Something in the charts suggests Microsoft's run has stalled: Technician

As shares of Microsoft, along with its other big tech peers, recovered after a notable two-day losing streak, one trader is making a unique bet on the tech giant settling into a trading range ahead of its quarterly earnings report in July.

By using a type of options trade called an "iron condor," Todd Gordon of TradingAnalysis.com is planning to capitalize on the relatively high price of options on the stock, along with his expectations that Microsoft shares are likely to move sideways.

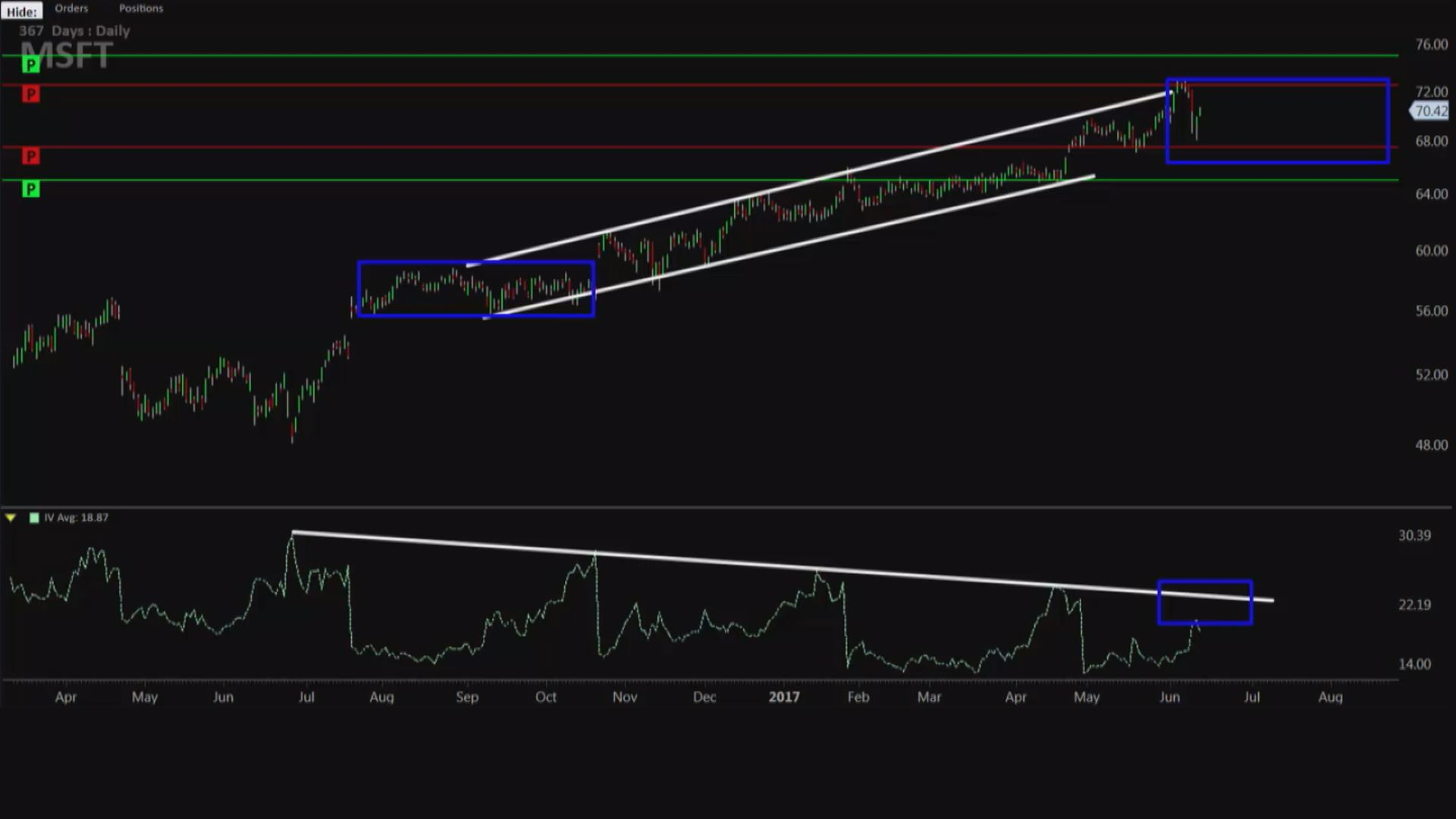

"Microsoft, as well as the broader market, has had a very nice move up over the last nine months, following a very orderly uptrend. It appears that the last consolidation we saw was back in the second half of summer 2016, into early fall. So that consolidation is right in this range, so it lasted about three to four months," Gordon said Tuesday on CNBC's "Trading Nation."

"It looks to me, based on the technicals that we're following, that Microsoft could be falling into a similar range" this time around, he added.

Yet while he sees the stock as being range-bound, he points out that "implied volatility is moving up due to this recent sell-off in tech, as well as earnings that are coming up on July 20. I would like to take advantage of this overbought volatility, which means options are expensive," Gordon said.

