Call Credit Spreads Explained Using Real Index Options Timer Trade

Earlier this week our Index Options Timer service booked 19% gain on a credit spread trade on the iShares 20+ Year Treasury Bond ETF (TLT)... a bearish bet, essentially. In the grand scheme of things this trade wasn't all that different from any of the other trades we take on in the IOT newsletter. But, in that this particular position is a good one to use as a means of teaching others about the power and potential of credit spreads, we want to go back and take a closer look at it.

Just to set the stage for any newcomers to options trading (or as a refresher for those who may have forgotten), a credit spread is a two-piece trade consisting of one long option -- meaning we're buying it -- and one short option, meaning we're selling it. In this case the call we sold (or sold short) was worth more than the one we bought, so we ended up pocketing some money upfront. The aim was to close out the trade later at a lower net cost (or debit), or better yet let it expire without needing to do anything. That essentially means we make an exit at a price of $0.00, allowing us to keep 100% of the upfront credit we garnered at the trade's onset.

Let's walk through the trade's initiation just to get a feel for how and why we did it.

In short, as of Wednesday of last week we suspected TLT was headed lower... for reasons to detailed to get into right now. We could have simply bought a put, which would have gained in value as the fund lost ground. But, that actually wouldn't have been the optimal means of taking advantage of the pullback. There was simply too much time value for the relevant options that was fading too quickly. So, rather than buy a put that we hope gains more value due to TLT's demise than loses value due to time decay, we opted to sell a call that will not only lose value as the fund loses ground, but will also lose value due to the passage of time. [Remember, when you're short a particular trade, you WANT that instrument to lose value.]

In this case the optimal put option to sell was the September Monthly (09/15) 129 call (TLT 170915C129). With the iShares 20+ Year Treasury Bond ETF trading around $128.15 at that time, the 129 calls could be sold at a price of around 35 cents... or around $35 per contract. (Note that this call was out of the money, so you wouldn't have expected to get much. That's ok though.... we'll be paying even less for the call we're buying. On that note...)

Generally speaking, being short an option -- or sitting on a "naked" option -- is just too risky of a trade to hold. To protect ourselves we can buy a call. We just don't want to pay too much for it. Otherwise, what's the point? In this case it was the next strike up, or the 130 calls, that made the most sense to own at a price of 15 cents each, or $15 per contract. Should the short position be exercised against us, we can use the call we own to simply pass that exercise along to someone else. We'd lose the $1.00 difference between the two strikes, though we'd still keep the 20 cent (or $20 per contract) credit we garnered at the trade's onset. Note that in this case, as will be the case with most call credit spreads, the strikes we used were both out of the money.

For savvy and intuitive investors who've already done the mental math, you'll already realize the risk here is $80 per contract with a maximum potential gain of $20 per contract. That's misleading math though. While that's the risk/reward scenario by the numbers, the odds of us being forced to book a loss anywhere near that level is very low. Remember, both options are losing value every day just due to the passage of time -- in our favor -- yet we'd have plenty of time and room to recognize if TLT was going to rally, so we could make an exit long before the TLT moved above the critical $130 level.

It's at this point we should stop and verify the idea you may have already picked up on... we're intentionally going to lose money on one of the options. We want it to be the 130 call we bought for 15 cents, or $15 per contract. That amount will offset the $35 we collected for selling, or shorting, the 129 calls, but that lesser gain is worth it because we reduce our risk tremendously.

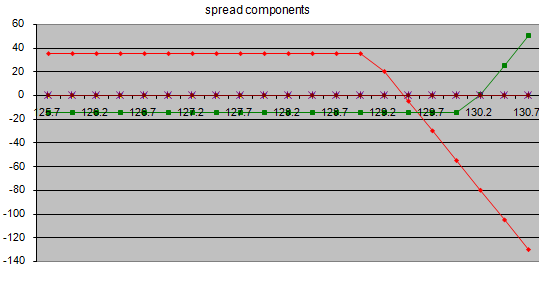

The profit and loss graph below helps you get a conceptual grip on how this credit call spread works. The green line is our P&L on the 130 calls we bought, while the red line is the P&L for the 129 calls we shorted. Our net gain is the difference between the two, and we only have a net gain as long as TLT remains below $129.20 by the time the options expire... if not before. Remember, we can always close the trade out before the options expire by buying the short call back, and selling the long call.

And, that's exactly what we did. We bought the 129 calls back for eight cents each, and sold the long 130 calls at three cents each for a net cost of five cents, or $5 per contact. We received $20 per contract when we opened the trade though, so our net profit was $15.

$15 isn't a lot, but you could scale the trade up as big as you wanted to. Just bear in mind your maximum risk for each long/short pair of contracts is $80. In fact, that's how we measured our gain of 19%.... we banked a $15 gain on $80 worth of risk.

You'll never make an outright killing by writing credit spreads. But, that's never the point. This is a low-risk way of continually collecting nickels and dimes and steadily building your portfolio's value.

If you'd like to learn more about credit spreads - and earn as you learn - the Index Options Timer newsletter is one of the favorites among BigTrends subscribers. Go here to learn more.