Veteran traders know that while the market rises and falls over and over again, not every sector or grouping or index rises and falls by the same amount. There are always leaders and laggards. Most of these groups at least move in the same direction as the broad market's movement, but every now and then there's an oddball that's completely out of sync.

Welcome to the market.

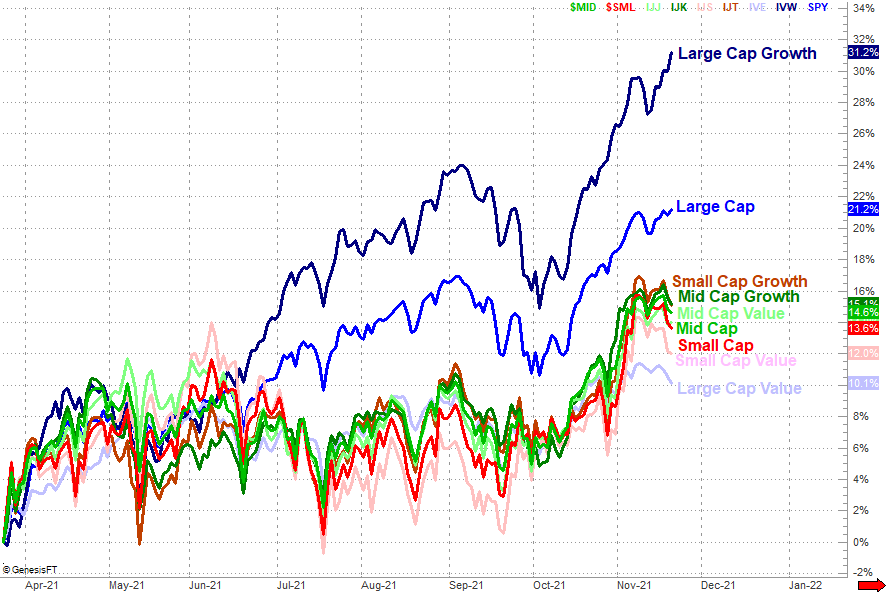

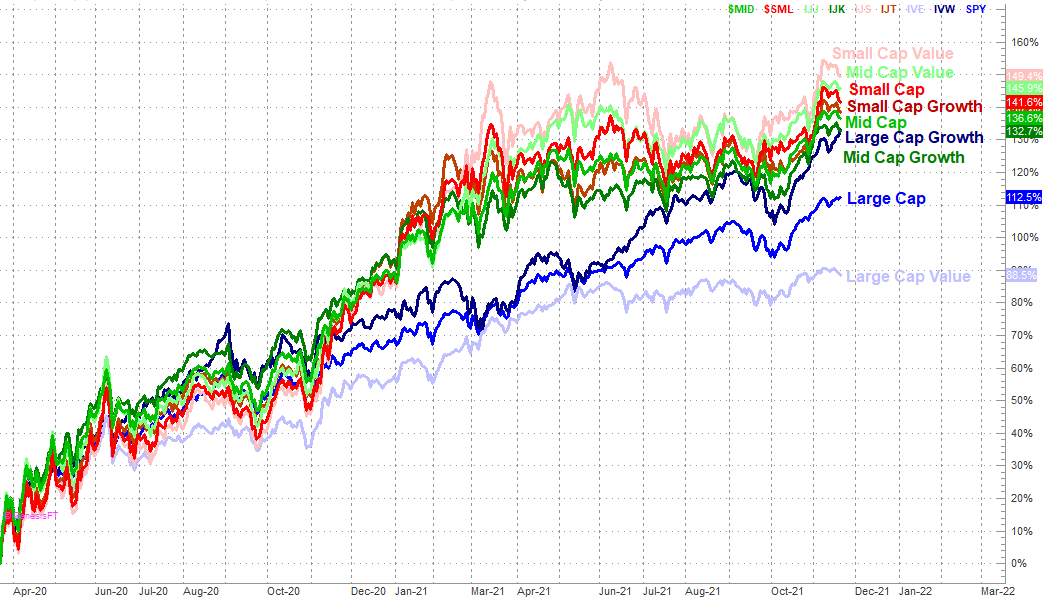

As of Thursday's close though, the rally that's been underway since the low hit in March of last year just got downright strange. Although the overall market is still edging higher, the only style/market cap grouping that's actually making forward progress this week is large cap growth stocks like Amazon (AMZN) and Meta (FB). Small and mid caps and value stocks are all down since last Friday's close. Take a look. [Note that large caps as a whole are only up by virtue of large cap growth stocks being up so much more than large cap value names are down.]

This leadership makes a little bit of sense. Going all the way back to the big "reset" created by the COVID-inspired selloff and subsequent reversal from March of last year, large caps began to lag quite a bit in December of last year. They began to outperform mid caps and small caps in June of this year, and even with incredible large cap bullishness since then, they've still yet to catch up with their small and mid cap counterparts.

Still, this much performance disparity for this long is a bit suspicious... and unusual.

There's at least one reasonable explanation. That is, traders and investors may be viewing the major large cap growth names like the aforementioned Amazon and Meta along with Alphabet (GOOGL) and Apple (AAPL) as the safe havens that value stocks and certain small caps used to be. And, that line of thinking isn't completely crazy. Consumer and corporate customer expectations have evolved quite a bit in just the past few years. The internet is the centerpiece of our lives, and recurring revenue is the new norm. Fortunes are made a few pennies at a time, but over and over and over again hundreds of times a day. Apple and Amazon and Alphabet are operating the reliable businesses that fare well even in uncertain environments, like consumer staples companies and utility providers used to.

That's only a theoretical idea though, that's never really been tested in the new-normal environment. The last time we've seen a true economic headwind that wasn't artificially created by a pandemic was back in 2008. We've not really seen the modern Apple or Google or Amazon forced to handle a real recession.

And, we may not be about to see that happen now.

Whatever's in the cards for the economy and the broad market, just know that this rally as it stands right now is very, very imbalanced... and not for the first time. This time though, things are wildly out of whack. Something's got to give sooner or later.