The stock market is too damaged for a sustained rally, strategist warns

- Morgan Stanley's Wilson: Too much resistance in stock market for a 'straight up' recovery -

The stock market is in the midst of its longest winning streak in months, but at least one Wall Street strategist is not convinced that investors are out of the woods yet.

Mike Wilson, equity strategist at Morgan Stanley, who had urged caution even as stocks were trading at records last year, reiterated his downbeat outlook on the market.

"We are definitely more constructive than we have been in over a year based on valuation, sentiment, and positioning, but we don't think it is time to blow the all-clear yet," he said in a report.

Wilson believes the market is too damaged and there is too much resistance for stocks to climb "straight up." He also noted that financial conditions continue to deteriorate despite the Fed's more "dovish" tone, and without the central bank backing off from its tighter policy regime, it will be tough for the market to support a rally above 2,600-2,650.

The Dow Jones Industrial Average has been whiplashing in the past couple of weeks as trade-war related headlines, speculation over the Fed's policy stance and economic data have played havoc with market sentiment. In perhaps the most dramatic sign of what investors are having to contend with, the S&P 500 went from having the worst start to a year since 2000 on Jan. 3 to posting year-to-date gains of more than 3% Wednesday.

Against this rather topsy-turvy backdrop, Wilson argues that it is premature to be too positive about equities as the market has yet to trough.

"Before making the call for the market to move sustainably higher, we think there are still a few more hurdles to clear," he said. "Ultimately, we expect a very important cyclical low to this bear market to be put in this year, and we expect a reversal of our rolling bear market to occur in a first-in, first-out (FIFO) manner with the weakest links bottoming first and leading."

As such, cyclical stocks - such as automobile makers, restaurants and airlines - which are more sensitive to the economy, are expected to lead when the market hits bottom.

Furthermore, Wilson said that although the rolling bear market has worked its way through on the index and sector level, there is still room for valuations to fall among individual stocks as well as potential for further earnings cuts, such as Apple Inc.'s revenue warning last week.

"We suspect there are more 'Apples' looming out there as we enter fourth-quarter earnings season," he said.

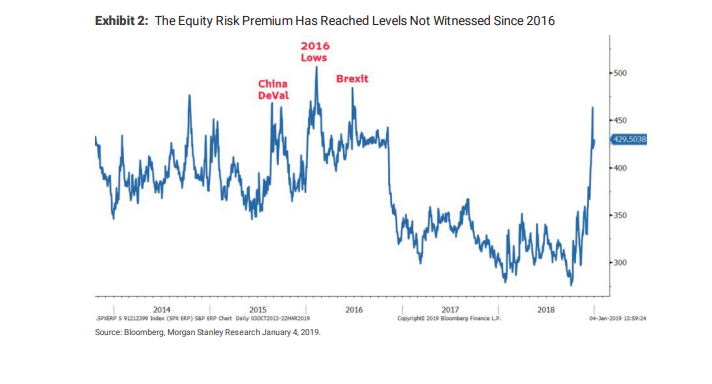

Meanwhile, equity risk premium has risen to levels not seen since 2016, thanks in part to a decline in yields, with the 10-year Treasury yield trading at 2.73% versus its 2018 peak of above 3%.

The strategist is projecting the S&P 500 to rise to 2,750 by the end of 2019, among the more subdued forecasts.

"We like the S&P 500 at current levels for those with a 12-month horizon, but we think there is a good chance we test or break recent lows as we experience a rolling bottom for individual stocks, particularly those that have high index weightings," he said.

U.S. stocks gained for a fourth straight session Wednesday as optimism over U.S.-China trade talks bolstered market confidence.

From MarketWatch