Budding Sector Trends Emerge at a Vexing Time for Stocks

It's been several weeks -- maybe too many weeks -- since we took our last look at how each major sector was performing in comparison to one another. We'll make up for lost time today.

It would be time well spent. An estimated 40% of an individual stock's movement can be attributed to its sector, meaning all of its peers drag it higher or lower (and its industry peers add another 15% to 20% worth of influence -- the rest is up to the broad market's tide). While it's a pointless analysis for short-term and day traders and irrelevant for true, long-term investors, for active investors that like to play with the market's natural ebb and flow, a sector-based analysis can make a huge difference to your bottom line.

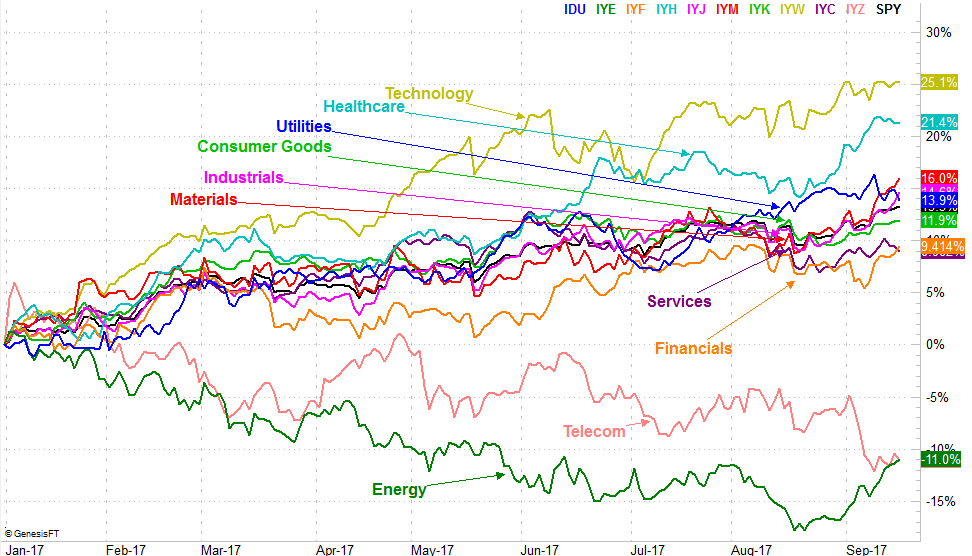

You may recall the last time we looked a few weeks ago we were concerned about tech stocks being a little too hot for their own good, impressed by the rekindled strength of utility names, looking for telecom names to come out of their funk, and expecting energy stocks to continue a major recovery effort. We also had an inkling that healthcare stocks had reaped about as much upside as they feasibly could for the time being.

Though it's a little soon to be dishing out grades, our scorecard doesn't look so good. Though tech stocks haven't been all that hot and energy names have been on a roll, telecom tanked, and utilities fizzled. Everything else... well, just take a look.

The shape of the updated sector performance chart leads us to a handful of new ideas, though in some cases our outlook hasn't changed. (Click on the image to enlarge it.)

The bullish call on energy still stands, and though we expect telecom stocks to bounce, any such bounce is just an exit opportunity for that busted rebound opportunity. We also suspect healthcare and technology stocks are pushing their valuation and rally limits -- both are still not great bets, from our view.

What's changed that's noteworthy in the meantime: Industrials are perking up, and materials stocks are as well. Services, conversely, are starting to fade.

None of those three budding trends is rock-solid enough to bet on yet. None have been really tested and verified either (which in many ways is the same thing as them not being rock-solid). All are worth keeping tabs on from here though. All three arenas have been middle-ground performers since the end of last year, and as such have some room to move higher or lower before reaching their travel limits.

The 800 pound gorilla in the room that may well negate any meaningful sector rotation analysis: So far September has been an unusually strong month... a month where we usually lose ground. The month isn't over yet, and we could still move into the pre-Q4 correction that sets up a fourth quarter rally. We can't presume that corrective move is a foregone conclusion though. As ripe as the market is for a pullback and as overbought as it feels, this year's slow advance isn't above the norm for a year in which the S&P 500 logs a gain. In fact, the S&P 500 is trailing its typical bullish-year path. It's up 10.7% for the year so far, but in a typical bullish year it would be up 12.3% by mid-September. (Click on the image to enlarge it.)

Point being, there's room for the budding sector-level trends to keep rolling without a great deal of influence -- good or bad -- from the broad market's undertow, as unlikely as that may seem right now.

Still, this market is like a toddler... you can't afford to turn your back on it for any length of time.