Strange Sector Leaders, Laggards Confirm This is a Maddening Market

If this market just doesn't feel right, you're not crazy. It is "off." Aside from the fact that we've gone far too long without even a modest corrective move, as of Thursday's close we're seeing leadership and laggardship that sends a mixed message.

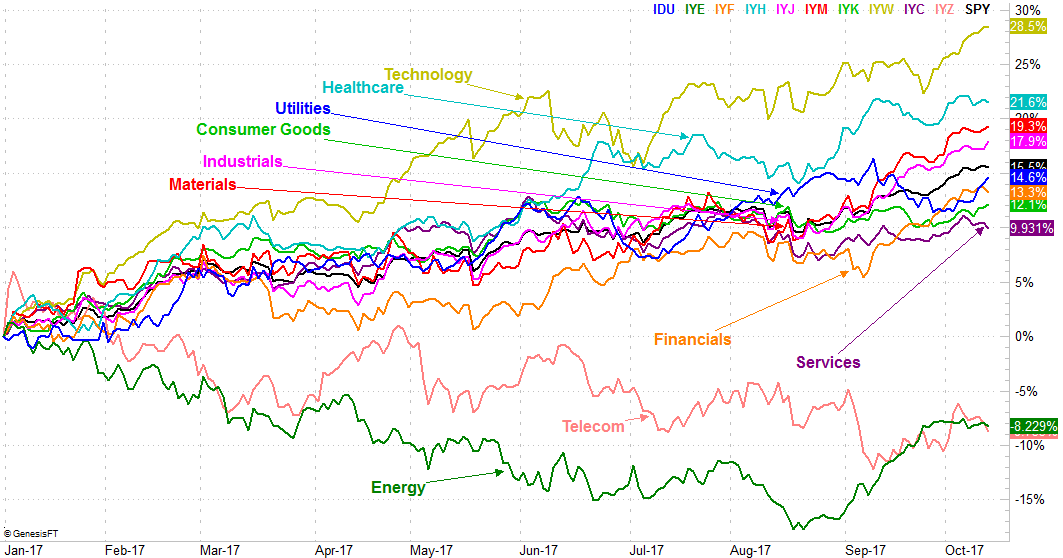

The graphic below tells the tale. The hottest performer over the course of the past week? Utilities -- a defensive sector -- with a 1.5% gain. It's a loose hint that traders are seeking safer, more reliable areas, rolling out of everything else and into the safe-haven sector. The fact that consumers goods are the second-best performer of the past week is telling of a defensive mindset as well.

The odd part: Technology stocks, which are not only overbought but arguably the most aggressive sector of the market, are running a close third. That says more than a few investors are thinking bullishly rather than bearishly. Presumably, the technology bulls and the utility bulls aren't the same people.

At the other end of the scale you'll find healthcare, with a 0.7% loss. Basic materials aren't fall behind with a 0.5% loss. The weakness from basic materials doesn't mean much, but one would expect to see a little more strength from health related names, as they too are a (fairly) defensive group. Most likely, uncertainty as to the future of Obamacare is wreaking havoc with those names.

Third from the bottom is services, which should also be defensive, but isn't being treated like a must-have safe haven right now. Energy isn't exactly impressing either.

Financials and industrial goods are bouncing around in the middle, as they have been since the beginning of the year.

This is all very unusual, and confusing. While there are always leading and lagging sectors (and they're always changing), those changes also tend to come and go with some semblance of logic or continuity. Given the lack of follow-through in other recent moves, we can't really trust anything we're seeing now. Indeed, we may be better off expecting no follow-through rather than counting on any follow-through.

In the bigger sense, we do know that yesteryear's laggards tend to become leaders, and vice versa. The recent choppiness isn't a long-term look that would be of interest to investors. It's more aligned with the kind of information traders would want... even though it's not even been useful to them of late. Either way, the inconsistent action and unusual activity has been maddening to both crowds of late.

It's unlikely this unpredictability will abate in the foreseeable future, now that earnings season is upon and the volatility kicks into a higher gear. Never even mind the fact that we didn't get the usual September pullback this year, making it unclear if we would be able to drive the usual Q4 rally this year. We're starting the fourth quarter out well ahead of schedule, and there may not be a whole lot of room left for more upside. There's also the not-so-small matter of frothy valuations.

The big takeaway: This really is a bit of a mess. Trading right now is truly a day-to-day matter, and you can't take your eyes of this market for a minute.

Hopefully -- hopefully -- things will normalize after earnings season and after the usual year-end reconfiguring. Until then though, this really is a crazy environment. It's not just all in your head.