An Index Options Timer 'Real-Life' Credit Spread Trade Under the Microscope

Last week, our Index Options Timer service closed out a nice winning option trade -- a credit spread -- on the iShares Russell 2000 (IWM) ETF. This position not only booked a healthy profit for subscribers, but it also serves at the basis for a nice illustration of how credit spreads work. A walk-through would be time well spent.

A quick explanation for anyone brand new to credit spreads..... they're a two-option position (one short and one long), called a credit spread because we're collecting proceeds at the inception of the trade, and aiming to close it out at an even-smaller debit; we keep the difference. Indeed, the ultimate goal of any credit spread is to let both options expire worthless so we don't have to pay anything to exit the trade -- we get to keep all the upfront credit we received.

In the case of the iShares Russell 2000 ETF, we were bearish or neutral on the fund so we used calls to enter a net-bearish position. Specifically, we issued this alert on June 9th, when IWM was trading at $141.60:

"Sell (or short) to open the IWM June Monthly 143 calls (IWM 170616C143) and SIMULTANEOUSLY buy to open the IWM June Monthly 144 calls (IWM 170616C144) for a net Credit of 0.22 or better."

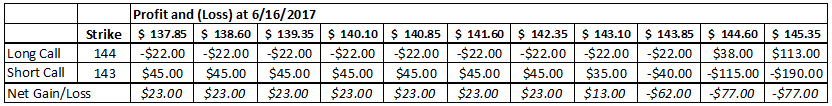

At the time, the June 143 calls could be sold for $0.45, or $45 per contract, and the June 144 calls could be bought for $0.22, or $22 per contract. The one we shorted -- the one with the lower strike price -- had a greater value than the one we bought, so after a $10 commission we pocketed a net of $22 for each pair of option contracts we traded.

Now, like all credit spreads, we entered this one knowing one of these two positions would technically be a loser, and the other one would technically be a winner. The idea is to walk away from the trade keeping the maximum difference, or credit between the two.

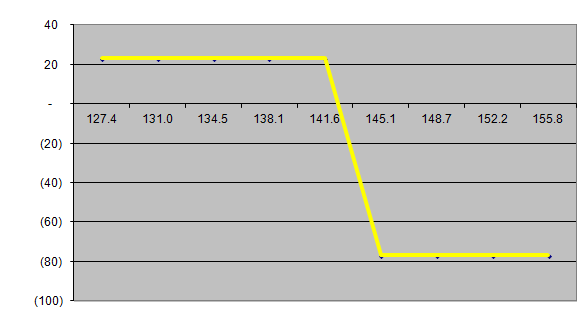

The simple profit-and-loss chart below somwhate tells the tale. As long as IWM remains below $143.50, we'll do no worse than a breakeven. The maximum net gain of $0.22, or $22 per contract is realized as long as the ETF remains below $143.00 through the options' expiration. Our maximum loss of $0.77, or $77 per contract, is realized only if the ETF moves above $144.60 before and up until the expiration date of June 16th. Anything between $144.60 and $143.00 would give is varying degrees of net-losses or gains. This could include any debit, or cost, we'd have to absorb if we decided to reverse the trade before it expired. The ultimate idea, though, is for both options to expire worthless. That's when the liability of holding a short position on a call is wiped away and we have no more risk in holding that short position.

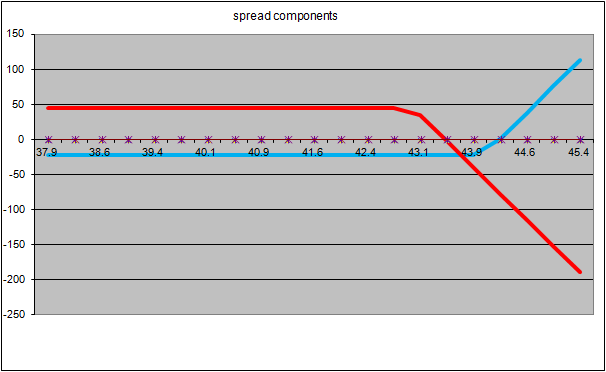

To really appreciate what's going on with a bearish trade using a call credit spread though, you have to look at what's going on with both legs of the trade at the same time.

That's what the chart below does. The profit-and-loss line for the long call (the 144 strike) is plotted in blue, while the profit-and-loss scenario for the short call (the 143 strike) is plotted in red. Not that the two are separable -- look at the net-result of both as a single unit -- but this view really explains what's going on. We made our money on the trade "up front", putting a net gain of $0.22 or $22 in our pocket. If IWM moves above $144.60 our long call gains in value, but our short call loses even more in value (and would likely be exercised against us). We want the opposite. We want the Russell 2000 ETF to remain at least below $143.000, so we can walk away with something.

Thing is, it doesn't really matter how far below $141.60 IWM is at expiration -- our upfront profit remains the same no matter what below that level. We just don't want to be forced to close the trade out (either by the short call being exercised against us, or simply as a defensive measure) , as that would cost us some money and reduce our initial $22 credit.

Or, if you're just more of a numbers person, the table below shows you what the graph above does. We paid $22 for the 144 calls, and we sold the 143 calls for $45. Between the two positions, even if we have to pay to close them out, we'll still keep something as long as IWM holds below $143.50. We keep the most when IWM is below $142.50.

[The profit and loss scenario above takes into account the initial credit we received, and adds that back into our maximum loss possibility.]

In these terms, credit spreads look like they have more risk than reward, as the potential maximum loss of $0.77 (the $1.00 difference between the two contracts' strike prices less the $0.22 credit we got upfront minus the $0.01 commission we paid) is greater than the maximum gain of $0.22 per contract we could reap. That's deceptive though. In this case, the value of the options is already dropping fast due to time decay, or theta, and that deterioration only accelerates the closer expiration gets. In the case above, the two call options were losing about four cents of their value per day. At that pace, it didn't take much in the way of a stagnant IWM for us to move into the clear pretty quickly.

That's why the math doesn't quite work out right above, for those of you who are sticklers. We were calculating our credit as of June 9th's prices, but calculating our potential profits as of June 16th when both calls expired. Their prices dropped in the meantime. We knew that was going to happen. In fact, that's what we wanted to happen. We were net sellers of volatility, knowing the passage of time would reduce the value of each call up until the expiration date. We 'sold high', and then got out of the trade 'low.' We just didn't have to do anything to sell the position. Their expiration did it automatically for us (though bear in mind we always have the option of closing the trade out if for some reason we think IWM wasn't going to remain below $143 by the time expiration rolls around)

In this case, the Index Options Timer service booked the maximum gain possible on the 143/144 credit spread by letting it expire worthless on Friday of last week. The 22 cent gain on the 77 cents we had at risk effectively meant we gained 28% on our at-risk capital.

It's also worth noting that the rapid time decay involved here not only works for us, but also means we don't have to be right about the fund losing ground. We only have to be right about it not going higher. In that sense, call credit spreads aren't inherently bearish trades. They can also be profitable when a stock is merely stuck in a narrow price range.

If it's all still confusing to you, don't let it be - credit spreads make more sense when you're doing them then when you're reading about them. Try a few hypothetical credit spreads on paper first until you get the mechanics of them. Just remember if you're bearish, sell a cell with a lower strike price for more than you buy a call at a higher strike price. Both will ideally be above the stock's current price to reduce any odds that the short call option would be exercised against you (and thus force you to exercise the long call you own).

Or, even better... earn while you learn. The IOT service does all the number-crunching and trade-finding for you, letting you trade Price's recommendations while simultaneously letting you focus on the process and mechanics of these trades. Here's how to sign up.