It's officially here... the worst month of the year (on average) for the market. Stocks generally lose between 0.6% and 1.6% of their value in September, depending on how far back in time you look. And, though not every single September is a loser, it's one the only month of the year where a loss is historically more likely than a gain.; the market loses ground in September 57% of the time. And, it's not as if 2017's September is starting out with any particular advantage.

Thing is, there are some exceptions to this norm. There are also specific reasons why the norm is the norm. That is to say, there are some pretty clear, habitual loser industry groups every year, though there are some strangely-reliable bright spots too.

Not that one month's action is worth worrying about for long-term investors, but for short-term traders or investors that were on the fence about getting into or out of a particular industry, this one's for you - a look at the areas most likely to be bullish in the month ahead, and a look at the areas that are probably going to lose more than their fair share of red ink.

For no particular reason, we'll start with the losers.

LOSERS

September may not be a horrifying one for carmakers (though this one in particular could be ugly), but it's usually a pretty poor month for suppliers of auto parts and components... names like Johnson Controls (JCI) and Delphi (DLPH). The group tends to lose about 3.5%, but even in a "good year" these names collectively lose about 1.3% of their value. The good news is, that weakness ends when the month does.

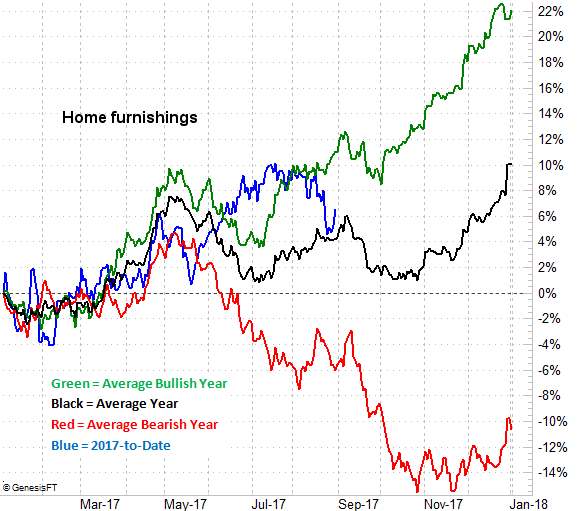

It's not a huge loss, but the 2.3% pullback home furnishing names like La-Z-Boy (LZB) and Stanley Furniture (STLY) is one you can count on in good times or bad. Even in bullish years, the group gives up 3.4% for the month of September; the bullishness just gives traders even more profits to take. Just don't stay out too long. Once September comes to a close, these names start to soar.

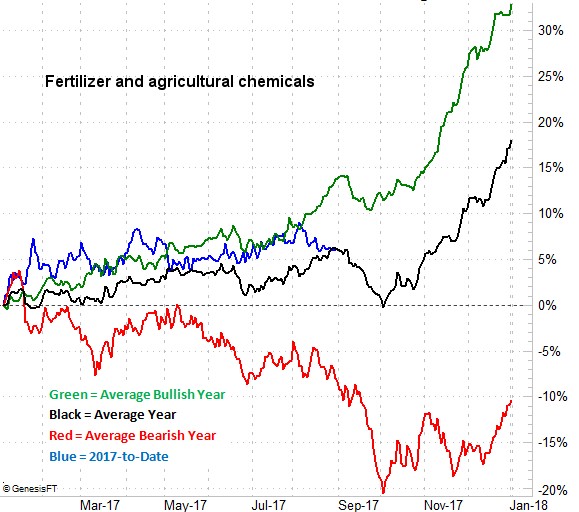

Maybe it's a seasonal thing, or maybe it isn't. Either way, the month ahead is almost always a bad one for fertilizer and agricultural chemical stocks like Potash (POT) and Mosaic (MOS). They lose, on average, 6.1% of their value in September, but even in a bullish year they give up about 2%. This is another bearish trade you wouldn't want to tarry with though, as they usually dish out rather bullish results over the course of the entire fourth quarter.

It's mentally tough to bet against semiconductor equipment stocks right now. Companies like FormFactor (FORM) and Amkor (AMKR) rank among 2017's best performers, and that rally still appears to be going strong. History says, however, the coming month usually isn't a great one for these names. All the year-to-date bullishness may well be a setup for a wave of profit-taking... even if just in the near-term.

