Retail Investors Just Made a Historic Move Into U.S. Stocks

By Luke Kawa and Sarah Ponczek

Looking for signs of exuberance that typically signal a market top? How about mom and pop backing up the SUV at the local brokerage.

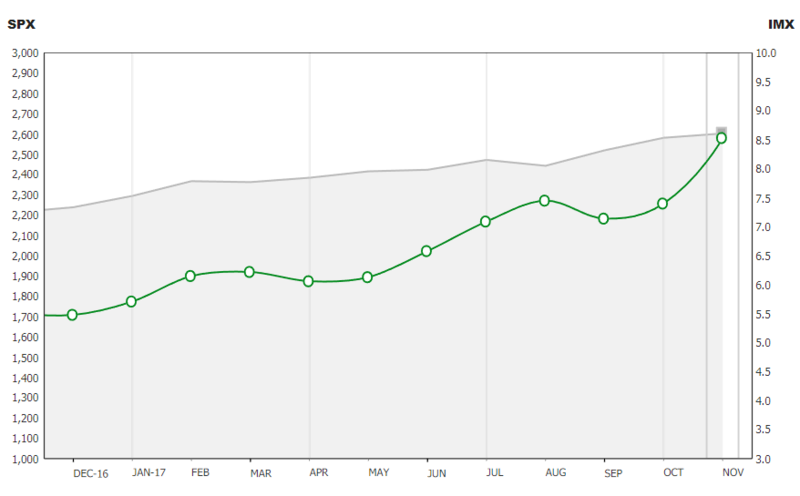

Clients at TD Ameritrade added to stock holdings for a 10th straight month in November, driving a gauge of retail investor sentiment 15 percent higher to a record, according to the online brokerage’s website. That was the “largest single-month increase ever” in the firm’s IMX measure, as investors piled into an equity market that’s on pace for its best year since 2013.

“The retail investor has become a bit more of a believer,” Joe “JJ” Kinahan, chief market strategist at TD Ameritrade, said in an interview at Bloomberg’s New York headquarters. “We don’t want people to get overzealous, if you will. This is controlled exuberance.”

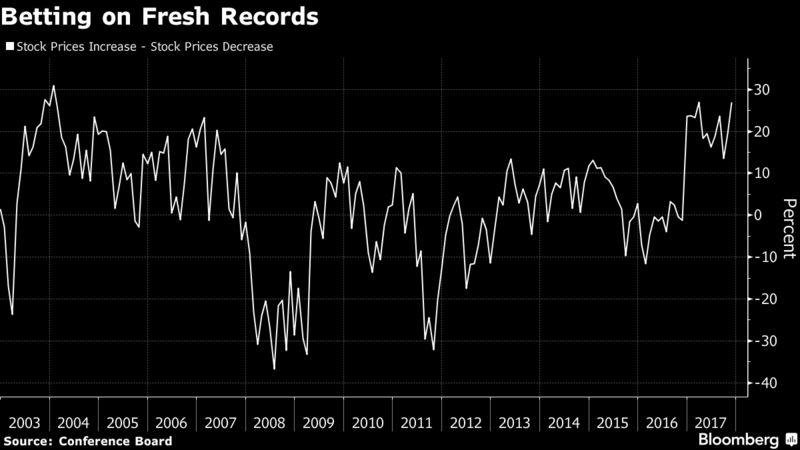

There are other signs retail investors have growing faith that the market will extend the eight-year bull market. According to Conference Board data, the net percentage of Americans who expect equities to rise next year reached 27 in November, the highest share since 2004.

TD Ameritrade clients were “positioning their accounts for more exposure to equity markets,” the firm’s report said. The buying came as Republican tax cuts moved closer to passing Congress and data continued to indicate the economy was picking up steam.

Investors eagerly bought dips in technology stocks like Nvidia, Micron Technology, Apple and Amazon.com at the end of November, said DataTrek Research LLC co-founder Nicholas Colas, citing his analysis of data released by Fidelity Investments. Those bets might not have turned out well, as tech shares have paced the slow start to December in U.S. stocks.

One aside: the data suggest that at least as late as last month, rules in the Senate tax bill that could raise capital gains levies on stock sales weren’t keeping anyone out of the market. For tax purposes, the cost-basis provision would force investors that hold multiple batches of shares to sell the one they’ve owned the longest first. It could cull an extra $2.4 billion in taxes from investors in 10 years, according to the Joint Committee on Taxation.

“They’ve changed those rules around a few times in the last 30 to 40 years, and although there might be small market moves, it tends to be very temporary and not really enough to try to get out in front of,” said Paul Nolte, a portfolio manager at Kingsview Asset Management in Chicago.

From Bloomberg