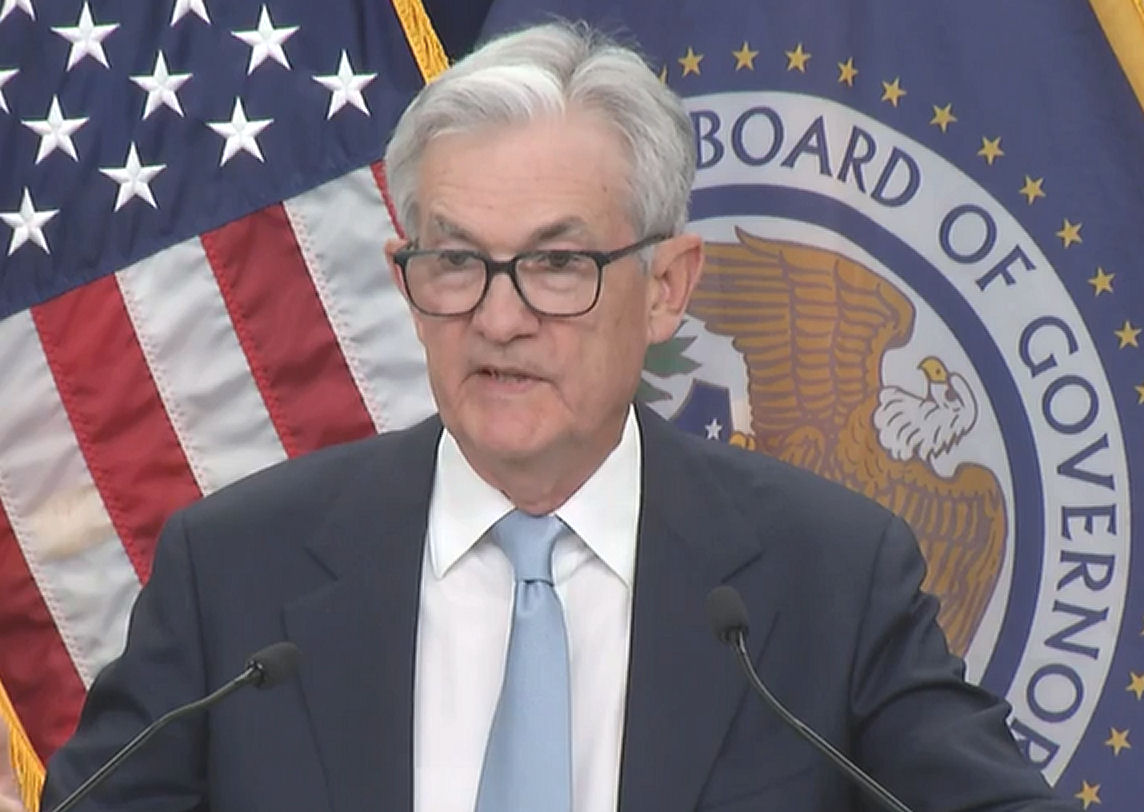

Jerome Powell Just Thwarted the Rally... Or Did He?

On the surface it looks like Fed Chairman Jerome Powell deserves the credit/blame for Wednesday's bearish reversal. At first the market liked the idea of easing off on the FOMC's recent cadence of rate hikes. Then it didn't.

It may have less to do with Powell's comments than it seems on the surface though. And, regardless of the reason, there's still a good chance the rebound effort that's been underway since earlier this month can still be revived.

