Gold is nearing what could be an ultra-bullish key level

Gold's relationship with inflation expectations has gotten interesting lately, and I'm watching one key level for gold in particular.

Consider this conundrum in the gold market: The metal has traditionally been a good hedge against inflation, but it hasn't seen much demand lately even in the face of rising inflation fears. It's not like gold hasn't rallied, of course; it's up a little over 6 percent since mid-December.

Still, the yellow metal hasn't broken out.

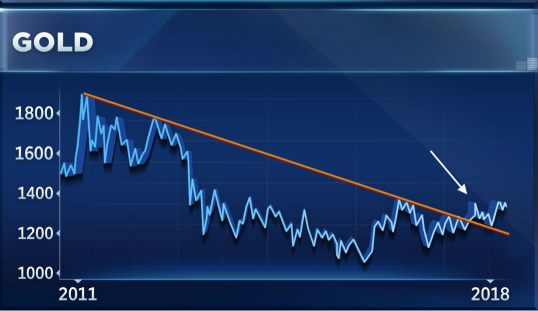

In fact, it has tested key resistance of $1,375 per ounce, but it hasn't managed to break above that level. The $1,375 mark was the metal's highs from both 2016 and 2017, so a break above that line would give gold a technically significant "higher high."

Furthermore, that level is the top line in an "ascending triangle" pattern, so a break above that level would prove quite bullish on a technical basis.

This is particularly true because gold has already broken above its six-year trend line, going all the way back to those 2011 highs.

Of course, we always have to wait for an actual break of this key resistance level before we can declare anything. Still, investors should consider that any meaningful break above $1,375 would confirm that the multiyear downtrend has reversed.

Gold on Thursday was trading modestly higher, at $1,332 per ounce.

From CNBC