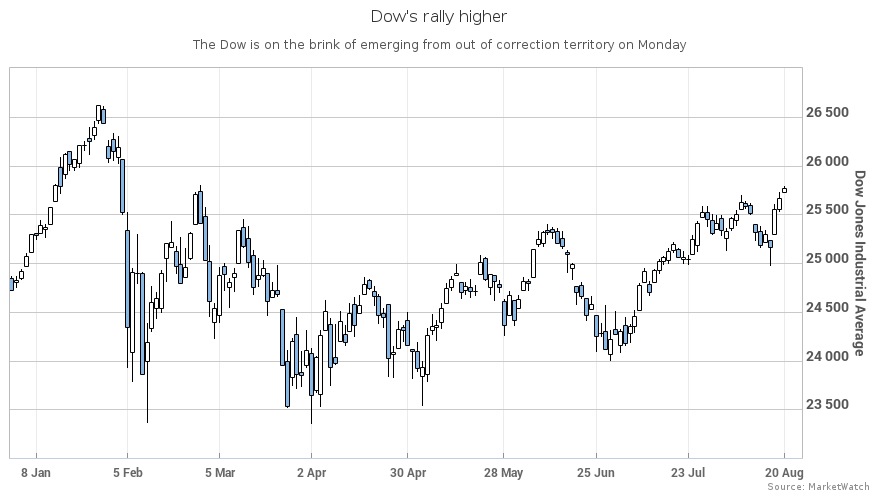

The Dow is on the verge of busting out of correction phase for the 1st time in 6 months

- S&P 500 has already exited correction phase -

The Dow Jones Industrial Average on Tuesday was on the brink of bursting out of correction territory for the first time in more than six months, underscoring some signs of renewed optimism on Wall Street.

The blue-chip benchmark has so far failed to trade 10% above the closing low of 23,533.20 hit on March 23, but could do so with a close at 25,886.52 or higher. It entered correction territory on Feb. 8 when it fell 10% from its recent peak, along with the S&P 500 index.

The Dow stands less than 0.5% shy of emerging from correction territory. After gaining 89.37 points, or 0.4%, to 25,758.69 on Monday, the 122-year-old stock gauge remains less than 130 points short of that mark. The S&P 500 and emerged from its correction phases which also began on Feb. 8. Meanwhile, the Nasdaq Composite Index narrowly avoided its own corrective phase and has put in more than two dozen records in 2018.

On Tuesday, all three benchmarks traded in positive territory.

This is the longest stint that the Dow has spent in correction territory since the 223 sessions in 1961, according to Dow Jones Market Data.

Some market-technician purists believe an asset must put in a new high to officially emerge from a corrective phase. Other technicians say a 10% gain from an asset’s lowest close is sufficient to exit correction territory, a characterization that MarketWatch adheres to.

A recent bout of optimism around U.S. stocks has stemmed partly on hope that China and the U.S. can lay the groundwork this week for ending a protracted tariff dispute between the world’s two largest economies, which has threatened to rattle other economies.

From MarketWatch