Amazon could crack $2,000 before we see a pullback, says market watcher

Amazon, already up 50 percent in 2018, just hit its 34th intraday high of the year on Thursday. At this pace, its stock will surpass the 43 records it set in 2017, an all-time high.

The sky is the limit for the shares, according to one market watcher.

"As long as Amazon can execute, basically there's a very strong chance here that we could go to $2,000 before we see any kind of correction," Boris Schlossberg, managing director of FX strategy at BK Asset Management, told CNBC's "Trading Nation" on Wednesday.

A rise to $2,000 implies roughly 15 percent upside from current levels and would tack on an additional $130 billion in market cap, putting its total at $970 billion. Such an increase would also put it in striking distance of the coveted $1 trillion level for which Apple and Alphabet are vying.

If Amazon was to then see a correction, representing a decrease of at least 10 percent from 52-week highs, its shares would still be at $1,800 and up 54 percent for 2018.

Schlossberg's $2,000 forecast puts him at the higher end of analysts' targets. The average price target on the street is $1,885, implying 8 percent further upside. However, analysts have also raised concerns about its high valuation. It trades at 110 times forward earnings, more than six times the price-earnings ratio on the S&P 500.

"I read all these reports from all the analysts saying that it's wildly expensive based upon all the normal metrics - price to sales, enterprise value to free cash flow - and I couldn't agree more," said Schlossberg. "But that's not what Amazon trades on. It trades on one simple variable which is growth."

Amazon has posted at least 20 percent year-over-year quarterly sales growth since its September-ended quarter of 2015.

Craig Johnson, chief market technician at Piper Jaffray, agrees that the stock has more upside from here.

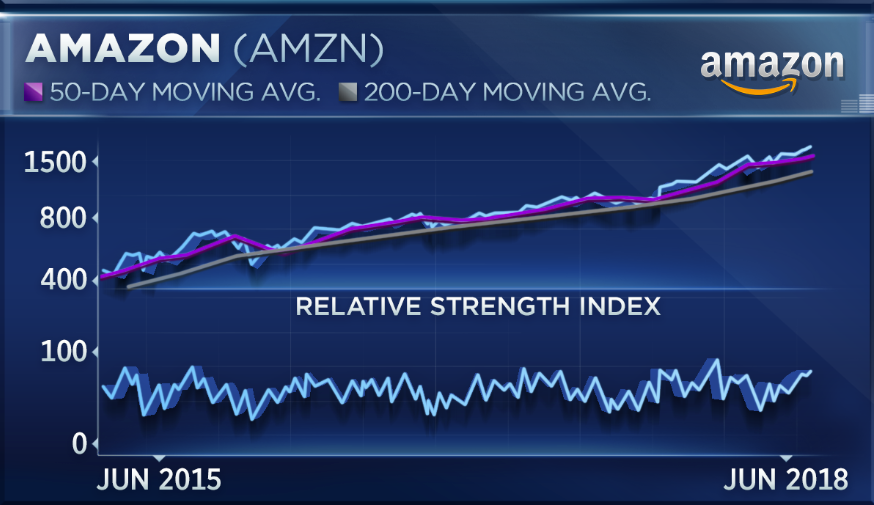

"There's a lot of risk of overthinking this stock," Johnson said on Wednesday's "Trading Nation." "When you look at Amazon, yes, it's extended above its 50- and its 200-day moving averages and when you look at the chart you can clearly see that. But there's a lot of strong momentum in there."

Johnson and Piper Jaffray have a $1,850 price target on Amazon shares, another 6 percent rise from current levels.

From CNBC