Small Cap Q1 Earnings Were Superb, Even if Those Stocks Didn't Reflect It

Two weeks ago we pointed out that with most of the S&P 500's companies have reported their quarterly results, Q1's earnings season wasn't going especially well. Though the aggregate number in the meantime has edged higher to $29.43 per share, the S&P 500 has still yielded a little less in first quarter income than was anticipated as of the end of the fourth quarter.

Last week we took a closer look at the mid cap sliver of the market using the S&P 400 as our proxy. As it turns out, these names have fared much better, earnings-wise, than their large-cap counterparts, but have lagged in terms of performance.

Even so, that looked like it was about to change.

It all begged the obvious follow-up question... what about small caps? As it turns out, though they've been dragging the bottom in terms of performance so far this year, the S&P 600's earnings growth has almost recovered even better than the S&P 400's has, and the group is on the verge of an outright earnings explosion.

First things first though.

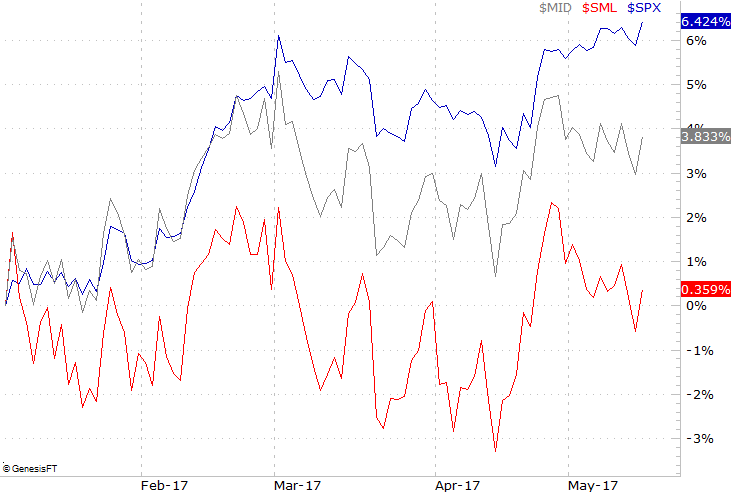

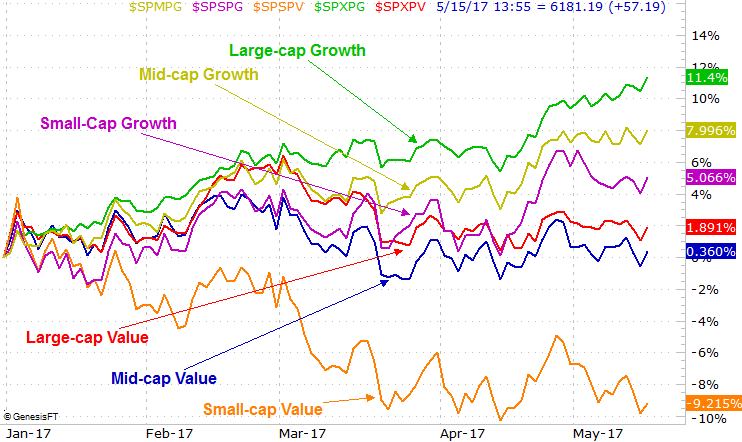

It's not hyperbole to say small caps have been strangely lagging of late. Barely better than a breakeven year-to-date, mid caps are further ahead with a 3.8% gain, while large caps are up a healthy 6.4% even though large cap earnings have grown the least and large cap valuations are well in excess of their long-term norms.

The weak link has been small cap value stocks, by the way. Growth stocks within the S&P 600 are up a 5.1% year-to-date, while small cap value names are down 9.2%. Even within the value and growth stratifications though, small cap stocks are clear laggards.

The irony? Small caps are arguably the best-performing names in terms of earnings, and the most undervalued in terms of P/E multiples.

