Buckle up, because the party's about to begin. We're soon going to see if the beleaguered bullish effort of late was the right call. Here's a closer look at what to expect.

------------------------------------------------------

It's officially here. That is, the second quarter's earnings season has begun. A little more than 5% of the S&P 500's constituents have chimed in already about their recently-completed quarter, including some very big names. It's time to really think about what's supposed to be in store for the next month and a half.

As of the most recent look, the pros expect the S&P 500 to have "earned" $30.93 in the second quarter of 2017. That's 20.5% better than the Q2-2016 bottom line of $25.70, though a footnote must be added to that outlook. That is, the bulk of the improvement stems from the turnaround in the energy sector, and energy stocks were losing money as of 2016's Q2 -- any improvement or a swing to a modest profit is going to look dramatic. $30.93 isn't a terribly impressive figure, and that assumes we'll actually reach that target. In most of the recent quarters, the S&P 500 hasn't topped or even met its outlook.

Still, should the S&P 500 report earnings of anywhere close to $30.93, that would put the finishing touches on a major turnaround effort that got going in earnest last year.The pink arrow on the chart below marks the Q2 outlook; everything to the right of the arrow is a forecast as well (through 2018).

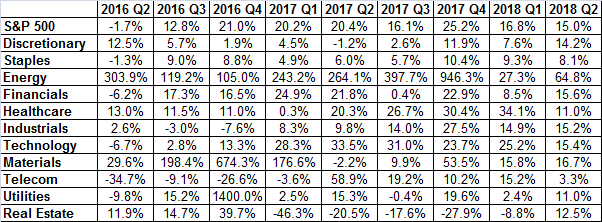

As was noted, the big driver of the market's overall growth in income for Q2 is the energy sector, though there are several sector-based curiosities waiting for investors as the second quarter's earnings season progresses. Namely, financial and technology stocks are expected to put up another great quarter, while discretionary and materials names are expected to suffer. The headwind the auto industry is facing explains much of the tepid outlook for discretionary names; materials names are struggling for a variety of reasons.

Sector Earnings Growth, Outlook

The healthcare sector looks like it's going to have a bang-up quarter as well, but caution is advised on that front. The prose have been calling for earnings growth of between 20% and 30% for the last several quarters, and the sector has yet to deliver anything close to that. It's unlikely that changed last quarter.

On the flipside, the market may have already factored in the likelihood that the healthcare sector won't reach those lofty expectations. At a trailing P/E of 15.8 and forward-looking P/E of 14.2, it's the second cheapest sector out there... second only to utilities, which have been inconsistent (albeit progressive) earners of late.

Tech stocks are expensive too, but worth it in light of earnings. That's in contrast to both staples and discretionary stocks, which are also expensive but not worth it.

Sector P/E Ratios, Trailing and Projected

There's more to life, and to a stock's bullishness, than valuations. In fact, earnings growth is more of a driver than value. On the other hand, traders do reach a point where a stock or sector is too cheap to pass up, and too expensive to buy, regardless the underlying earnings trajectory. With the S&P 500 valued at a trailing P/E of 21.0 and an unlikely/unachievable forward-looking P/E of 17.8, it's possible we're at that point on a marketwide basis. Though few investors recognize it and even fewer care to acknowledge it, that's a big part of the reason stocks have struggled to make prolonged gains of late .... a bunch of traders have this nagging feeling that a valuation-adjustment is in the works.

Of course, valuations don't matter until the masses collectively decide they matter. Until that happens, everyone is being forced to decide if they're trading, or investing. Some are doing both.

Whatever the case, the second quarter's earnings season will either prove the bulls right or prove them wrong. It should be fun to see the market's response.