Opinion: Here's what the Russell 2000's new high means for the S&P 500

- Bulls shouldn't get too excited about smaller stocks' rally -

It's undeniably good news that the Russell 2000 is at a new all-time high. But bulls are premature in concluding that this widely-used benchmark for the small-cap sector means the U.S. bull market is alive and well.

It may very well be that the broad U.S. market, as represented by indices including the S&P 500 will soon join the Russell 2000 in new all-time high territory. Currently the broad market is still about 5% below highs set in late January - even after a strong rally to start this week.

The bulls need to remember that the Russell 2000 represents less than 10% of the total market cap of the entire U.S. stock market. That's a small tail to wag a big dog.

Still, the belief remains widespread that small-caps are a leading indicator. An oft-quoted aphorism in this regard is that "when the troops lead, the generals will follow" - the idea being that it's positive when small-cap stocks (the "troops") are outperforming the large caps (the "generals" being companies such as General Electric and General Motors), on the theory that shares of big companies will have to perform particularly well just to catch up.

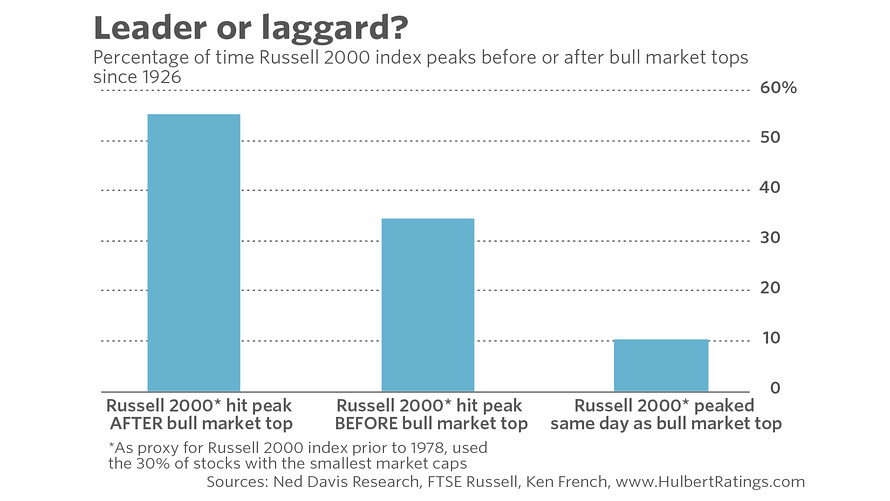

But history provides no support for this theory. Consider the 29 bull-market tops since 1926 in the bull-market calendar maintained by Ned Davis Research. In more than half of these cases, the Russell 2000 (or comparable) index hit its peak after the bull market's high, not before. (My reference to a comparable index is for the period prior to 1978, when data for the Russell 2000 begin. For the pre-1978 period I focused on the 30% of the stocks with the smallest market caps.)

The most recent three bull market tops in the Ned Davis calendar provide a good illustration of how little consistency there is in whether the Russell 2000 hits its high before or after the broad market's top:

- The top on May 19, 2015. The Russell 2000 hit its high on June 23 of that year.

- The top on April 29, 2011. The Russell 2000 hit its high on the same day.

- The top on October 9, 2007. The Russell 2000 hits its high on July 13, 2007.

The bottom line: The bull market may be alive and well. But confirmation of its health will have to come from other indicators besides the Russell 2000 alone.

For more information, including descriptions of the Hulbert Sentiment Indices, go to The Hulbert Financial Digest or email [email protected] .

From CNBC