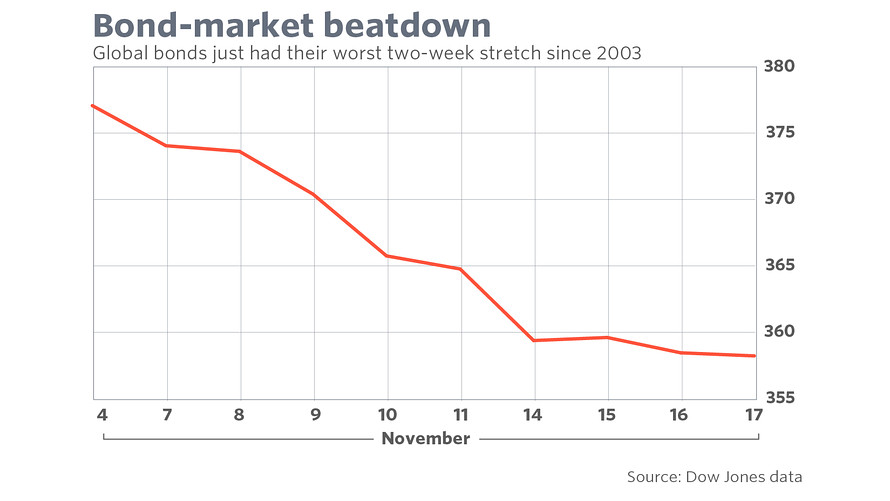

Global Bonds Just Had Their Worst Selloff In 13 Years

Global bonds just endured their worst selloff in more than 13 years

Bond investors have had a rough couple of weeks.

The Bloomberg Barclays Global Aggregate Index fell by 5% during the two weeks ended Thursday — its worst such drop since March 2003, according to Dow Jones data.

More than $77 billion in assets are benchmarked to the index, according to data provided by Morningstar, making it one of the most widely followed in the fixed income world. It incorporates investment-grade debt denominated in 24 different currencies. Sovereign bonds have historically been the index’s most heavily-weighted constituent, followed by asset-backed securities, corporate bonds and government-related debt.

Global bond yields, which rise as prices fall, have been moving higher since falling to historic lows in late June following the U.K.’s vote to leave the European Union.

But the selloff accelerated aggressively after Donald Trump won the U.S. presidential election — an outcome that took most market participants by surprise, because polling had shown Democrat Hillary Clinton with a slight edge over her Republican opponent.

The selloff was predicated on the notion that Trump’s campaign promises to rebuild America’s infrastructure, cut taxes and raise trade barriers, would — if they become reality — drive up inflation, and possibly force the Federal Reserve to raise interest rates more quickly.

Rising inflation expectations typically drive up long-term bond yields because rising prices eat into the real return on investment.

The selloff continued on Friday, with the yield on the 10-year Treasury TMUBMUSD10Y, +1.49% up 3.3 basis points at 2.334%.

Courtesy of marketwatch.com