Is it really time for earnings season again? Didn't we just get off that train? Yes, and yes. Alcoa (AA) - the unofficial arbiter of earnings season - will post its first quarter numbers on Wednesday of next week, though a couple of major names will be spilling the beans before this week comes to a close. Wells Fargo (WFC) and Citigroup (C) will be dishing out Q1 numbers on Friday, and Delta Airlines (DAL) will be posting its quarterly figures on Thursday.

It's time.

To that end, the best way to prepare for a bevy of individual earnings reports is to take a step back and look at how the broad market is doing earnings-wise, and how it's expected to do this time around. There's good reason for optimism.

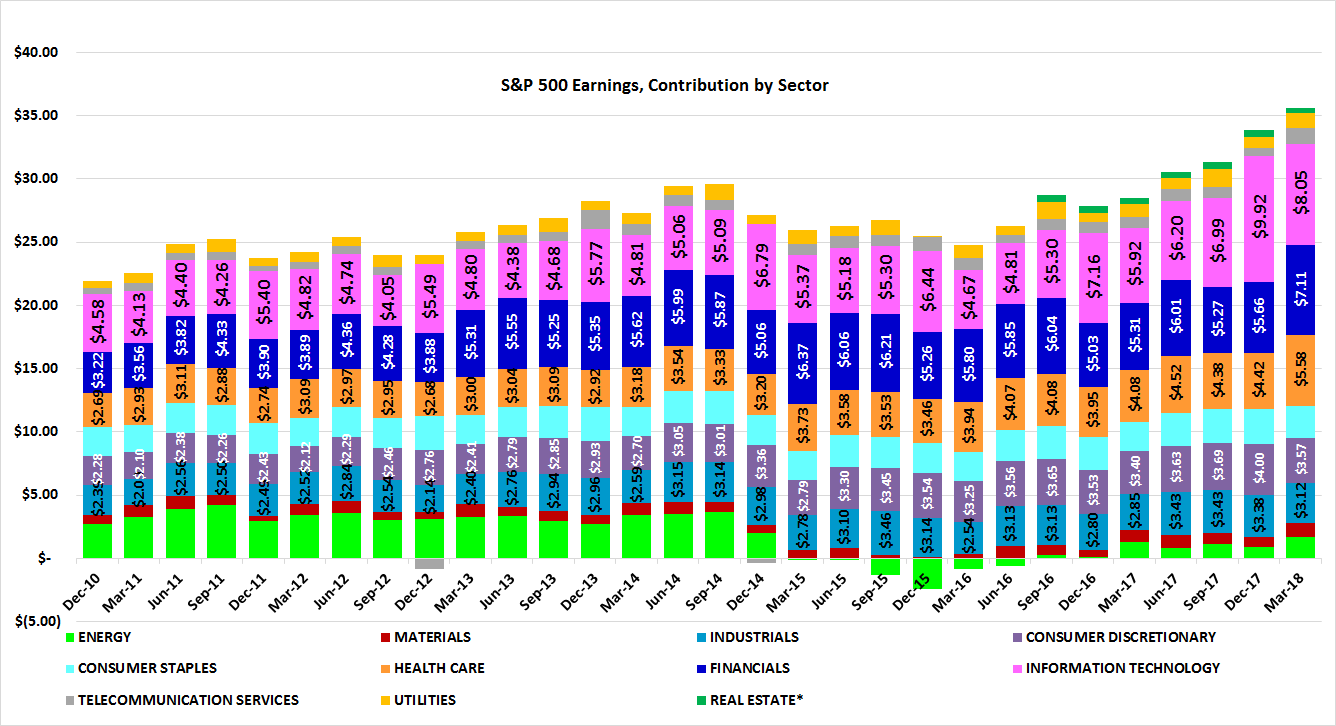

As of April 5th, the pros were saying the S&P 500 would post a per-share profit of $35.64 for the first quarter of 2018. That's 23.6% better than year-ago numbers, but bear in mind most of that growth is being driven by just three sectors. The energy sector's bottom line is expected to grow 41% yoy, while healthcare and technology companies are collectively expected to drive earnings growth of 38% and 36%, respectively. The tech sector might do it, but analysts have been strangely (and mostly errantly) optimistic about healthcare earnings growth of late.

The breakdown of the S&P 500's earnings, by sector, gives you a much better feel for what's happening, particularly for the energy and healthcare sectors. You can see why the big expectations for healthcare's part of marketwide earnings seems a bit out of place. You can also see how, despite relatively big growth, the energy sector is still nowhere near as profitable as it used to be.

Whatever the case, until we actually hear otherwise, we'll use $35.64 as our working figure. At that number, the S%P 500 is valued at a trailing P/E of 20.2. On a forward-looking basis, the S&P 500 is priced at 16.6 times earnings. That's a historically high trailing P/E, though less than the recent average. The projected P/E is also above average, though not uncomfortably so.

It's also not clear exactly how much of Q1's projected increase can be attributed to tax cuts, and how much was going to materialize regardless. Realistically speaking, it's about half and half.

What's largely been lost in the matter is that, even well before the trade war scuttlebutt took shape (and obviously well before it cooled in response to Chinese President Xi's decision to back off a bit), the earnings growth projected for Q1 was already on its current trajectory. This isn't suddenly a manipulated or artificial earnings growth. This is "more of the same," and there's no particular reason to think an implosion is any more likely now than it was two years ago.

The only real risk here is inflation soaring out of control and bringing the expansion phase to a screeching halt. The Federal Reserve's got a pretty tight grip on that matter though, and if anything, has arguably been too aggressive with its hawkish behavior... not that being hawkish is worse than remaining too dovish and letting things get to a point where nothing can be done to keep the economy between the guardrails.

Whatever the backdrop, the upcoming earnings season should be a good one.