Fed minutes show support for June hike and calm about inflation outlook

- Only a 'few' saw inflation moving above 2% target -

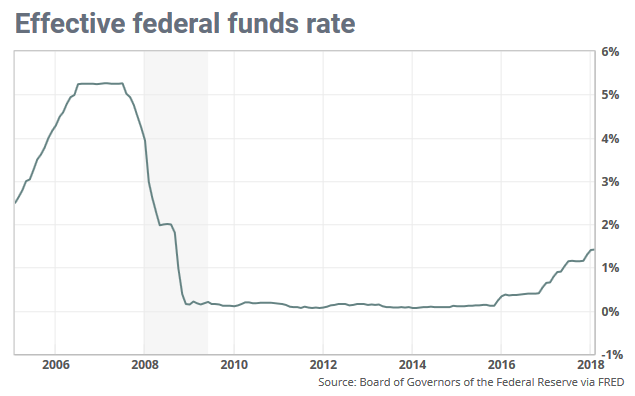

Federal Reserve officials in their meeting in early May confirmed they planned to raise interest rates in June and were not concerned they were behind the curve on inflation.

"Most participants judged that if incoming information broadly confirmed their economic outlook, it would likely soon be appropriate for the FOMC to take another step in removing policy accommodation," the minutes said.

Traders in the federal funds futures market see more than a 90% chance of a June rate hike.

Although inflation hit the Fed's 2% target in the latest reading for March, for the first time in a year, officials were not convinced it would remain there for long.

"It was noted that it was premature to conclude that inflation would remain at levels around 2%, especially after several years in which inflation had persistently run below the Fed's 2% objective," the minutes said.

Only a "few" officials thought inflation might move "slightly" above the 2% target.

And other Fed officials stressed a move above 2% "could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective."

"Several" others thought the underlying trend in inflation "had changed little," the minutes said. They saw some of the recent increase in inflation as "transitory" price changes in some categories such as health care and financial services.

On the trade dispute with China, officials said the possible outcome on inflation and growth remained "particularly wide," but there was some concern the dispute would hurt business confidence.

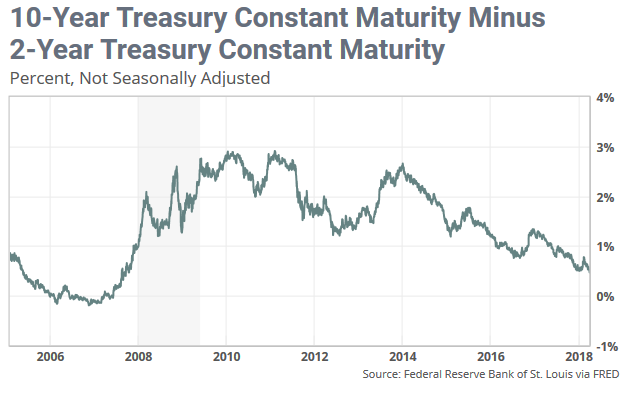

Officials disagreed on whether the flattening of the yield curve was a reliable signal of a recession. The yield curve is the plot of government bonds of different maturities, and an inverted yield curve has often preceded recession.

Several officials said it would be important to monitor the slope of the curve. A few others thought that central bank asset purchases and other factors made it less reliable.

The Dow industrials dropped by about 100 points on Wednesday and is basically flat for the year. The yield on the 2-year note, which is sensitive to Fed interest rate expectations, fell 2.3 basis points to 2.569%.

From MarketWatch