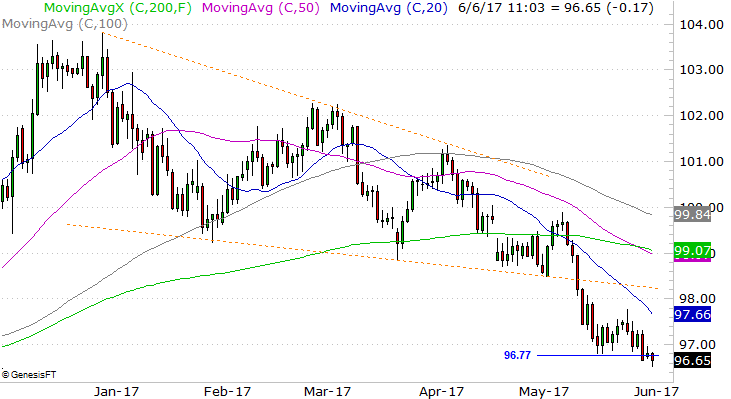

The depth of the dollar's demise continues to expand, with the U.S. dollar index falling another 0.2% today -- a lot, by currency standards -- hitting a new multi-month low in the process. Perhaps worse, the last bastion of support that could have turned things around for the greenback was just obliterated.

If the story rings a bell, it may be because we first covered it back on May 8th, pointing out how the U.S. Dollar Index had fallen under its 200-day moving average line, and was putting pressure on the lower edge of a falling wedge pattern. By May 25th, the dollar has broken well under that floor, and was working on establishing a new one at 96.8. That floor at 96.8 was damaged yesterday, however, and dealt a death blow today. On Tuesday, the dollar reached a low of 96.53 and is still lingering under 96.8.

The greenback is now officially taking on water at a faster rate than the bulls can bail it out.

That being said, to fully appreciate just how well the downtrend has developed and just how far the dollar might fall now that it's developed some bearish momentum, you have to take a step back and look at a weekly chart. It's in this timeframe you can see all the gory details, and determine that there's no plausible floor until you get to the 93.07 level where the U.S. Dollar Index found a floor several times in 2015 and 2016.

Hopefully the selloff will stop there, but even if it does, the move from the peak near 103.8 to 93.07 would represent a catastrophic pullback in itself.

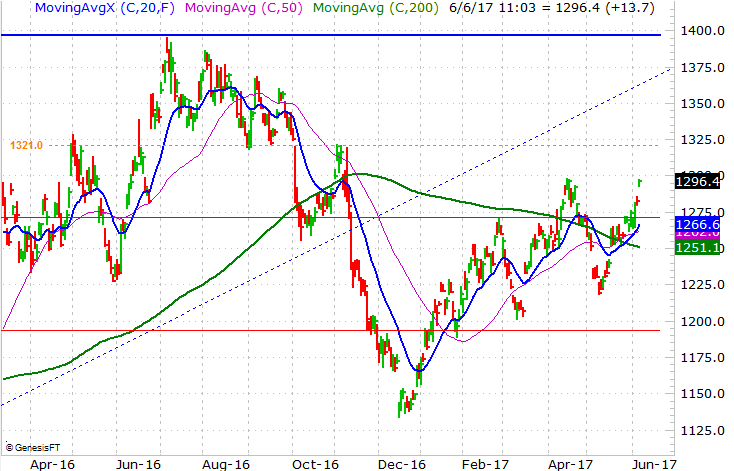

It's not all bad, mind you. In fact, there are arguably more upsides to a weaker dollar right now than not. Namely, a weaker dollar boosts gold's and oil's bullishness. While the dollar's recent setback has yet to do oil prices much good (concerns that OPEC won't live up to its production-cut promise abound), gold has clearly benefitted from what's going on with the greenback. More of the same may be on the way too.

It's an idea we dissected back on the 25th, when gold futures were still below a key ceiling at 1268.8/ounce, but were at least above a convergence of moving averages. With the tank full, so to speak, all it would take was a small nudge to get the ball rolling.

That ball got rolling late last week, but accelerated today. Gold's got its sights set on a minor resistance level around $1321, which shouldn't slow it down.

There is one thing that could slow the dollar down though... at least for a while. That is, the overblown surge that left behind a sizeable gap this morning. Traders could try to fill in that gap first, putting in place at least a mini-wave of profit-taking. As long as the support around $1260 remains intact though, that'll just be a blip. The stage for a move all the way back to the $1400 area will still be set.

Too much of a rally for gold? Just take a look at the dollar again. There's still a ton of room for the U.S. Dollar Index to slide back to 93.07, and we're assuming that line acts as a floor. It may not.

Whatever the case, this story is getting real good, real fast.