WINNERS

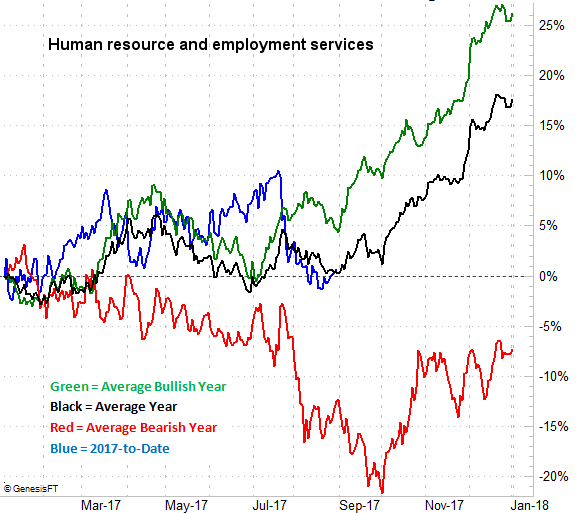

While September is generally a good month to get into human resources and employment stocks like Kelly Services (KELYA) or Manpower (MAN), it can be a test of patience and fortitude. Though the group gets the month started with a bang, there's a pretty reliable pullback late in the month. Don't let that deter you. Once September is over and October begins, these names really heats up. This year's performance looks like it's going to be a pretty typical one too. That bodes well.

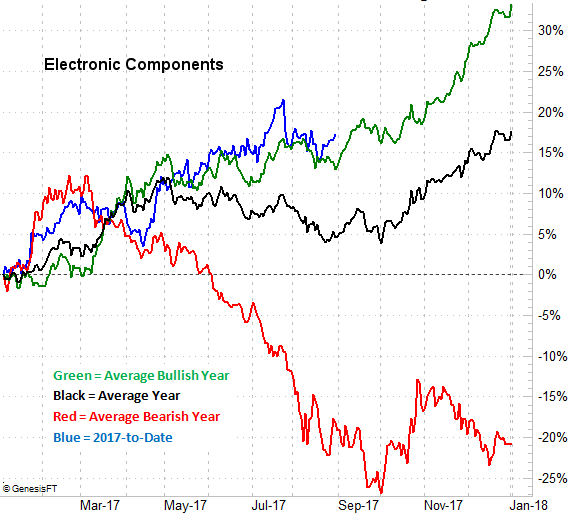

The tern 'electronic components' can mean a lot of things. In this case it means companies such as Dolby Laboratories (DLB) or LG Display (LPL). To be clear, the calendar month of September is breakeven for these names, on average. There's a noteworthy nuance with the electronic components group though. They're reliabky bullish in the first half of the month, and if you're willing to ride out the weakness during the second half of the month then you're well positioned for big-time bullishness through the end of the year.

It's tough to get excited about owning a reinsurance name like Greenlight Capital (GLRE) or Everest Group (RE) right now. They spent the bulk of August in a freefall, and stepping in now is tantamount to catching a falling knife. For those who have the guts though -- and are willing to put stop-losses in place -- reinsurance may be an industry worth a bet at this time. These stocks generally gain 4% in the month ahead, but even in a bad year September is usually a healthy winner.

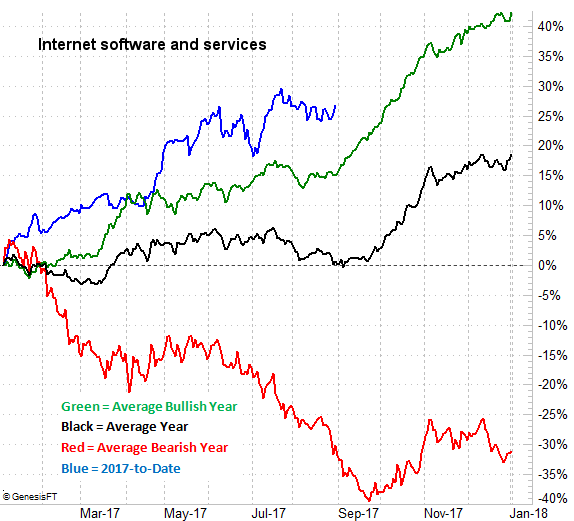

Technically speaking, internet software and service stocks like Alphabet (GOOGL) or MeetMe (MEET) are not only overextended and overbought right now, they're even ahead of their usual pace for a "bullish" year. While that may ultimately translate into profit-taking potential, right now these stocks are moving into their hottest time of the year. Internet stocks collectively gain an average of about 4% in September, and in a good year like 2017 has been so far, they gain about 9% in the month ahead. In both cases, October is just as hot.

Bottom Line

Obviously nothing is ever set in stone - there can be and will be exceptions to the norm. On the other hand, historical averages and tendencies are averages and tendencies for a reason. You at least have to respect the odds.