This incredible shrinking stock market is bad news for this type of investor

There are fewer than half as many listed companies today as in late 1990s

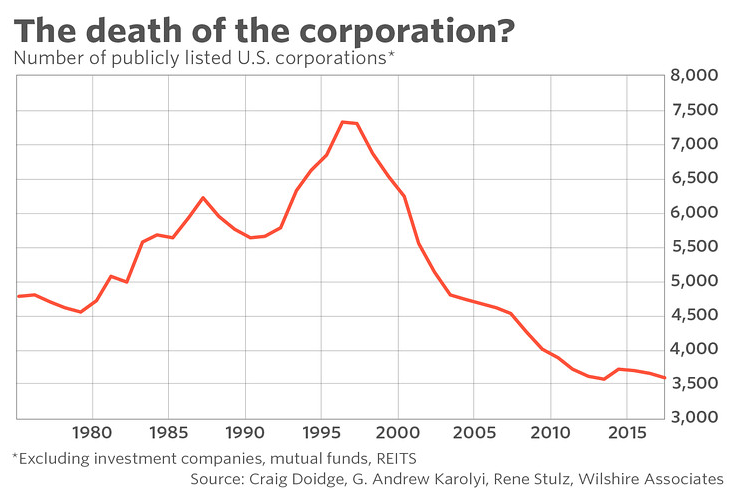

The stock pickers among you have fewer than half as many stocks to choose from as you did 20 years ago.

No wonder it’s getting harder to construct a portfolio that does better than a broad-market index fund.

As you can see from this chart, the peak came in the late 1990s, when there were more than 7,300 of publicly traded U.S. corporations. Today, the number is hovering around just 3,600.

This dramatic reduction undoubtedly has been caused by a combination of factors, and many of them have been widely discussed. One cause is that startups are waiting longer than ever before to go public. Another is the increased number of mergers and acquisitions.

But another factor that has received less attention has perhaps the most profound implication for you as a stock picker: We are moving into what Dartmouth College engineering professor Geoffrey Brown calls the “winner take all” economy—an economy that is increasingly dominated by a relatively few large players.

The investment implication is that if a company isn’t one of the few winners, it may very well not survive.

Perhaps the most revealing statistic in this regard is the percentage of corporate profits that come from the 100 most profitable listed firms. In 1975 that percentage was 48.5%, according to research conducted by finance professors Kathleen Kahle of the University of Arizona and Rene Stulz of Ohio State. Twenty years later, in 1995, that percentage had grown only slightly to 52.8%.

Over the subsequent two decades, however, this proportion mushroomed to 84.2%.

Consider what this amazing statistic means for the 3,599 publicly-listed U.S. corporations that currently are part of the Wilshire 5000 index W5000, +0.16% Assuming that the 2015 percentages still hold, the 100 most profitable firms accounted for $1.46 trillion of total after-tax first quarter corporate profits of $1.74 trillion. That means that the remaining 3,499 companies accounted for just $274 billion in profit—which works out to an average of $78 million profit for each.

In effect, these 3,499 “losers” are left fighting over the crumbs that fall off the dining table of the 100 most profitable. Because many of those operate with little financial cushion, many won’t survive.

The emergence of the “winner take all” economy would have different investment implications if there were some way of identifying in advance which companies will become winners. But I know of no reliable method for doing so. And bear in mind that the consequences of failure are now worse than ever before, since the flip side of “winner take all” is that “loser takes none.”

The only surefire way of guaranteeing that you own the winners is to invest in a broad-market index fund, such as the Vanguard Index 500 Fund VFINX, +0.03% which is benchmarked to the S&P 500 index SPX, +0.03% .

This is yet another reason why index funds have become harder than ever to beat.

From MarketWatch