital. At the other end of the spectrum, our gain with the stock at $151.21 four weeks after our entry would be $648, or 137%.

Fast forward another week, right to expiration day. At this time the maximum loss of $471 - all of our initial capital put into the trade -- is realized at any price below $139.20, but our breakeven price has edged up to $145 (give or take). Even if Adobe were at $151.21 by then, the profit would only be $649, or a gain of $137.... same as the prior week. Eventually, a trade can get so deep in the money that theta goes away altogether and it's just all intrinsic value. When and to what degree depends on how much time is left and how deep in the money the trade is.

A couple of lessons emerge here. One of them is the simple fact that for outright put and call purchases, time decay, or theta always works against you.

Perhaps more important though, if it seems like theta works against you more when your option is out of the money, you're right -- the pace of time decay is hasty when the call option in question technically has NO theoretical value. That's why it's important to not let losing trades get too deep underwater. There comes a point in time -- and sooner than you might be ready to deal with -- when a sinking trade starts to accelerate lower. In this case, three weeks from expiry and/or two points under the option's strike price was the point where things went from bad to worse.

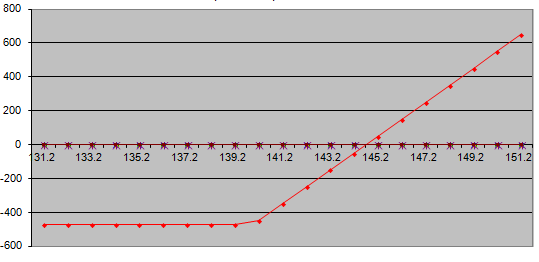

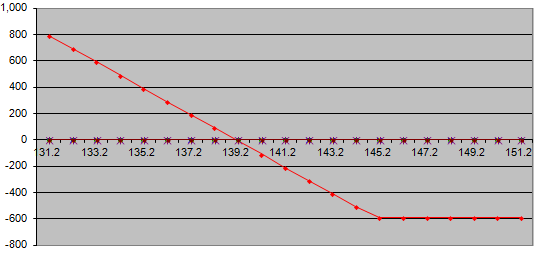

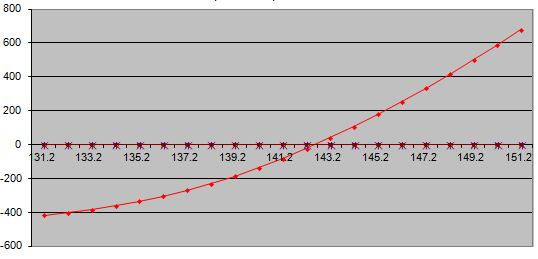

It works the exact same way for put options.... the deeper out of the money and the closer you get to expiration, the faster losing trades can get real ugly. Let's walk through an example using the 145 puts that expire about six weeks from now.

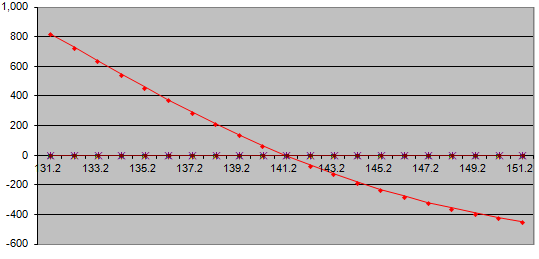

As a refresher, puts are bearish bets, and gain in value as the underlying stock falls. In this case, the 145 puts would cost $5.88, or $588 per contract while Adobe shares are trading at $141.21. Were ADBE shares were to fall ten points today to a price of $131.21, the put trade would gain $824 for a 140% gain. At the other end of the spectrum, if Adobe shares rally ten points to $151.32, the put trade would lose $445 in value, translating into a loss of 75%.

Two weeks from now, assuming nothing else changes, a price of $151.21 would mean an 82% loss on the position, while a price of $131.21 would translate into a profit of $811 or a gain of 138%.

Two more weeks after that, if ADBE shares are trading at $131.21, then the put trade would be worth $1385 per contract, for a gain of 135%. At the other end of the spectrum, a price of $151.21 would leave the put trade at a value of only $40, for a loss of 93%. The breakeven at that point -- at $141.21 just four weeks earlier -- would be right around $139.20....two points less than where it started.

Finally, on expiration day the maximum loss of $588, or 100%, is realized at any price above $145, though any price under $139.20 would represent a net loss on the trade. At $131.21, the gain on the put trade is $791, for a profit of 134%.

As was the case with the call, the put option lost value as time passed. But, also like the call trade, the further out of the money the position was, the toll theta took was faster and more dramatic than it was at the other end of the spectrum. That's because there's no intrinsic value left... it's all time value, which evaporates quickly when it becomes clear the option is going to expire worthless.

Like the calls, the puts really started to implode about two weeks away from their expiration data and/or about two points out of the money. At that point, the market started to proverbially throw in the towel.

Lesson learned? Same as before -- theta, or time decay, is hairiest and scariest the further out of the money is, and does more damage late in the trade than it does earlier in the trade. That's especially true for out of the money and at the money trades, and less so for in the money options.

Moral of the story: Know that time decay isn't static. It changes over time, almost always accelerating. That's why you can't tarry in trades, or sit on losers. That's also why you may want to buy a little more time than you might think you need.

Other food for thought: Theta is almost always traded-off for delta. Other food for thought #2: The adverse impact of accelerating time decay is a reason to sell options rather than buy options when their expiration is in sight.