Opinion: Wall Street’s herd is now much too bullish about the S&P 500

Ed Yardeni: Optimism is rich and corporate profits and revenue are thinning

The latest earnings season seemed to contribute to the sharp selloff in stocks during October, as some companies reported bullish earnings that were more than offset by bearish guidance about future earnings prospects.

Collectively, though, the S&P 500 results through the week ended Nov. 8 were 4.9% better than analysts expected during the Sept. 28 week, i.e., just before the start of the latest earnings season (Fig. 1). As I’ve noted many times before, such positive "earnings hooks" are par for the course. (See our S&P 500 Earnings Squiggles Annual & Quarterly.)

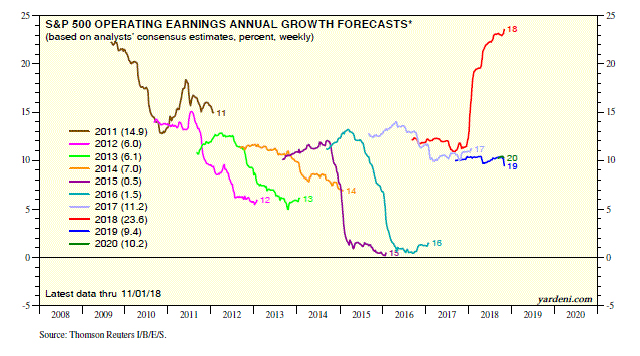

In aggregate, the negative guidance that corporate managements provided during earnings conference calls somewhat deflated analysts’ consensus earnings estimates for the fourth-quarter of 2018 and the quarters of 2019 (Fig. 2). However, the 2018 estimated earnings growth rate held steady during the week of Nov. 1 from the week before at 23.6%, the highest reading for this series (Fig. 3 and Fig. 4). The 2019 estimated growth rate edged down to 9.4%. The 2020 projected growth rate remained solid at 10.2%.

In other words, third-quarter results didn’t curb analysts’ enthusiasm for earnings growth this year and the coming two years. I, however, curbed my enthusiasm for the earnings outlook on October 30. Here’s more on why I did so:

1. Me vs them: My estimates for earnings growth during 2019 and 2020 have been lowered to 4.9% and 5.3% from 6.8% and 8.8%. I am predicting S&P 500 earnings per share will be $162 this year, $170 in 2019, and $179 in 2020 (Fig. 5). During the Nov. 8 week, the comparable Wall Street analysts’ consensus estimates, respectively, were $162.67, $177.69, and $194.55.

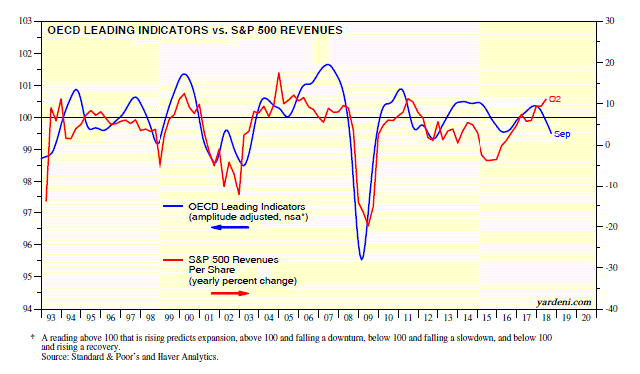

2. Revenues slowdown ahead: The growth rate of S&P 500 revenues has been remarkably strong this year, which has contributed—along with the corporate tax rate cut at the end of last year—to the strength in earnings growth. Revenues per share rose 11.2% year-over-year during the second quarter, the highest growth rate since the second quarter of 2011. (Fig. 6).

Industry analysts are expecting a slowdown in revenues-per-share growth from 8.5% this year to 5.5% in 2019 and 4.4% in 2020 (Fig. 7). That makes sense to me, since the trend growth rate of revenues has been roughly 4.0% (Fig. 8).

In addition, the global economic outlook is deteriorating, as evidenced by the weakening trends in recent months in both the OECD Leading Indicators and the Global Composite PMI (Fig. 9 and Fig. 10).

3. Profit margin unlikely to set new records: What doesn’t make sense to me is the implication of analysts’ consensus earnings and revenues estimates that the S&P 500 operating profit margin will continue to climb to record highs. Their latest numbers imply that the profit margin will rise to 12.4% in 2019 and 13.1% in 2020, from 11.9% this year. (Fig. 11). Thomson Reuters data show that the operating profit margin rose to a record-high 10.9% at the end of 2017 before the corporate tax cut. After the cut, it rose to fresh record highs of 11.9% during the first quarter of 2018 and 12.3% during the second quarter (Fig. 12).

During the third-quarter earnings season, many company managements warned that, in addition to their revenues growth being weighed down by the global economic slowdown, their profit margins were likely to be squeezed by higher labor costs as well as the impacts of tariffs, which were raising their materials costs and disrupting their supply chains. They didn’t say whether they expected to offset some of those higher costs with productivity gains.

So I don’t expect the S&P 500 profit margin to rise further from here. If it remains flat in record-high territory over the next two years, then earnings growth will match revenues growth. And if that happens, then industry analysts will be lowering their heady growth rates for earnings.

Ed Yardeni is president of Yardeni Research, Inc. , a provider of global investment strategy and asset allocation analyses and recommendations. He is the author of Predicting the Markets: A Professional Autobiography . Follow him on Twitter and LinkedIn.

From MarketWatch