US Investor Optimism Jumps to 9-Year High: Survey

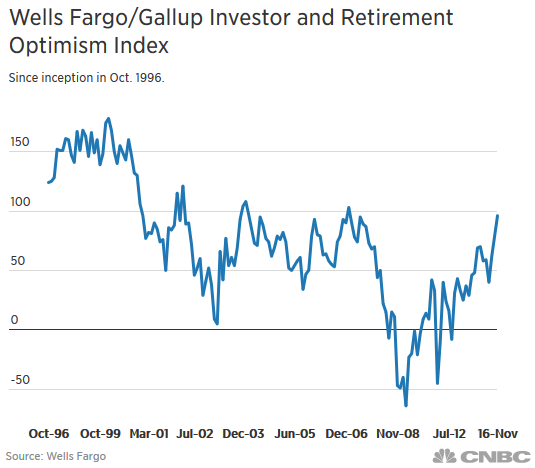

Individual investor optimism jumped to a nine-year high in November, according to the Wells Fargo/Gallup Investor and Retirement Optimism Index published Tuesday.

The 96 read last month marked the third straight quarterly rise and was up from 79 in the third quarter, the survey said. The last time the index approached the November level was before the financial crisis, in May 2007 with a read of 95, the report said. The index was at 103 in January 2007.

"Rising investor optimism and the stock market reaching all-time highs is great news to end the year on, but it isn't necessarily driving investors to put their money into the markets," Scott Wren, senior global equity strategist at the Wells Fargo Investment Institute, said in the release. "Investors are more interested in the markets, but it takes time for this optimism to translate to flows into the stock market, especially when investors have been cautious for so long," he said.

The poll was conducted by phone Nov. 16 to 20, just over a week after the U.S. presidential election. At the time, the Dow Jones industrial average had gained more than 500 points postelection but hadn't crossed 19,000 yet.

The Wells Fargo/Gallup study surveyed 1,012 U.S. investors with total savings and investments of at least $10,000. About 40 percent of American households fall in that category, the report said.

Fifty-four percent of investors said they were optimistic about the stock market, up from 51 percent in the prior quarter and 32 percent in the first quarter of the year, the survey said.

Nearly three-fourths of investors said the stock market will be volatile in 2017. About one-fifth of those investors expect stocks will be "highly volatile," from 16 percent in the same period in 2015.

The S&P 500 ended down less than 1 percent for 2015 after a more than 10 percent drop in August of that year. Stocks had one of their worst starts on record at the beginning of 2016, but the S&P has not fallen more than 10 percent from a recent high since February.

"Last year was not as volatile as some investors perceived it to be, and we are not forecasting a lot of volatility in the U.S. markets for the first half of the new year. We encourage investors to think of volatility in terms of what opportunities it may present," Wren said.

Among retired investors, which accounted for 27 percent of respondents, the optimism index rose 36 points to 117, while the index rose 11 points to 89 for nonretirees, or 73 percent of respondents.

Of total respondents, 42 percent reported annual income of less than $90,000, while 58 percent reported $90,000 or more.