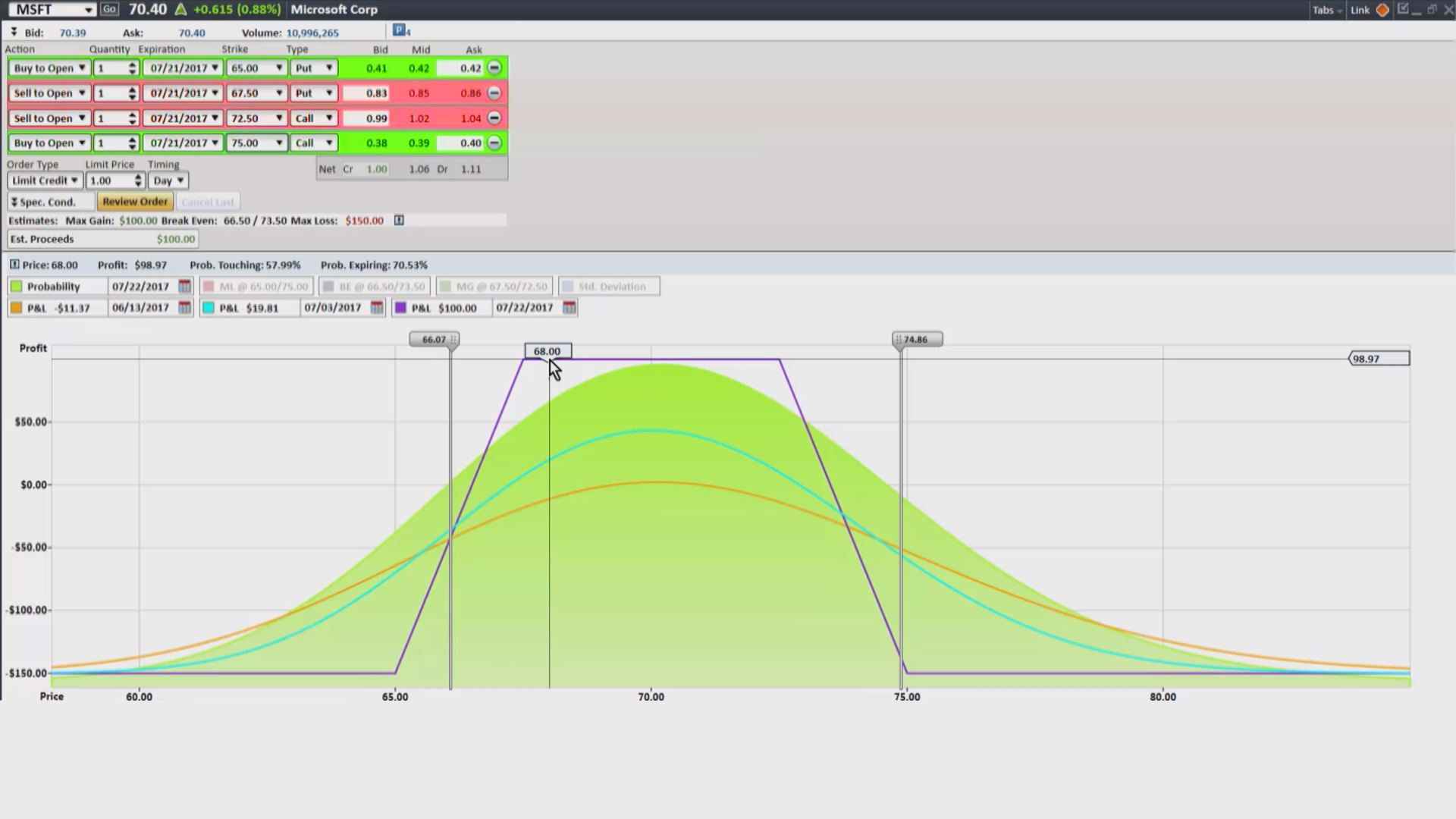

Specifically, Gordon plans to sell the July 67.50-strike puts, and buy the July 65-strike puts, meaning he is selling the put spread for a net credit of about 40 cents per share; on the other side, Gordon plans to sell the July 72.50-strike calls and buy the July 75-strike calls, meaning he is selling a call spread for a net credit of about 60 cents per share.

The "iron condor" thus combines a short call spread with a short put spread. In this case, Gordon will get to keep his entire credit of $1.00 per share, or $100 per options spread, so long as the stock is between $67.50 and $72.50 on July 21.

"What we're essentially doing is defining a range in which we think Microsoft will exist heading into July monthly options," he explained.

Below and above those levels, Gordon stands to lose money. However, the fact that he bought a call and a put for protection limits his potential loss. In this case, his maximum loss is $1.50 per share, or $150 per options spread.

The shape of the profit-and-loss graphic for this structure — a flat maximum profit, declining in "wings" on both sides to a flat maximum loss — is what gives the trade its avian name.

Interestingly, the iron condor expresses a market view that would be very difficult to profit from without the use of options.

"Done properly, options are a wonderful way to potentially make money in a sideways market in high implied volatility situations," Gordon said.

From CNBC