Apple has what it takes to weather these market bombs, says market watcher

As the market sell-offs roll on, Wall Street's biggest name has sustained some of the least damage.

Apple is one of the best equipped to weather any more market turmoil headed its way, says Gina Sanchez, CEO of Chantico Global.

"You could hide out in Apple as this kind of melts down around because it is fairly stable and mature," Sanchez told CNBC's "Trading Nation" on Thursday.

No Dow Jones industrial average component has been spared February losses, but Apple is in the middle of the pack in its declines this month. One-third of the Dow has seen double-digit losses in February, while the index has dropped 9 percent. Meanwhile, Apple, with a month-to-date loss of 7.5 percent, is the ninth best-performing stock in the index. Disney, Nike, J.P. Morgan and Cisco are the best performers in the Dow in February.

On Monday and Thursday this week, when the Dow plummeted more than 1,000 points apiece, Apple shares declined 2.5 percent and 2.75 percent, respectively. The tech giant is on track for a 3.5 percent drop this week, less than the XLK Technology ETF's 6 percent fall and Dow's 6.5 percent decline.

And according to one widely followed technician, Apple's resilient price action could be a sign of strength to come.

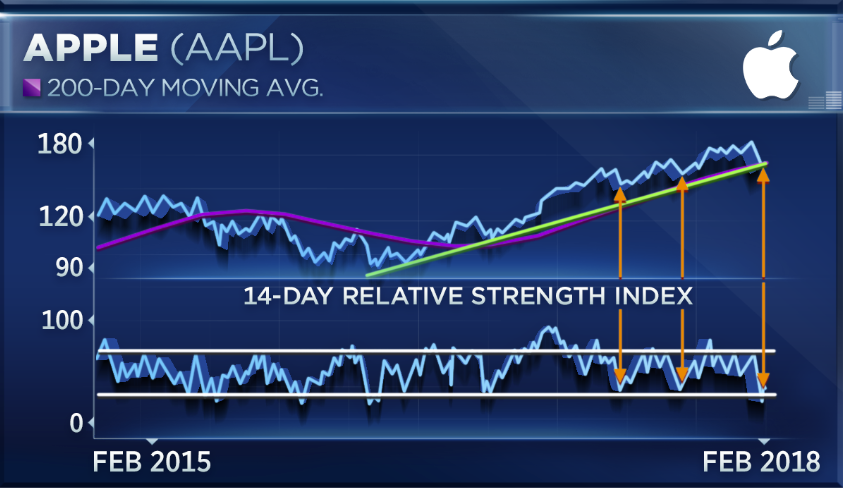

"You haven't got any sort of technical breakdown happening on the charts," said Craig Johnson, senior technical strategist at Piper Jaffray, on "Trading Nation. "All you've done is pullback to a longer-term uptrend support line."

Apple shares are currently trading around $155. The stock broke below its 200-day moving average of $160.50 last Friday when the Dow tanked 666 points, but has held within reach of that level. Technicians often look to moving averages as key inflection points for stocks. While Apple is currently 4 percent below that moving average, Johnson believes the stock has shown some resilience.

Apple shares remain in correction territory Friday, roughly defined as a pullback of 10 percent or more from the 52-week high. Its shares have dropped 14 percent since their 52-week high on Jan. 18. Twenty-eight of the 30 Dow components finished the week in correction territory.

From CNBC