Basics of Currency Trading Through ETFs & Forex

Currency ETFs

As the ETF market has exploded over the past few years, mutual fund

companies are trying to create every type of ETF that comes to mind. ETFs

have made trading commodities and currencies much easier for the average

trader. Similar to how instruments such as (GLD) and (USO) allowed you to

trade Gold and Oil without having to buy futures, the same is now true with

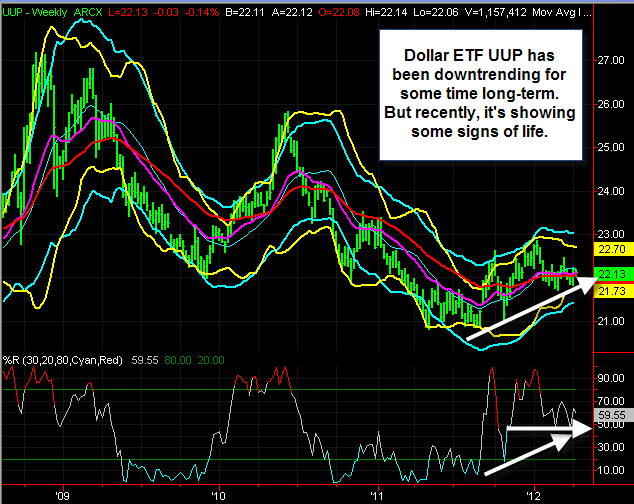

currency ETFs. There are pure plays on the US Dollar such as the Dollar

Bullish ETF (UUP), as well as a whole family of Currency Shares funds from

RYDEX investments and WisdomTree that allow you to play the foreign currencies as well.

The major CurrencyShares Currency ETFs which are priced versus the US Dollar include:

CurrencyShares Australian Dollar Trust ETF (FXA)

CurrencyShares British Pound Sterling Trust ETF (FXB)

CurrencyShares Canadian Dollar Trust ETF (FXC)

CurrencyShares Euro Trust ETF (FXE)

CurrencyShares Japanese Yen Trust ETF (FXY)

CurrencyShares Swedish Krona Trust ETF (FXS)

CurrencyShares Swiss Franc Trust ETF (FXF)

All of the CurrencyShares ETFs listed above have active option trading. All of these are also outperforming UUP for 2012, with the exception of Japanese Yen FXY. WisdomTree has moved into some of the smaller currencies in their ETFs, such as:

WisdomTree Dreyfus Brazilian Real Fund (BZF)

WisdomTree Dreyfus Chinese Yuan Fund (CYB)

WisdomTree Dreyfus Emerging Currency Fund (CEW)

WisdomTree Dreyfus Euro Fund (EU)

WisdomTree Dreyfus Indian Rupee Fund (ICN)

WisdomTree Dreyfus Japanese Yen Fund (JYF)

WisdomTree Dreyfus South African Rand Fund (SZR)

Note that all of these WisdomTree ETFs (except for JYF) are also outperforming UUP in 2012 thus far. Many of these are WisdomTree ETFs are not as liquid and may not have options available, so be cautious and do your research before trading/investing.

Trading the ETFs by themselves is very similar to trading most other ETFs. Always check the liquidity of the options through measures such as open interest, volume and bid/ask spread. You can use the currency ETFs as a pure play on the market or as a hedge against your stock and option portfolio, allowing diversification. Currency ETFs are the easiest way to enter into currency trading, and they can be traded in any brokerage account or self-directed IRA with option trading set up in it.

Currency Options

An ETF is simply an index, real or fabricated, that will fluctuate in value

based upon the price changes of the underlying securities. Thanks to our

friends at the International Securities Exchange (ISE), we now have a set of currency indices that are optionable.

Options in general come in two forms: American Style and European Style.

These names are not derived from where they are traded, but rather how they

can be exercised. American options can be exercised by the holder at any

time between the date of purchase and expiration. European options can only

be exercised upon expiration, not before. Most Currency ETFs that are now

optionable offer American Style options, because the option holder might

want to exercise the option and buy/sell the ETF at that particular strike

price.

The ISE currency options are European Style options because they are

designed to be trading vehicles rather than 'buy and hold' securities. This

shifts all of the trading focus towards the options rather than the index

itself. ISE FX Options have been popular and active, but as usual check the liquidity. These options, by definition, must be traded in a brokerage account that has enabled options trading. If you trade any stock or ETF options in your account, then you

can trade FX Options.

FOREX Pairs

Finally we come to the FOREX or FX trading. FOREX trading is simply trading

one currency for another in an attempt to capitalize on changes in exchange

rates from one currency to another (US Dollar to Euros for example). FOREX

implies more leverage than most stock or options accounts, so less initial

capital is required to trade these markets. This leverage, as we know all

too well know from the recent financial meltdown, can often be a

double-edged sword though. There is an added lure of higher potential

profits with the FOREX markets from the leverage, but in reality, the vast majority of novice FOREX accounts are closed at a loss within the first year of being opened.

Simply stated... it's not easy.

The FOREX market is where big profits can be made, but also where

the largest losses can accumulate. Another downside to the FOREX market is

that you have to open and fund a separate account than your typical

brokerage account. Some brokers allow you to have a FOREX account and a

separate brokerage options account, which some brokers don't allow you to

trade FOREX pairs on their system. In this case, you would have to have

different accounts at different brokers, often trading on different

platforms. This can become a little cumbersome.

The Spot FX market is open 24 hours a day, from Sunday at 8:00 PM - Friday at 5:00 PM Eastern Time (depending on your broker). These expanded market hours allow for trading outside of the typical NYSE hours of 9:30 AM - 4:00 PM (Currency ETFs and Currency Options are only traded during NYSE hours). The ultimate profit potential and flexibility are available in the FOREX market.

Bottom Line

If you are interested in getting involved in the currency markets, there has

never been a better time. Liquidity and ease of use through ETFs has made the market grow ever more available. For information on our BigTrends Forex Home Study Course, click here.