Weekly Market Outlook – One More Bad Day For Stocks Could Do It

For the second week in a row, stocks suffered losses. And this time around the market was dragged to the brink of implosion… all the way to the brink, but not past it. It’s close though. It’s so close, in fact, that one more bad day could do the trick and push the indexes below key technical floors.

We’re not there yet, however. We’re just uncomfortably close.

We’ll see how closer we are to the brink in just a moment. Let’s first look at last week’s most important economic news and then preview what’s due this week. Spoiler alert: It’s getting tougher for the Federal Reserve to say it’s planning on imposing a handful of interest rate cuts in the foreseeable future.

Economic Data Analysis

There was only one set of data released last week, but it’s a doozie. We heard March’s inflation numbers. Consumer inflation was posted on Wednesday, while producer inflation figures were released on Thursday. Core rates (excluding fuel and food) are mostly flat -- and flattening at above-target levels -- while overall inflation rates are clearly starting to edge higher again. Interest rate cuts would only exacerbate this nagging problem, of course.

Inflation Rate Charts

Source: Bureau of Labor Statistics TradeStation

Everything is on the grid.

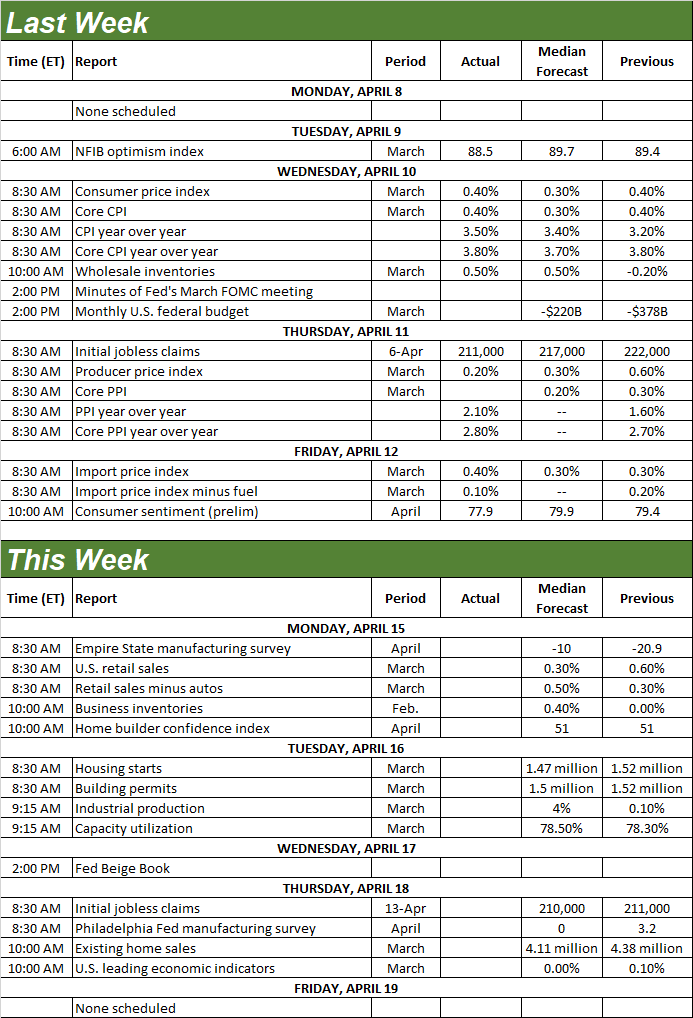

Economic Calendar

Source: Briefing.com

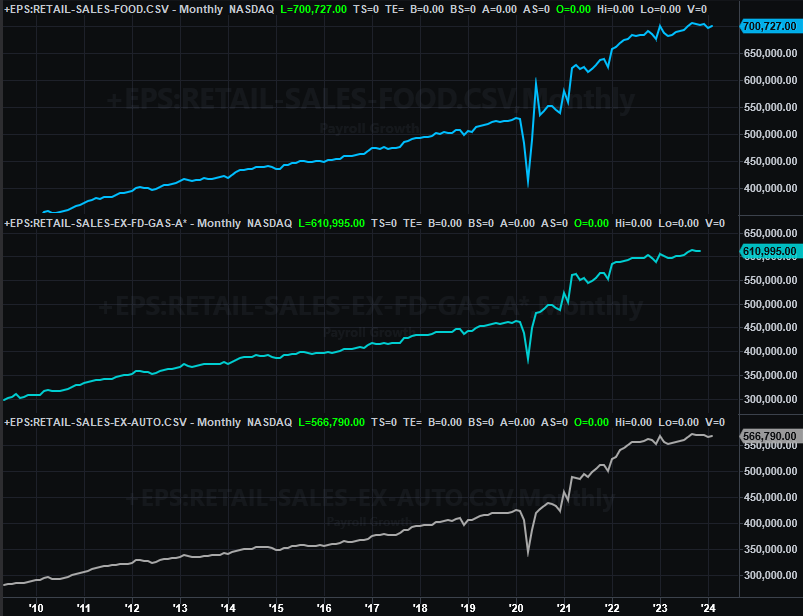

This week’s going to be a pretty big one, particularly for real estate. The party starts, however, with Monday’s look at March’s retail sales. Retail spending has been broadly slowing down, and will likely continue doing so.

