One Thing Missing From Copper Boom Is Buyers of Actual Metal

- Premiums that suggest level of physical demand have stayed low

- Optimists expect fundamentals to catch up with futures prices

By Mark Burton and Susanne Barton, Bloomberg

The world economy is taking off, factories are humming again and copper futures prices are jumping. The one thing that’s missing is buyers of the actual metal.

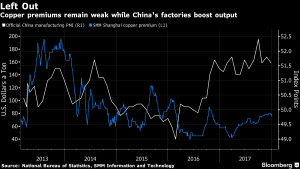

Evidence of the anomaly can be seen in the premiums that purchasers of physical copper pay over futures prices to cover shipping and other costs.

Typically these rise as demand grows and buyers are willing to pay extra to access supply that’s being used up at a quicker rate. Yet, even with factories running at the fastest in years, premiums have been stuck at a low level.

That’s a disconnect with the optimism in futures markets, where hedge funds have been adding to their bullish bets since the middle of December. Such wagers have helped fuel a rally in prices to their highest since early 2014.

“Certainly from a fundamental perspective, I do find it difficult to justify the copper price where it is today,” Colin Hamilton, managing director for commodities research at BMO Capital Markets, said in London.

Along with high stockpiles and a slack forward price curve with spot prices trading below futures on the London Metal Exchange, low physical premiums suggest buyers aren’t yet rushing to secure copper as factories ramp up.

“The question becomes ‘When are the net consumers, the tradesmen going to show up?’,” said Peter Thomas, a senior vice president at Zaner Group LLC in Chicago. “It takes a little while to get that wheel turning.”

Cliff Hanger

Optimists expect it to happen sooner rather than later.

As demand picks up from a seasonal low in the first quarter, fundamentals may bring further support for prices of copper and other metals, according to Christoph Eibl, founder and chief executive officer of Tiberius Group, a commodities-focused hedge fund and trading firm based in Zug, Switzerland.

"We’re not worried about China falling off a cliff," Eibl said.

Metals may also gain as money is pulled from shares and bonds and put into markets where valuations look less stretched, he said. Tiberius favors nickel and aluminum given the potential for supply curbs in those markets.

"There’s a bullish undertone across the metals markets,” Eibl said. "It’s not hard to imagine that prices will be another 10 percent higher a few months from now." Copper traded at about $7,150 a metric ton in London on Thursday.

Less Refined

In the physical copper market, the mood is less rosy.

One issue weighing on sales of refined copper cathode is a flood of scrap as recycling yards have offloaded their inventories into the rising market in the past year. Scrap is offered at substantial discounts to cathode prices on the LME, an attractive alternative for factories that usually buy refined copper.

That’s particularly so in Europe as recently introduced curbs by China on scrap imports leave more for buyers elsewhere, according to Juergen Schachler, head of Hamburg-based Aurubis AG, the largest copper recycler. Scrap discounts in Europe are way above long-term averages, he said on a call last month.

On the flipside, buyers in China could turn to copper cathode as the restrictions on scrap kick in and orders come through after the end of the Chinese New Year holiday late next month, finally pushing up premiums.

“No one quite knows what’s going on with Chinese scrap imports yet,” said Hamilton at BMO Capital. "This isn’t the right time of year for premiums to be rallying. Around the end of March, that’s when you might start to see it.”

From Bloomberg