Are you looking for a bit of an extra edge this month? While March is generally a good month for stocks with the S&P 500 gaining an average of 1.14%, March of 2017 could prove a little tougher and than usual simply because stocks are starting the month out very overbought thanks to a heroic February.

Nevertheless, there is a handful of hotspots worth noting. Specifically, there are some sectors and industries that tend to do well this month -- better than most other groups -- and maybe positioned for another month of strength. The trick is simply knowing where to look.

Here's a quick look at March's usual big winners.

Financials

This particular March could prove tough for financial stocks, simply because they were so unusually strong in February. Nevertheless, the financial sector boasts an average March gain of 4.9%. Note, however, that strength doesn't last much past the beginning of April.

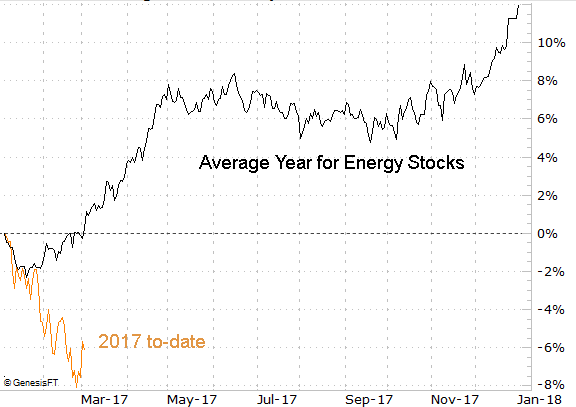

Energy

Unlike financial stocks (and most other stocks for that matter), energy stocks have been poor performers of later even though they usually do well in February. This recent weakness could prove to augment the usual 3.7% advance energy stocks muster this month. Better still, this bullishness tends to persist through April.

Insurers

Though it's often lumped in as a subset of the financial sector, in this case, the insurers are a separate group that does well in March all on their own - they typically gain 3.4% this month (and April isn't too shabby either).

Retailers

Finally, after a wobbly start to the year following a usual year-end runup, retailing stocks tend to find a firmer footing again in March to gain 3.8% in the month. The bullishness plateaus after that, for several months. It's a good run though, and this year it's not as if the group has already raced too far ahead of its norm to dish out a gainful performance.

Bear in mind, of course, that tendencies aren't etched in stone. It's entirely possible that this year's March could yield historically unusual results. Indeed, much of March's bullishness is predicated on February's usual bearishness, but the S&P 500 gained a whopping 3.7% last month. That oddly bullish move calls into question how much -- if any -- bullishness we can reasonably expect for the month. With the exception of energy, all of the groups discussed above are starting out with that disadvantage.