Retail Sales Charts

Source: Census Bureau, TradeStation

Note that also on Monday we’ll get April’s Homebuilder Confidence Index. It’s been healthy of late, and while the rate of rebound should come to a screeching halt, it’s halting at reasonably-healthy levels. The homebuilder sentiment score, however, precedes Tuesday’s look at housing starts and building permits (which of course are related to the Homebuilder Confidence Index). We should see a slight slowdown this time around, but not enough of a slowdown to alter the current, shallow recovery that’s trying to take hold.

Housing Starts and Building Permits Charts

Source: Census Bureau, TradeStation

Also on Tuesday we’ll hear last month’s capacity utilization and industrial productivity numbers from the Federal Reserve. Both have been alarmingly deteriorating for many months now. Economists are calling for a slight uptick in both numbers again, but it’s not enough to change the bigger downtrends.

Capacity Utilization and Industrial Productivity Charts

Source: Federal Reserve, TradeStation

Finally on Friday we’ll get March’s existing home sales report. They’ve been rolling higher for a while now, but forecasters say the rebound is going to hit a slight wall here. It’s still too soon to presume the worst, however.

New and Existing Home Sales Charts

Source: Federal Reserve, TradeStation

The new-home sales data for last month will be released next week, rounding out this slate of real estate sales information. Unlike existing-home sales figures, new-home sales have remained anemic (if only because builders were a bit afraid to build a new home on spec; would-be buyers may be a little hesitant to commit to more-expensive new houses anyway). It’ll be interesting to see if sales actually follow homebuilder sentiment and starts/permits figures higher.

Stock Market Index Analysis

Both of the major market indices suffered a serious technical blow two weeks ago. That damage was worsened last week. Former support levels seem to be resistance lines now.

Take the S&P 500 as an example. It fell below the 20-day moving average line (royal blue) two weeks ago (albeit briefly). It fell back under that line last week, and the effort to crawl back above it on Thursday ultimately failed once it was touched. The index was most definitely moving the other direction the next day -- Friday -- to make its lowest close since early March. With that tumble, the S&P 500 is now priced 2.6% below its late-March peak.

S&P 500 Daily Chart, with VIX and Volume

Source: TradeNavigator

And yet, the S&P 500 clearly remains above an even-more-pivotal moving average line, finding support at it on Friday. That’s the 50-day moving average line (purple) at 5,111. All it took was a touch of that line on Friday to stop the bleeding.

The daily chart of the NASDAQ Composite is in similar shape. That is, the composite is no longer finding support at its 20-day moving average line, nor is it finding support at its straight-line support that had been steering it higher since January (light blue, dashed). Also like the S&P 500, however, the NASDAQ is still holding above its 50-day moving average line (purple) at 16,072… although it certainly is testing that floor.

NASDAQ Composite Daily Chart, with VXN and Volume

Source: TradeNavigator

There’s something else that’s readily evident on the NASDAQ Composite’s chart, however, that should worry the bulls (even if stocks have yet to be dealt a decisive death blow). That’s the way the NASDAQ’s Volatility Index (or VXN) is acting. It’s knocking on the door of breaking above an established technical ceiling at 20.2.

This is a repeated attack on that resistance line too, and now it’s coinciding with an attack on the support the NASDAQ Composite itself is finding at its 50-day line. If both of these lines are breached at the same time it may well be a sign that the proverbial bearish flood gates have opened. They won’t likely be closed again until any correction has run its full course.

The weekly chart of the NASDAQ Composite puts this whole dynamic in perspective. The runup from October’s low is huge… so huge that it’s begging profit-taking now. The weekly chart also reminds us how long the VXN has been so low. It too is ripe for a reversal that would work against stocks. Perhaps most problematic with the weekly chart, however, is that the NASDAQ’s MACD lines have just made a bearish divergence. The last time we saw this happen was in August of last year, preceding a pretty big correction.

NASDAQ Composite Weekly Chart, with VXN and Volume

Source: TradeNavigator

The stage is certainly set for some serious downside. Just bear in mind the most important triggers of such a selloff have yet to materialize. And, they might not. It’s entirely possible the market could end up pushing up and off its 50-day moving average lines… possible, but decreasingly likely given the way things are shaping up right now.