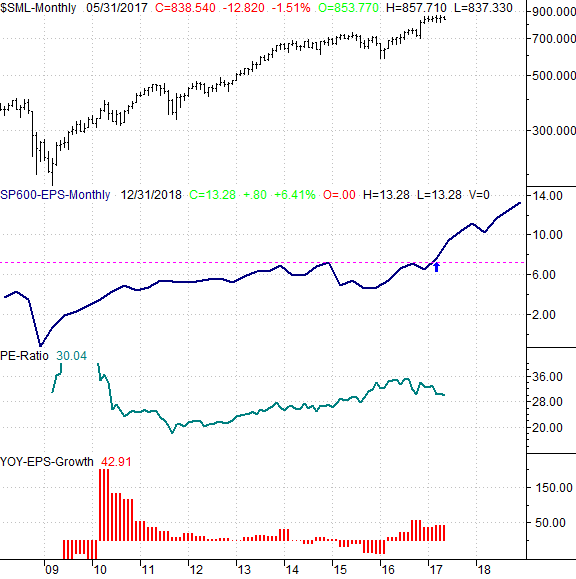

The graphic below tells the tale. The S&P 600's per-share earnings of $7.66 for the first quarter is 43% better than year-ago levels. This resurgence after a modest Q4 lull puts the S&P 600 back to record-breaking income for the index, but more important, validates what looks like is a massive forward leap in earnings growth.

The end result is a trailing P/E of 30.0, and a forward-looking P/E of 20.5. The latter seems high, but is actually close to normal for the S&P 600. The latter is below average for the index.

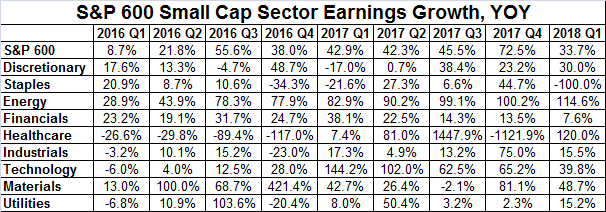

Granted, a massive improvement in the energy sector's bottom line explains the crux of the swing. That's hardly the whole foundation for the improvement though. As the table below shows, most sectors in the group had a very nice first quarter.

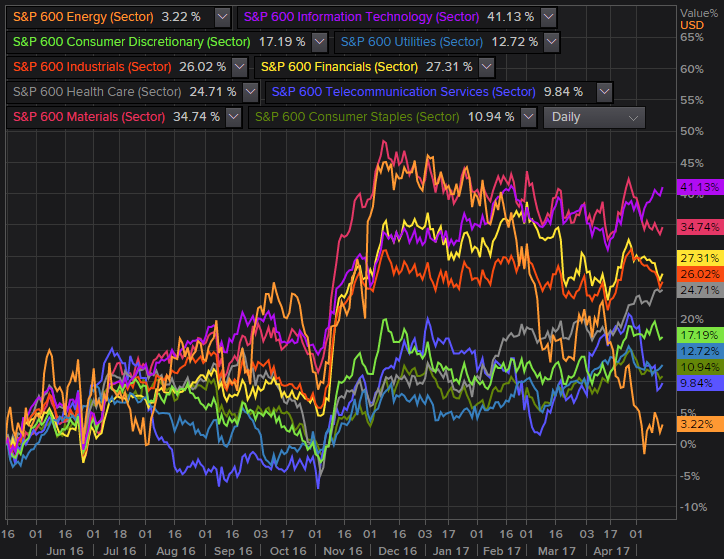

Perhaps more than any other groups broken down to this level, each small cap sector's stocks have more or less performed as you might expect them to given Q1's earnings. Small cap technology stocks have taken the lead again, and small cap healthcare stocks are barreling higher after a rather disappointing performance late last year. Energy stocks -- which at one month were the best performers for the past twelve months -- have fallen to dead last again.

The performance-comparison chart isn't necessarily telling us much more than that right now in terms of actionable ideas, but that's not always the case. The idea is to look for new breakout or new breakdowns, and there aren't many right now with the exception of the healthcare sector's newfound bullishness.

Even so, that's a good bullish sign for small cap healthcare names.

Whatever the case, know that while small caps have been lagging, it's not been due to a lack of earnings growth. It's actually the best-performing group in terms of Q1's bottom line, and the least overvalued based on forward-looking earnings estimates. Their lagging is likely to be mostly attributable a lack of optimism about the foreseeable future, and/or an intense focus only on the most storied FANG stocks at the expense of everything else. That will change, in time, though it won't necessarily change right away.