June's Encouraging Employment, Job Growth Headlines Are For Real

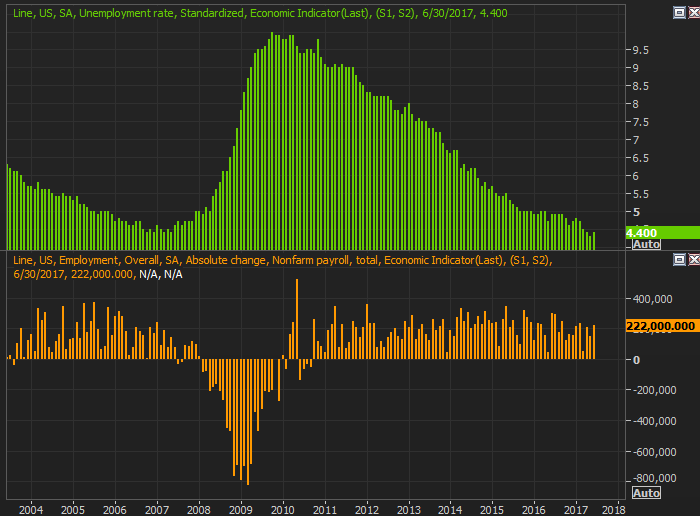

It's official. The U.S. economy is humming again... at least judging from June's employment report from the Department of Labor. The country added 222,000 new jobs last month, handily topping expectations of only 173,000 new payrolls. The data was a pleasant surprise following a lackluster jobs-growth report from ADP on Wednesday. The payroll processor said we only created 158,000 new jobs in June, missing expectations of 185,000. The DOL's data is arguably the more meaningful of the two, and it says the nation's economic engine revved in June.

Yes, the unemployment rate edged a little higher, from 4.3% to 4.4%. That's not a bad thing in this particular scenario though. In this case, the unemployment rate ticked higher from near-absolute low levels largely because a swath of people came to -- or came back to -- the work force expecting they could get a job now but couldn't before.

As is almost always the case though, there's more to the story.

While the unemployment rate and job-growth figure are generally the most touted data on the first Friday of any given month, they can also be the most deceptive. A more telling picture of the employment scenario is the raw number of people with jobs, the number of people without jobs but receiving unemployment checks, and people without jobs but not getting any unemployment checks yet also not bothering looking for a job.

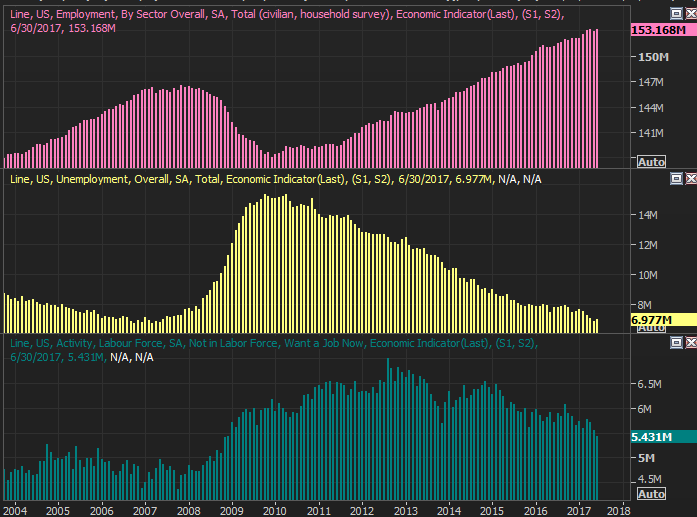

On these fronts, respectively, June's figures were bigger, bigger, and a lot smaller. The number of employed people grew from 152.923 million to 153.168 million (up 245,000), and the number of people counted as unemployed only edged up from 6.861 million to 6.977 million (up 116,000 people). The most dramatic change came from the group that's not in the labor force bit still do want a job. That figure fell from 5.561 million to 5.431 million, for a decrease of 130,000.

That's undeniable net progress.

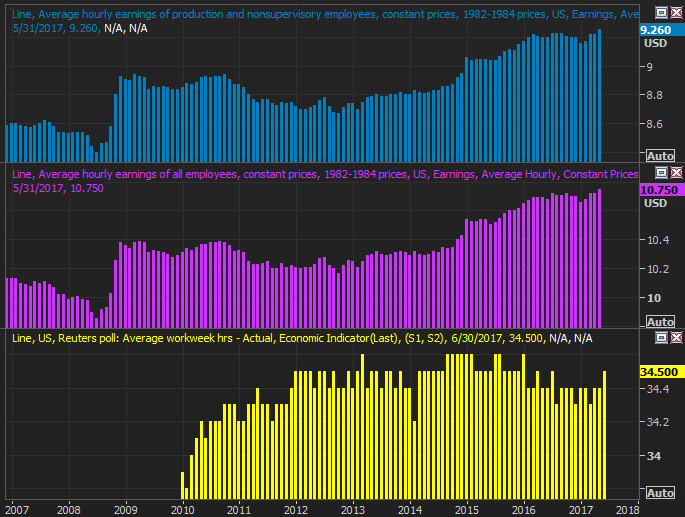

It's not like these people are simply gaining part-time and low-wage employment either. Though the average hourly income data for June isn't posted yet, between January and May, hourly pay across the nation ramped up to multi-year highs. And, as of last month, the average number of hours worked per week finally ticked a bit higher again, to 34.5. Collectively, this says employers are being forced to compete for workers, and they're giving their workers more hours out of necessity.

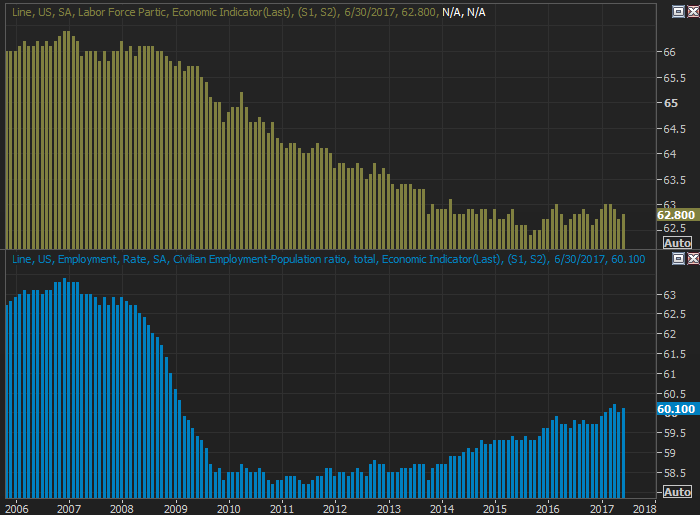

Perhaps the most compelling set of data from June's jobs report, however, is the uptick in the labor force participation rate and the employment/population ratio. While the mass retirement of baby-boomers has understandably whittled both numbers down, their declines since 2007 can't entirely be chalked up to older workers leaving the work force. The bulk of their weakness reflected a mindset that there were no decent jobs to be had.

This started to change -- a little -- in 2012 as the employment/population ratio started to ramp up. The labor force participation rate (the number of people in the work force, working or not, compared to the population) continued to dwindle through mid-2015. It hinted at a recovery effort last year, but the rebound effort was so anemic and inconsistent that it couldn't qualify as real improvement. April's and May's back-to-back drops put the whole thing in doubt. In June though, the labor force participation rate as well as the employed/population ratio both moved higher again, suggesting the undertow is pointed forward.

Perfect? No, there's still room for improvement, and more progress. There's not a lot not to like about the trajectory though. If the labor picture can simply keep moving at its current pace, the economy could achieve escape velocity before the end of the year.