One would think after rallying nearly 18% since early November and with valuations stretched to their breaking point, there wouldn't be any room left for more gains. Like John Maynard Keynes put it though, "The market can remain irrational longer than you can remain solvent." In other words, never say never no matter how rational the counter-argument is. As unlikely and unbelievable as more upside seems from here, a closer look at the bigger picture reveals the buyers aren't too worried to stop buying yet. In fact, they're trading in their other assets explicitly to buy stocks.

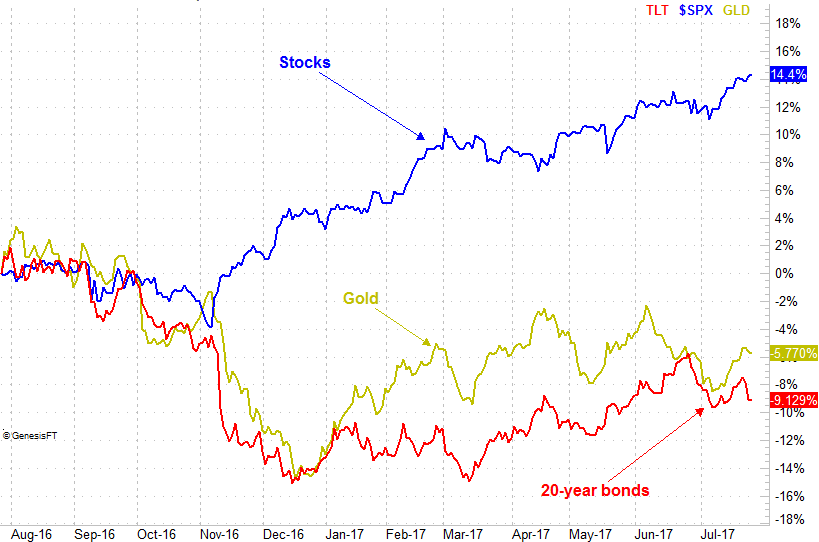

The chart below is one we've looked at before, though the last time we looked at it we expressed concern for stocks because traders were migrating out of equities and into alternatives like gold or bonds. As it turns out, the interest in bonds and commodities like gold was short-lived -- investors fell in love with stocks again, and haven't changed their minds in the meantime.

As we've said numerous times before, it's better to respect and respond to what the market is doing rather than trade based on what you think it should be doing.

Thing is, it's not like this rekindled strength in stocks is completely without merit.

We're far closer to the beginning of Q2's earnings season than the end of it, but with about one-fourth of the S&P 500's companies having already reported their second quarter numbers, we can get a decent feel for where things are headed.

And where they're headed here is encouraging. Analysts were only expecting the S&P 500 to 'earn' $30.97 per share in Q2 before earnings season began, but based on the results thus far, that projection has been bumped up to $31.15. It's not a leaps-and-bounds improvement, but in that the pros usually overestimate earnings results, the collective beat so far bodes well.

The trailing P/E of 21.3 is still frothy, but not uncharacteristic of valuations investors have supported of late. Perhaps more important, the forward-looking P/E of 18.1 doesn't seem out of reach given the earnings-growth trajectory so far for Q2. Just a few weeks ago, reaching those earnings targets seemed like a long shot, at best.

Don't read the wrong message. This market is overbought and overvalued, and the very minute enough traders start to express their doubts, it could all come unraveling in a hurry. We're also headed into a weak time of year for stocks. The S&P 500 generally loses a quarter of a percent in August, and falls half a percent in September, on average. It's also well ahead of its normal year-to-date pace this time around, leaving it even more vulnerable to a pullback soon. There's not actual evidence that pullback is ready to materialize though, and it's not wise to trade presumptively.

On the flipside, this is still a time to be ready for anything. The amount of complacency, as indicated by a rock-bottom VIX, is uncomfortable, which is dangerous -- when everyone agrees things are bullish, everyone has already bought into all the stocks they're going to. The only people left are the sellers.

Again though, we don't actually see that starting to happen yet, as the fundamentals so far are rolling in better than expected for Q2.