The Spin on the BlackBerry Limited (BBRY) Earnings Report Doesn't Change Reality, Yet...

Merely judging from the headlines, one would expect BlackBerry Limited (BBRY) shares to be soaring today. The struggling smartphone maker managed to not only top analysts' earnings estimates for the recently-completed fiscal third quarter, but upped its full-year earnings guidance as well. Its software ambitions are panning out; there's measurable growth there.

And yet, BBRY shares are only up a muted 1.0% in the wake of Q3 news.

What gives? Investors are understandably concerned that what the company is losing out the backdoor is much more than the new business it's got coming in the front door.

In other words, as great as the software business is becoming, BlackBerry's hardware business is losing even more ground.

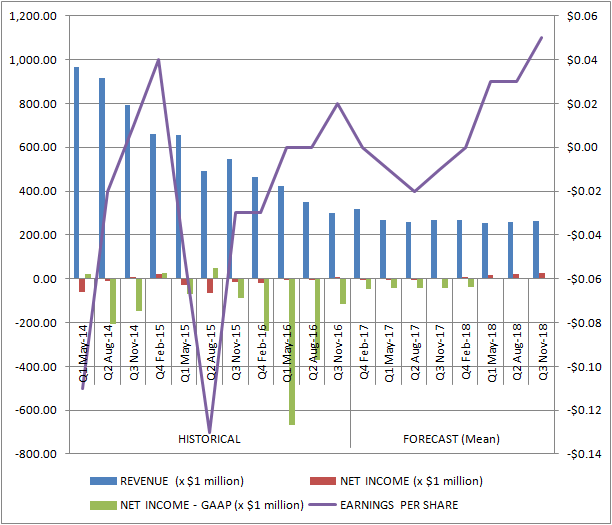

The vital stats for last quarter: Excluding non-recurring items, Blackberry reported adjusted earnings per-share of 2 cents, topping the average outlook for a breakeven. The company lost 3 cents per share of BBRY in the same quarter a year earlier. Revenue fell to $289 million, from $334 million, missing expectations of $330 million. The quarter's results extended a long-term trend of deteriorating and erratic bottom lines, with more losses than profits since 2011.

The former technology icon raised its full-year earnings projection from a loss of 5 cents per share to a breakeven, which would mathematically mean a breakeven for the current quarter versus previous expectations for a loss of one cent per share.

On a GAAP basis though, BlackBerry lost $117 million, up from the year-ago loss of $89 million, but down from the fiscal Q2 loss of $372 million. A second quarter of sizable gap losses on top of a couple of major acquisitions -- and this may be the biggest concern of all for current or prospecting investors -- pulled the company's cash and near-term assets balance down from $3.26 billion at the end of last fiscal year to $1.74 billion as of the end of last quarter.

The concern is rooted in the pace of how fast that cash is going away.

Few are unaware that BlackBerry is transitioning from a hardware (smartphone) maker to a software and service provider, where margins are higher. It's spending heavily to make that happen though, and doesn't really have enough organic growth -- let alone profits -- to justify those deals. The $1.74 billion in the bank is still a boatload of money, but it's roughly half of what it was not too long ago, and it's not clear that the company is offsetting its lost hardware business with software revenue. In fact, it's clear that it's not offsetting what it's losing on the hardware front.

The company remains optimistic about the future, of course, but that's not a sentiment most investors can blindly afford to agree with even though analysts do expect profitability to improve going forward. As it stands right now, the strategy appears to be one aimed at shrinking its way to success. As the chart below shows, revenue is expected to flatten, buying time for the losses to turn into profits.... albeit paper-thin profits. Again, that may be more hope that reality, even for the pros.

Yet, most investors are at least willing to entertain the idea that BBRY shares could be worth more in the foreseeable future.

Since late-2015, a multi-year selloff has morphed into a wedge pattern, and BBRY is not only finding support at its long-term moving average lines, but it's using them as pushoff points to attack the upper edge of the wedge shape. It may not be justified by fundamentals yet, but the chart says there's a glimmer of hope.

That glimmer would mean much more if there was actually some volume behind the bullish effort, but first things first. That volume might materialize once the upper side of the wedge pattern is breached, and we see the top line start to actually grow again.

The good news is, to that end, we're almost to the point where smarpthone sales were so bad a year earlier that the ongoing deterioration of the company's hardware business won't have a meaningful adverse impact on year-over-year revenue comparisons.

In other words, BBRY may not be worth owning yet, but it sure is worth watching.... not as an investment, but at least as a trade.