More Leverage at Less Risk? Here's the One Place It's Easy to Create Such a Scenario.

Like leveraged ETFs? A lot of traders do, and for good reason. Just a little movement from the market or a sector can translate into a lot of movement for an exchange-traded fund, and the availability of bearish and bullish leveraged funds means it doesn't even matter which direction that trade-worthy move is pointed.

What if, however, there was a way to extract more leverage from a move than a leveraged ETF alone can provide, and all for less risk? There is, particularly when you're talking about gold, gold-based ETFs, and options of gold-centric exchange-traded funds.

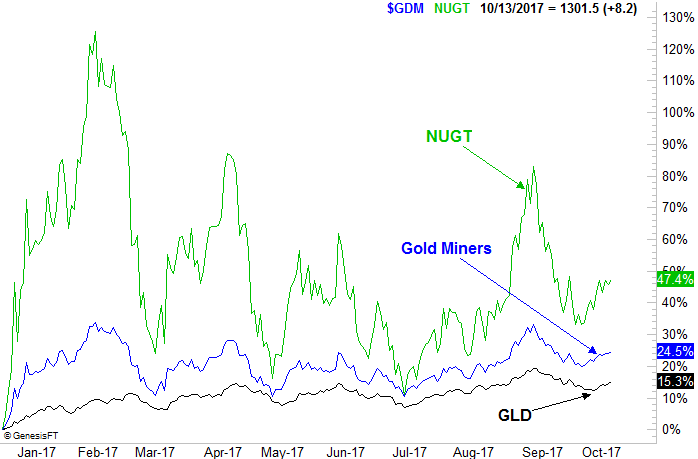

The crash course in trading gold stocks: Gold, though closely-followed and frequently-traded, isn't a major mover... at least not to the same degree stocks can ebb and flow. Gold mining stocks, however, are highly levered; even the minor changes in the price of gold can drive wide swings in the profitability of mining the commodity, to a little bullish progress in gold prices inflates gold mining stocks in a hurry. Conversely, a small dip in the price of gold can lead to a big dip in the value of gold mining stocks. Leveraged ETFs of gold mining stocks like the Direxion Daily Gold Miners Bear 3X ETF (DUST) and the Direxion Daily Gold Miners Bull 3X ETF (NUGT) move three times as much as already-leveraged gold mining stocks do.

That's a lot of action for not-a-lot-of-movement from gold itself.

There's a downside to all that leverage though. If you're on the wrong side of a trade -- meaning you Direxion Daily Gold Miners Bull 3X ETF and gold prices end up falling -- your highly-leveraged trade can lost a lot of value in a short period of time. It's easy to get burned.

There's a solution, however. And ironically, the solution to the uncontrolled risk of high-beta instruments like the Direxion Daily Gold Miners Bull 3X ETF or the Direxion Daily Gold Miners Bear 3X ETF is not only a better cap on total risk, but higher potential for net returns. That solution is using call and put options on those very-levered (3X) ETFs.

To be clear, options won't always be the answer. If you're looking to make a long-term stance on gold, bearish or bullish, this strategy won't be ideal. If your only goal is to hedge a bet or take a speculative near-term swing though, this may be the better solution. A comparison example illustrates why.

Let's assume we think gold prices are going higher. Broadly speaking, this coincides with even greater gains from gold miners, and even bigger gains still from leveraged ETFs. If we wanted to play the opportunity, we could simply buy NUGT. Let's say we're going to buy 100 shares at a the current price of $33.45, for a total cost of $3345. Just for the sake of illustrating our point, let's also say the most reasonable near-term trading target of $39.22. A move between here and there would translate into a profit of $577, or a 17% gain, with just a mere 2% to 3% bullish bump for gold prices.

That's a two way street though. Should gold prices slide 2% to 3%, the $3345 we allocated to the trade could quickly fall to a value of only $2768 before we even realized what was going on; we could lose $577 rather easily before we stepped in to stop the bleeding.

What if, however, we used a super-cheap call option to make the same "play" on the near-term move we were expecting? Let's find out.

Since this is nothing more than a speculation, we can afford to think aggressively (yet also limit our risk at the same time). Specifically, we could buy some November 36 calls at a price of $1.50, or $150 per contract; bear in mind that one contract controls 100 shares of NUGT.

From this point there are a myriad of "what if" scenarios that could play out, most of which have to do with time. Wherever we think NUGT is going to go, it has to get there before November 17th, when the 36 call expires. Just to make sure we're making a true apples to apples comparison though, we'll assume we're talking about the same price of $39.22 for NUGT as of mid-November. At that time and with NUGT at that value, the November 36 calls would -- theoretically anyway -- be worth $3.22, or $322 per contract. That's a profit of $172 per contract.

Yes, the profit of $577 on NUGT is greater than the $172 profit on the calls, but put things in perspective. You can scale up the call trade to only four contracts, which would costs $600, and the trade would have driven a profit of $688... more money, for less capital.

Here's the best part: While the risk of the outright NUGT trade was significant compared to the reward, the downside risk of the call trade was less, with an even greater reward. In fact, the maximum potential loss on the call option trade was just the $150 it took to buy each contract, and that loss is only realized in a worst-case scenario outcome. The maximum potential loss on the NUGT trade, however, could have easily been more than the above-described $577 if the trade wasn't dumped in time.

The only real downside in this case is the limited timeframe. Though NUGT will never "expire," the call options will. Then again, it's tough to hold onto something like the Direxion Daily Gold Miners Bull 3X ETF for the long haul anyway. They really weren't designed for that.

To be clear, all options are leveraged trades. Not all option trades create this much leverage relative to their risk though. This situation described above is unique because it leverages something that's designed to be leveraged to something that is already well-levered. A little action can go a long way. What we like best about it, however, is how little risk you have to take compared to how much upside you have on a fairly modest move from a commodity.

It certainly helps a lot to be right about the directional call, of course.