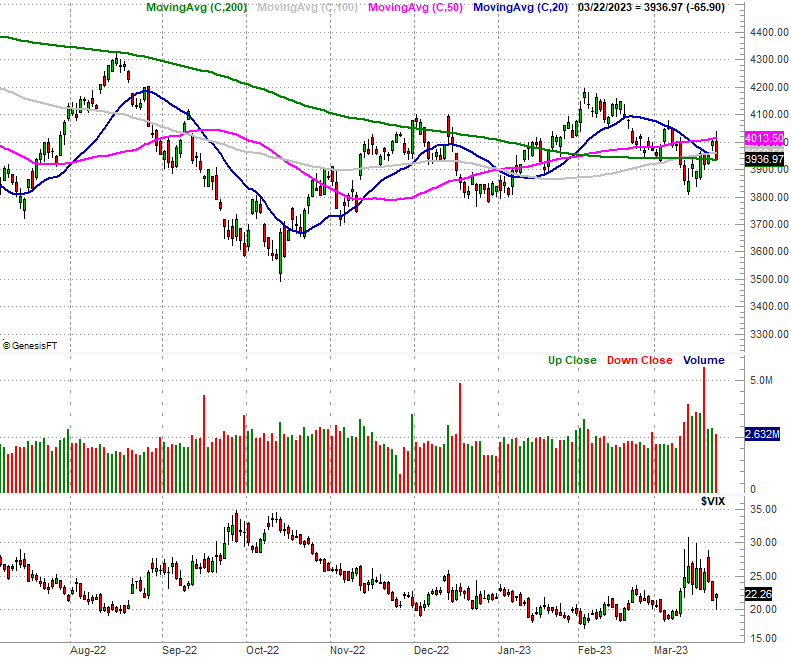

Take a close look at the daily chart of the S&P 500 below. Namely, look at the 50-day moving average line (purple) at 4013.5. That's where the index peaked on Tuesday, and near where it faced a great deal of indecision on Wednesday before finally rolling over. Wednesday's rollover was apt to happen no matter what.

And that's a good thing. If the bulk (or all) of Wednesday's big pullback is technical rather than economic or fundamental, a technical rebound is still on the table. To this end, notice how Wednesday's selling was stopped right at the 200-day moving average line (green) at 3934. This is a floor the S&P 500 could push up and off of. Underscoring this bullish possibility is the fact that as rough as Wednesday's selloff was, there was relatively little volume behind it. Not many sellers are actually participating in the weakness.

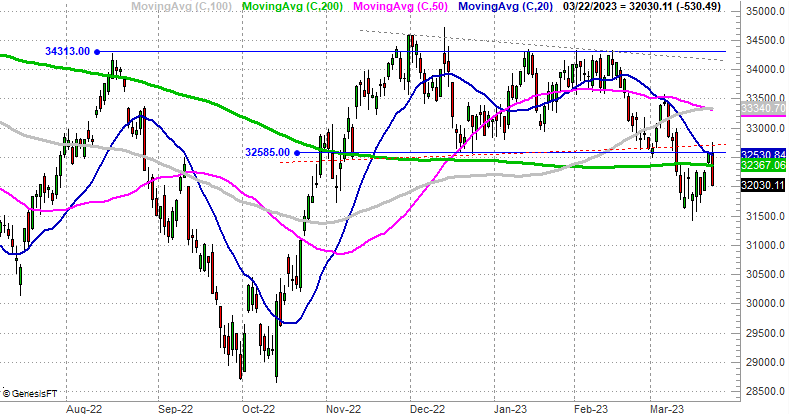

Not every major index is still in contention for a rekindled breakout. Take the Dow Jones Industrial Average as an example. It danced with its 20-day moving average line (blue) on Tuesday and Wednesday only to end up sliding back under its pivotal 200-day moving average line (green) at 32,367 by Wednesday's close. Then again, there seems to be something about the horizontal level of 32,585, where the Dow topped out in the middle of this week.

And the NASDAQ Composite's recovery effort is completely intact despite Wednesday's intraday reversal. It's still above all of its key moving average lines, and the golden cross from last week (where the 50-day moving average line crosses above the 200-day moving average line) that suggests the establishment of a major new uptrend is still in place.

This isn't a bullish call, to be clear. Stocks are still mostly on the fence and could go either way. The point being made here is simply that we don't want to rule anything out despite Wednesday's seemingly dire warning. We were apt to see the bullishness be tested with or without any decision on interest rates. None of this means the test was conclusively failed... at least not yet. Let's at least give the bulls another shot at breaking above and staying above the aforementioned technical ceilings, since we've certainly not taken on nearly enough water to panic just yet.