The Bull Market is ‘Relentless’ but Risky, says Goldman

“Distribution of market outcomes appears asymmetrical,” firm writes.

By Ryan Vlastelica, MarketWatch

U.S. stock market investors have been confronted with an unusual dilemma of late: the number of apparent risks is growing, but Wall Street doesn’t seem to be showing signs of fear.

Equities have climbed to repeated all-time highs—the Dow Jones Industrial Average (DJIA) could notch its 12th straight record close on Monday, its longest such streak since 1987. That streak has Goldman Sachs hailing the equity rally as a “relentless bull market.”

The question, the investment bank added, was how investors should position themselves in such an environment “given a long list of near-term drawdown risks.”

Strategist at the bank recommend selling unlikely upside as a risk mitigator.

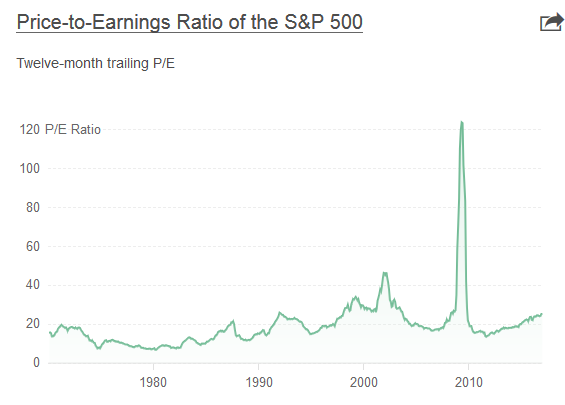

“Looking ahead, the distribution of market outcomes appears asymmetrical,” the firm wrote in a note to clients, citing the risks of higher interest rates, populist elections in Europe, and the prospect that lower corporate taxes—a key driver behind recent gains—wouldn’t take effect until later than most investors appreciate. Other analysts have cited valuation as a concern, and by one metric stocks haven’t been this pricey since 2004.

On the upside, it added, “the clearest potential tailwinds for S&P 500 (SPX) upside include government policy an acceleration in U.S. economic data, but neither catalyst looks likely.”

Despite that, Goldman wrote that recent market action actually augured for further gains. Despite the records, equity markets have been quiet of late; the S&P 500 hasn’t closed with a move greater than 1% in either direction since December, an atypically long time. However, this extended period of stability isn’t an indicator of drawdown risk, it wrote.

“Since 1980, there have been only six instances of the S&P 500 trading for 80 or more consecutive days without a 1% decline,” read the note, which was written by David Kostin, Goldman’s chief U.S. equity strategist. “Following the end of these stable market periods, the S&P 500 actually registered a positive three-month return in five of six episodes, with a median 6-month return of 9% and a 12-month return of 15%. In short, following previous periods of market stability, the S&P 500 usually continued to march higher.”

Goldman still expects markets to struggle this year. It reiterated its expectation that the S&P 500 would hit a 2017 high of 2,400 during the first quarter and then retreat, ending the year around 2,300. The benchmark index closed at 2,367.34 on Friday.

Given that forecast, it recommended that investors sell a 2,410 S&P 500 call option that has a June 30 expiration, using the premium from that to purchase a 2,240 put option. “This strategy protects investors from a drawdown of 5% or more during the next four months while allowing participation to our upside forecast level,” it wrote. So-called put and call options are derivative contracts that allow an investors to buy or sell an asset at a given price and time. Puts give investors the right to sell an asset, while calls confer the right to buy a security.

Courtesy of MarketWatch