If Stocks Tank, These Two Asset Classes Could Thrive

Don't read too much assumption into the headline. The stock market -- equities -- could be fine, pulling out of this slow-brewing funk unscathed. We're just saying, rather than panic if things get ugly, stay cool and use your head. What's bad for stocks could be good for gold and/or bonds.

It's a point we (and Jim Cramer) have made before but it bears repeating now... there's always a bull market somewhere, as money has no home. It's always looking for the best relative opportunity. It's just a matter of finding it.

Sometimes you can find out a lot just by taking a step back, and looking at the right depiction of how changes are taking shape.

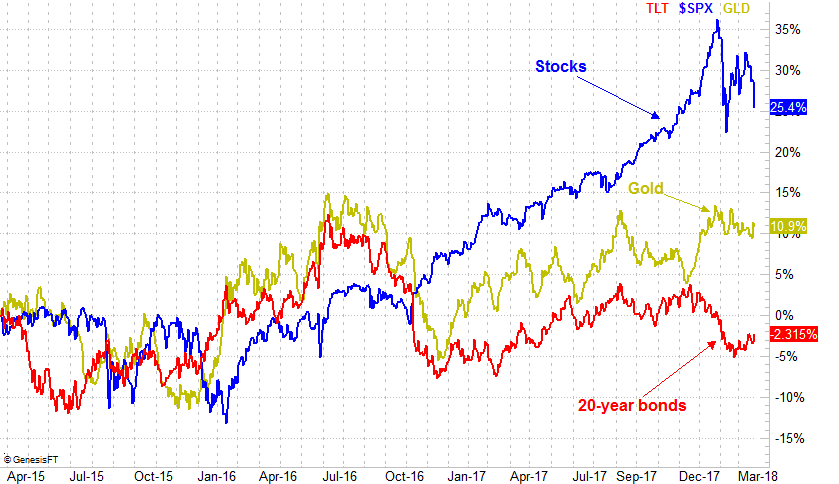

We've got that chart.

Take a look. Not that all three assets can't rise and fall together, but it's a rarity when they do. And even when they do, they don't do so to the same degree. Mostly though, one of them is almost always moving in the opposite direction as the other two. It doesn't take a long look to realize gold -- and even bonds -- have been testing the waters of higher highs while stocks have been taking on water.

There's more than just the oppositional meandering of these three asset classes that bodes well for gold and poorly for stocks though. The U.S. dollar is also struggling, as you can see on the daily chart of the U.S. Dollar Index. It broke back under the 20-day and 50-day moving averages on Thursday, rekindling a long-standing downtrend.

Here's a bird's eye view of the U.S. Dollar Index (green) with a chart of gold futures. What's good for the dollar is bad for gold, and what's bad for the dollar is good for gold. It's not hard to see where gold is getting its boost from, making it easy to push up and off its moving average lines as well as a rising support line (dashed).

So what will it take to push gold over the edge (in a bullish way)? The U.S. Dollar Index reaching a new multi-year low would be huge in that regard, but there's something a little more finite and accessible evident on the weekly chart of gold itself. That's a break above the recent double-top level of $1370. There's a converging wedge pattern already in place, making it ripe for the squeeze up and out of the pattern. Past that, it's an open-filed run.

If and when that happens, stocks could be and should be in a more decisive breakdown mode.

As for bonds, there's a little less historical context to help out, but we can see a slight curl higher from bonds in the past several days. And, that move is heating up after Thursday's sharp drop in yields. Truth be told though, bond yields have been under pressure for a month. They just buckled under the pressure in a bigger way on Thursday. Yields may not recover easily from Thursday's decisive blow.... a blow that was matched, by the way, by a sharp pullback from the greenback; the dollar and yields tend to move in tandem.

It's a lot to think about... a lot of moving pieces. And again, none of it is set in stone. These are just possibilities. But you know what to look for, and what's driving the underlying trends. The U.S. dollar and interest rates will ultimately drive gold and bond prices, and if gold and bonds are bullish, it's going to be all too easy for traders to decide to move out of equities and move into the better bets. That's going to exacerbate any weakness already being seen for stocks.

Your only real challenge here isn't figuring out what could happen; we just did that for you. Your real challenge will be remembering this information when and if the stock market does indeed melt down. That should be good for other areas, even if only temporarily.