Investors face ‘extreme mental exhaustion’ in markets where nothing is ‘normal’

- Best to remain ‘constructive’ on stocks and bonds: Macquarie -

Are you feeling stressed and irritable, just waiting for something to go awry as stocks and other assets go from high to high and volatility declines? Analysts at Macquarie understand, and if it’s any reassurance, they say it’s only natural.

“Investors are probably suffering extreme mental exhaustion. Historically low volatilities and risks, coinciding with high valuations, would make anyone nervous,” wrote analysts Viktor Shvets and Chetan Seth.

After all, they continued, investors “understand that there is nothing normal in the current environment of unprecedented financialization and economic disruption.”

Central bank liquidity

They argue that it’s all down to the massive amounts of liquidity pumped into the global economy by major central banks in the aftermath of the financial crisis. While the Fed this month begins to ever so slowly unwind the more-than-$4 trillion portfolio of securities it accumulated via its asset-buying program, the European Central Bank and Bank of Japan continue to add to their stockpiles. All in all, central banks are still providing around $1.5 to $2 trillion in liquidity a year, they estimate.

Beleaguered investors will just have to console themselves with stocks that continue to scale record heights, with major U.S. indexes, including the S&P 500 and Dow Jones Industrial Average hitting the latest in a string of all-time highs on Tuesday. Government bond yields, which move the opposite direction of stocks, remain historically low and corporate credit is expensive by most measures. For example, the yield premium demanded by investors to hold noninvestment grade U.S. corporate debt over Treasurys is historically low, they noted, while the global high-yield corporate index continues to set new highs.

Meanwhile, volatility is declining, with the CBOE Volatility Index a measure of expected volatility in the U.S. stock market, recently plumbing levels last seen in 1993.

Turning the corner?

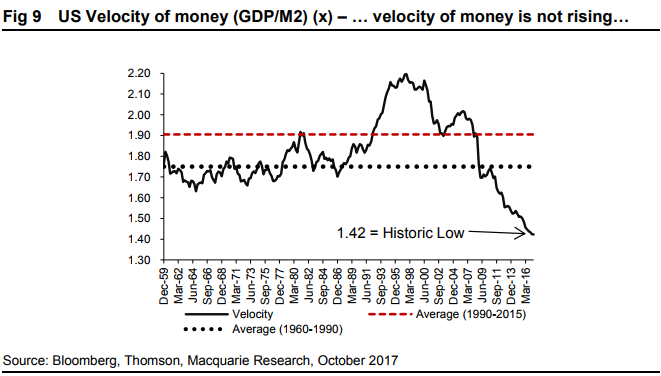

And while optimists argue that the global economy is starting to turn the corner, leading to a pickup in the velocity of money and allowing central banks to gradually begin withdrawing liquidity and inching up rates, Shvets and Seth aren’t convinced (see chart below).

They argue that the “best reason” why investors feel risks are so low is because they believe that “liquidity cannot be withdrawn, volatility must be arrested and cost of capital cannot go up, and hence, financial assets are in many ways underwritten.”

Sure, they said, central banks wouldn't mind “a little bit more volatility and a little bit more price discovery,” but the bottom line is that policy makers remain “highly averse to shocking what is the highly financialized and leveraged global economy.”

‘Remain constructive’

So what to do? They argue it’s best to “remain constructive” on financial assets—both equities and bonds. That is not because they expect a return to a self-sustaining private-sector led recovery and growth “but because we believe that an ongoing financialization is the only politically and socially acceptable answer.”

Meanwhile, if that’s the case, then the greatest danger is a “policy miscalculation.” They write:

This implies that liquidity must continue to grow, volatilities must be controlled and neither demand nor supply can yield higher cost of capital. Thus, risks facing investors are that either [central banks] and/or China misjudge extent to which reflation is dependent on inflating asset values and China’s fixed investment. We remain constructive on financial assets, not because we believe in a sustainable recovery, but because we back the perpetual leveraging ‘doomsday’ machine.

From MarketWatch