5 Attractive Stocks With 50+ Years Of Increasing Dividends

5 Dividend Champions

by Michael Fowlkes

What exactly is a dividend champion? Ask ten people, and you will probably get ten different answers... there is no real definition of what it means to be a dividend champion, so you have to decide what that title means to you.

To me, the title dividend champion relates to stocks that not only have solid stock performance, but also have remarkably long streaks of annual dividend increases. Some people will use 10 or 25 years for their criteria, but I believe the word "champion" means that the streaks much be much longer. If you search for companies that have increased their dividends for 25 years, the list is pretty long, and while it is an impressive group of companies, it is not a super-exclusive group.

Of course, the longer the streak, the fewer stocks you will find. In my mind, to be considered a champion, you have to be among the most elite, and that is why I use 50 consecutive years of dividend increases as my definition of dividend champion. Searching for companies that have increased their dividends for 50 consecutive years produces a much smaller and exclusive group of stocks.

After narrowing down the list of possible stocks, I then turned my attention to recent stock action. After all, to be a champion, you need to be strong in every area, so it would be pointless to consider a stock a "champion" of any category if the stock itself has been weak.

The five stocks below all have good-looking charts, and have increased their dividends for 50 or more consecutive years. These are my dividend champions:

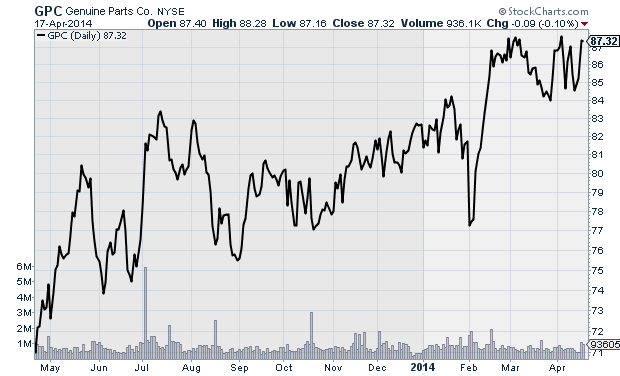

Genuine Parts (GPC)

Auto parts retailer Genuine Parts (GPC) has one of the longest streaks of annual dividend increases. The company has managed to boost its dividend 57 years in a row. The last few years have been good to auto parts retailers, and GPC has been no exception. The stock started trending higher towards the end of 2012, and while its momentum appears to have slowed a bit, the stock is still trending higher, and is currently just shy of its 52-week high. Americans are keeping their cars on the road longer than ever, which means steady demand for auto parts to keep them road-worthy. GPC currently has a 2.6% dividend yield, and pays a quarterly dividend of $0.575 per share. The company already lifted its dividend this year, so shareholders should not expect news of another dividend increase until February of next year.

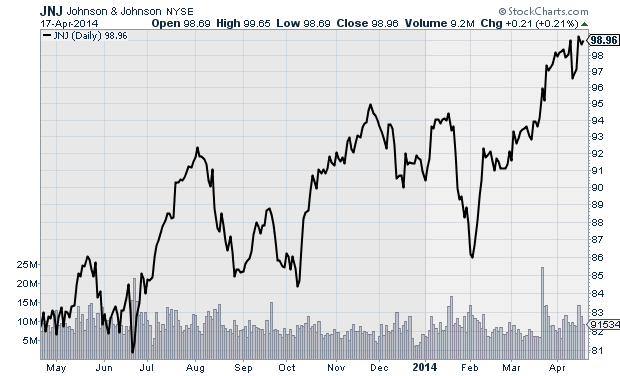

Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) is currently paying a 2.7% dividend yield, and the company has increased its dividend each of the last 51 years. Johnson & Johnson is one of my favorite stocks, primarily due to the fact that it's business is so diverse, and that it manufactures such a wide range of consumer staples. You are probably most familiar with its consumer products, which include household names such as Listerine, Band-Aid, Aveeno, etc., but it is also a major player in the pharmaceutical and medical device industries. The stock started to trend higher in the summer of 2012, and has maintained its momentum ever since. It is currently trading just shy of its 52-week high. I am very bullish on the stock because I see ongoing demand for its goods, and its dividend streak just makes the stock all that more attractive. The company should announce a dividend increase any day now, with the stock trading ex-dividend sometime during the latter part of May, probably during the third week of the month.

