Don't worry, crude's recent plunge does not mark the end of the oil rally: Piper Jaffray technician

Oil begins a new week after ending the last with its worst losses in three months. Commodities traders shouldn't worry, though, says one technician - the charts suggest more good news than bad.

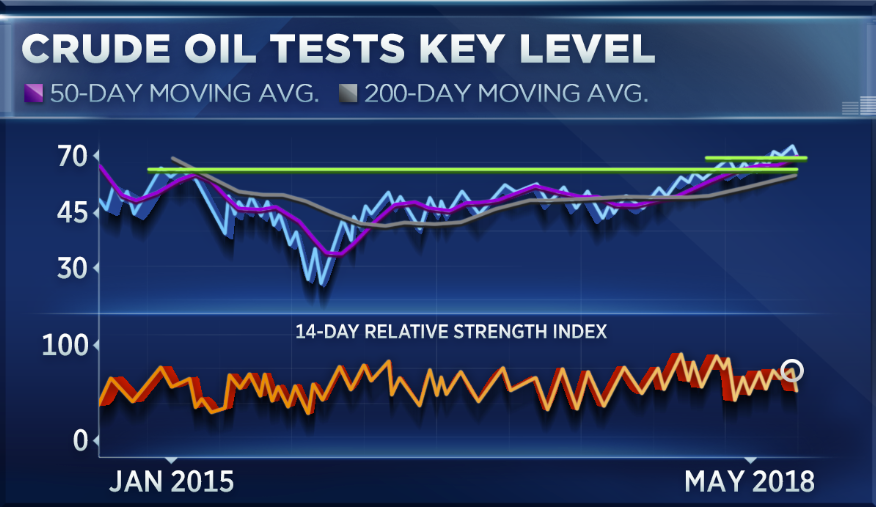

"At this point in time, the charts just look like a pullback within the context of a bigger uptrend," Craig Johnson, chief market technician at Piper Jaffray, told CNBC's "Trading Nation" on Friday. "We're right back to the 50-day moving average, we're retesting that at about $67.50 ... and it looks like just a normal pullback."

Crude touched its 50-day moving average during Friday's brutal sell-off. West Texas Intermediate declined by 4 percent over the session and hit its lowest level since May 3. Over the past five sessions, crude tumbled 4.8 percent in its first negative week in a month and its worst weekly drop since Feb. 9.

Should oil continue its decline this week, Johnson has identified its next level of support.

"If this level doesn't hold, you've got really good support going back to the '15 highs at about $62," he said.

WTI is still around 8 percent higher than that level.

"The longer-term uptrend is still intact and this looks like just some normal profit-taking along the way here," Johnson said.

Gina Sanchez, CEO of Chantico Global, is also bullish on the long-term picture for oil, but says geopolitical issues are muddying the shorter-term outlook.

"There are several factors that have been pushing oil up - geopolitical factors," Sanchez said on Friday's "Trading Nation." "The renewed Iran sanctions, Venezuela sanctions, as well as the tight OPEC."

That final driver, OPEC cuts, will be the deciding factor for oil's next move, said Sanchez. Saudi Arabia, the cartel's largest producer, and non-OPEC member Russia are reportedly considering easing back on their supply cuts.

"In the short term that actually could be fairly meaningful," said Sanchez. "The long-term outlook for oil is still robust and positive and we should still see an uptrend for oil but that doesn't mean that the downdraft can't be pretty significant if in fact Russia and Saudi ease up on their oil supply cuts."

OPEC will next meet in Vienna on June 22 to determine policy.

From CNBC