November Jobs Report Points to a "New Norm" in Labor Force Participation Rate

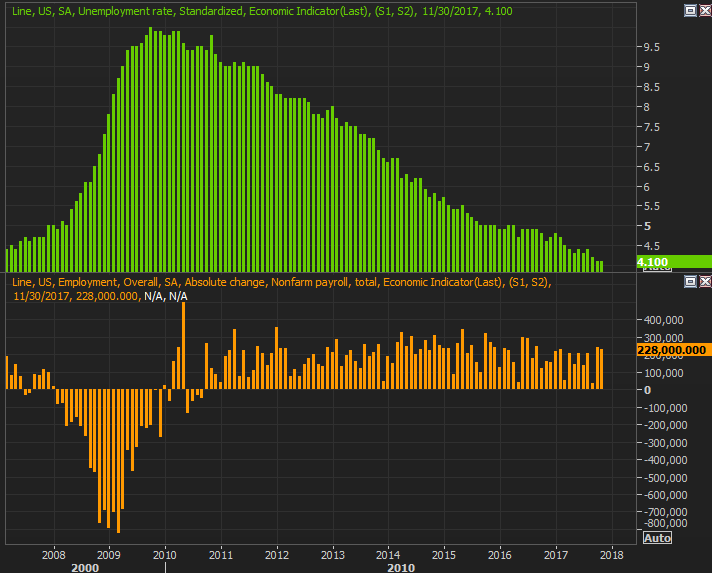

The headlines look great -- the economy added 228,000 new jobs last month, which is quite impressive in light of the fact that we're at what some would consider "full employment," with the unemployment rate rolling in at 4.1% again. And truth be told, this aspect of the economy is certainly doing its part to keep the ball rolling forward.

On the other hand, take all of this data with a grain of salt... the good and the bad. The fact of the matter is, we've still got a hurricane hangover, so the data since September has yet to paint a clear picture of employment and joblessness in the United States.

Here's the rest of the story (not that it makes the picture any more clear).

The basics: Last month's 228,000 new payrolls was down slightly from October's figure of 244,000, but around the average nonetheless; it appears in this regard September's hurricane strikes are in the past. No, the unemployment rate didn't fall, but even in the hottest of economies 4.1% of the working population are apt to be unemployable at any given time. [Keep that idea in your back pocket for a moment, as we'll be coming back to it with some additional analysis.]

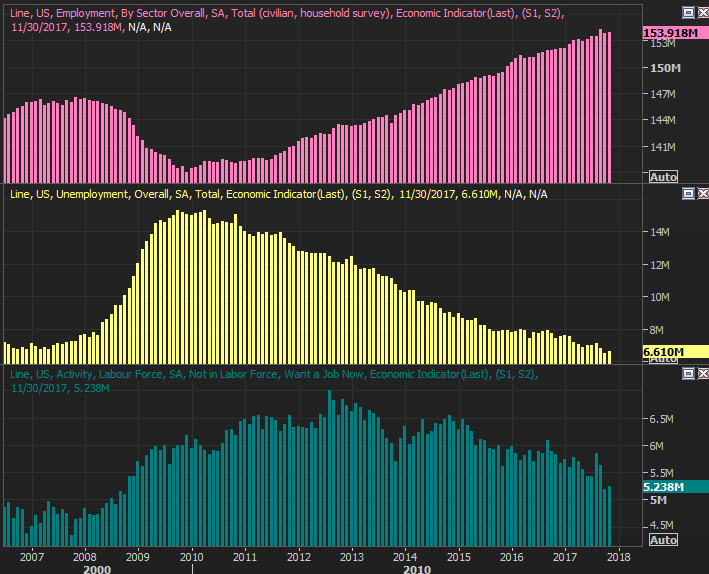

Making more sense of the job-growth and unemployment rate report is the raw data those calculations are based on. To that end, the number of people with jobs as of the end of last month grew 57,000 to 153.92 million, while the number of people officially counted as unemployed also grew 90,000 , to 6.6 million. The number of people without jobs and not being counted as unemployed -- but still want jobs -- edged up 53,000 to 5.24 million, though that figure is still near multi-year lows.

It's not clear to what extent hurricanes Harvey and Irma are still holding employment levels back. The answer is "some," though one would have thought more. Indeed, one can't help but wonder if we'd be reaching another employment record had the two storms not made landfall. Of course, the post-storm response also creates jobs, so...

Whatever the case, the scant number of people that are unemployed (officially or unofficially) continues to point to more strength than weakness, which makes the next set of data all the more difficult to analyze.

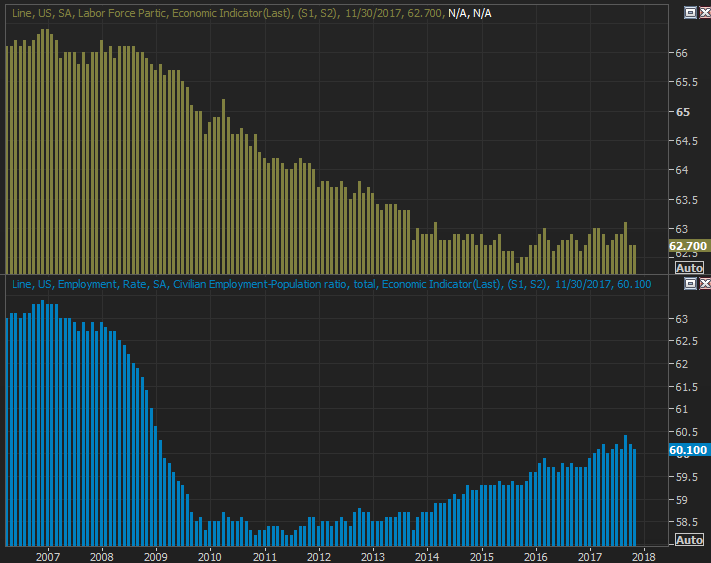

It was on the way up prior to September, but for the past couple of months the labor force participation rate and the employment population ratio have been lackluster. The former came in at 62.7% again, and the latter fell from 60.2% to 60.1%.

Were we losing jobs or seeing unemployment rise, the tepid participation and employment figures would be concerning. That's not what we're seeing though. This current dynamic suggests that people without jobs don't actually want one, nor need one.... something that jibes with the sudden drop in the number of people that say they're not officially unemployed but also don't want a job.

It's a mixed bag to be sure. It's encouraging that they don't need to work, as it implies they've got other means of income -- maybe a spouse, or an inheritance. It's also limiting, however, because if more people were working (and there's room for them to work), it would stimulate the economy more so than it's already being stimulated.

We're going to view the glass as half-full rather than half-empty.

Bolstering the "glass half full" case is last month's wage growth. Hourly earnings were up 0.2% last month (on a month-to-month basis), while the average workweek length grew from 34.4 hours to 34.5 hours. Those are small gains, but actually big moves by employment norms. We would have liked to seen a little more, though the data still points to a tightening labor market, which indicates broader economic health.

It may be a case where we have to ignore what appears to be sub-par participation and employment rates, at least partially fueled by the mass retirement of the baby-boomers. Everything else seems to be working the way it's supposed to be, or pointed in the direction we'd like it to be pointed.

The post-hurricane impact is still a mostly-unknown X-factor, though not a severely unknowable one at this point. It looks like it doesn't matter much either way anymore.

Whatever the case, the employment picture is bullish, suggesting jobs are not only easy to find, but paying relatively well.... better than they were paying just a few months ago. That won't stave off a short-term setback, but it will keep the bigger bull market moving forward.