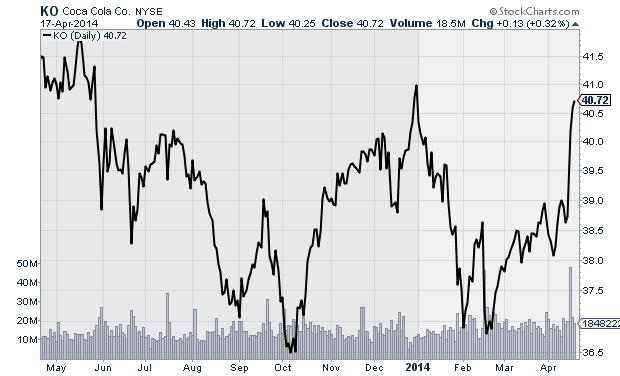

Coca-Cola (KO)

Soft drink giant Coca-Cola (KO) is a true dividend champion. The company has a streak of annual dividend increases that spans the last 51 years. There has been some concern regarding the stock in recent years resulting from a shift by consumers away from sugary soft drinks, but the company recently posted strong first-quarter revenue that put some of those fears to rest. The quarter was aided by higher sales in emerging markets. China was a particularly strong market for the company during the quarter, and it plans to continue building on that strength by investing $8 billion into the country over the next five years. The company historically announces its annual dividend increases in February, which it did once again this year. The stock currently has a 3.9% dividend yield.

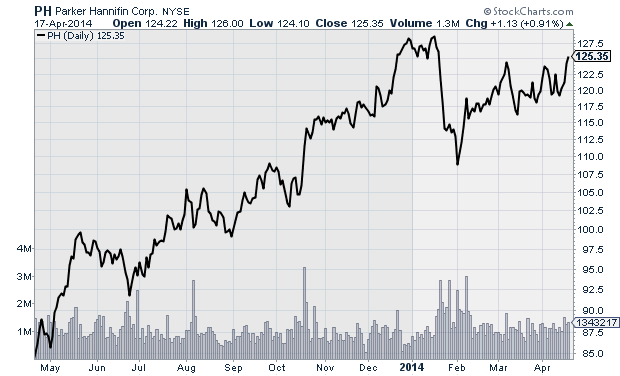

Parker-Hannifin (PH)

Industrial equipment and components manufacturer Parker-Hannifin (PH) has a lengthy streak of annual dividend increases that stretches over the last 54 years. The stock has been trending steadily higher over the last two years, and is currently trading just below its 52-week high. PH has an annual dividend yield of 1.5%, and while it already announced a dividend increase once this year, it could be close to announcing another one as well. The last three years it has announced a dividend increase in January, and then another one in late April. If it keeps to that pattern, you may see another increase coming any day now, with the stock trading ex-dividend for the higher payment during the first week of May.

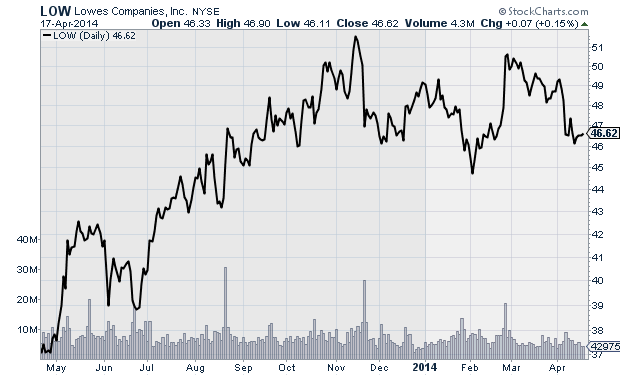

Lowe's (LOW)

Home-improvement retailer Lowe's (LOW) has boosted its dividend an impressive 51 straight years. The stock currently has an annual dividend yield of 1.5%, and pays a quarterly dividend of $0.18 per share. Improvements in the housing market have helped the stock over the last two years, but it has started to lose some momentum since the end of last year, with rising interest rates stoking fears of a possible slowdown in the housing recovery. The company historically has announced its annual dividend increases towards the end of May, and I see little reason to believe it will allow its 51 year streak to come to an end this year. Look for news of the new dividend at the end of May, with the stock trading ex-dividend in late July.

Courtesy of Market Intelligence Center